K92 Mining Inc. (TSX: KNT) (OTCQX: KNTNF) has announced a significant 18 per cent year-on-year increase in production for Q2 2023 at its Kainantu Gold Mine in Papua New Guinea.

Despite a brief suspension of operations due to a fatal accident in June, the company said on Monday it maintains its production and cost guidance for 2023, anticipating a strong second half of the year.

Among the notable results, the company found 30,794 ounce gold equivalents (AuEq) or 27,405 ounces of gold, 1,526,547 pounds of copper and 34,001 ounces of silver.

This represents an increase of 18 per cent from Q2 2022 and 43 per cent from Q1 2023, respectively. Sales during the quarter were 28,141 oz gold, 1,657,115 lbs copper and 36,253 oz silver.

The performance of the underground mine improved significantly after early April. This improvement came after a period of difficult conditions in a specific area. The mining focused on Kora’s K1 and K2 veins and Judd’s J1 Vein. During the quarter, 10 levels were mined, resulting in a total of 109,155 ore tonnes.

The average mill head grade was 9.23 g/t AuEq or 8.20 g/t gold, 0.66 per cent copper, and 11.56 g/t silver. Mining on Kora took place on eight different levels, and on Judd on two levels.

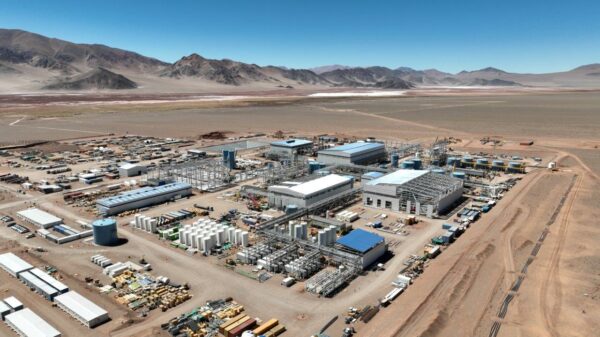

In May, the company achieved a significant goal. It commissioned the final part of the Stage 2A Plant Expansion. This action doubled the capacity of the rougher flotation circuit. After this, the process plant saw a substantial increase in recoveries for gold and copper.

In June, the first full month after the expansion was fully commissioned, recoveries averaged 93.0 per cent for gold and 92.9 per cent for copper.

Company stock went up on Monday by 11.08 per cent to $6.27 on the Toronto Stock Exchange.

Table via K92 Mining.

Read more: K92 Mining reports 2 fatalities at Papua New Guinea operation

Read more: K92 Mining discovers high-grade gold intercepts in Papua New Guinea

K92 Mining expects the second half of 2023 to be the strongest for production

The average recoveries for Q2 were 92.4 per cent for gold and 92.8 per cent for copper. These were the highest since Q4 2021 for both gold and copper and were much higher than the 2022 average of 90.4 per cent for gold and 90.5 per cent for copper. The total ore processed during the quarter was 112,471 tonnes. Now that the Stage 2A Plant Expansion is commissioned, the company is working to increase throughput. It believes the throughput could be much greater than its original design.

As reported earlier, the company briefly suspended underground mining operations on June 28 due to an accident involving a vehicle underground. This incident did not have a significant impact on surface activities, and the surface stockpiles were treated during the suspension. Underground mining operations resumed on July 6.

K92 Mining expects the second half of 2023 to be the strongest in terms of production and anticipates that 2023 production will fall within the lower half of the guidance range. The expected increase in production for the second half of 2023 is based on a significant anticipated increase in operational flexibility and stope sequencing.

“The second quarter of 2023 has demonstrated that we have moved beyond the localized geotechnical challenges encountered in the second half of Q1, and the initial part of Q2, with the operation delivering near-budget production and showing that Kainantu production is well positioned for the balance of 2023,” K92 CEO John Lewins said.

“As we have been guiding since the beginning of the year, the second half of 2023 is expected to be our strongest, driven by stope sequence and operational flexibility significantly increasing through the remainder of the year.”

Lewins expressed satisfaction with the recent performance of the process plant, particularly after the completion of the Stage 2A Plant Expansion in May. He noted that the recovery rates for gold and copper in the second quarter were the highest since the end of 2021.

With the plant expansion complete, the company is now focusing on optimizing its potential. Lewins also mentioned the arrival of new equipment and progress on long-term infrastructure projects, which are expected to improve operational efficiency.

In addition, the company continues to actively explore new mining opportunities.