Integra Resources Corp.’s (TSXV: ITR) (NYSE American: ITRG) recently released preliminary economic assessment (PEA) shows the potential for a low-cost, high-margin, heap leach gold-silver operation in Nevada.

The company announced results on Wednesday for its maiden PEA and updated resource estimate for its Wildcat Project and Mountain View Projects in western Nevada.

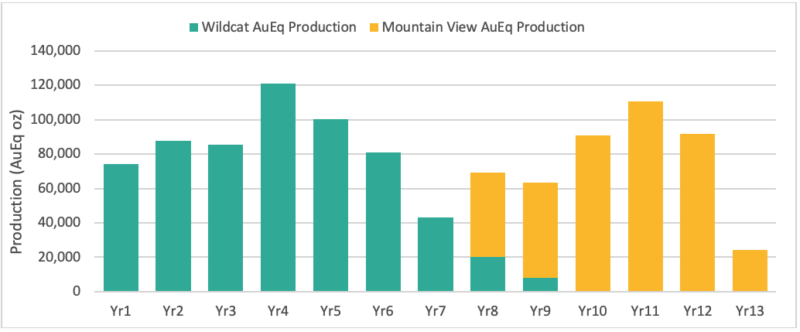

The PEA illustrates a profitable heap leach operation, with a phased development plan starting at Wildcat and expanding to Mountain View in the eighth year. This approach allows the company to utilize a single fleet for mining and processing equipment, resulting in significantly reduced capital requirements. The operation is projected to process approximately 30,000 tonnes per day (tpd) at Wildcat and 16,000 tpd at Mountain View, totalling 99.5 million tonnes of mineralized material over a 13-year life of mine (LOM).

Production profile chart. Image via Integra Resources.

During this period, the operation is expected to produce approximately 1 million ounces of gold equivalent (AuEq). The average annual production at Wildcat and Mountain View is estimated to be 80,000 ounces of AuEq, generating a total net free cash flow of US$485 million over the LOM and an average annual free cash flow of US$46 million for each of the first 13 years, assuming base case metal prices of US$1,700 per ounce of gold and US$21.50 per ounce of silver.

“The updated resource estimate and PEA for Wildcat & Mountain View demonstrate two high-margin, low-cost, heap leachable gold and silver deposits with a strong combined production profile, low pre-production capex and robust economics,” said Jason Kosec, Integra’s president and CEO.

“The PEA strengthens Integra’s position in the Great Basin as a multi-asset developer with a pathway to become a 200,000 ounce per year gold-silver producer.”

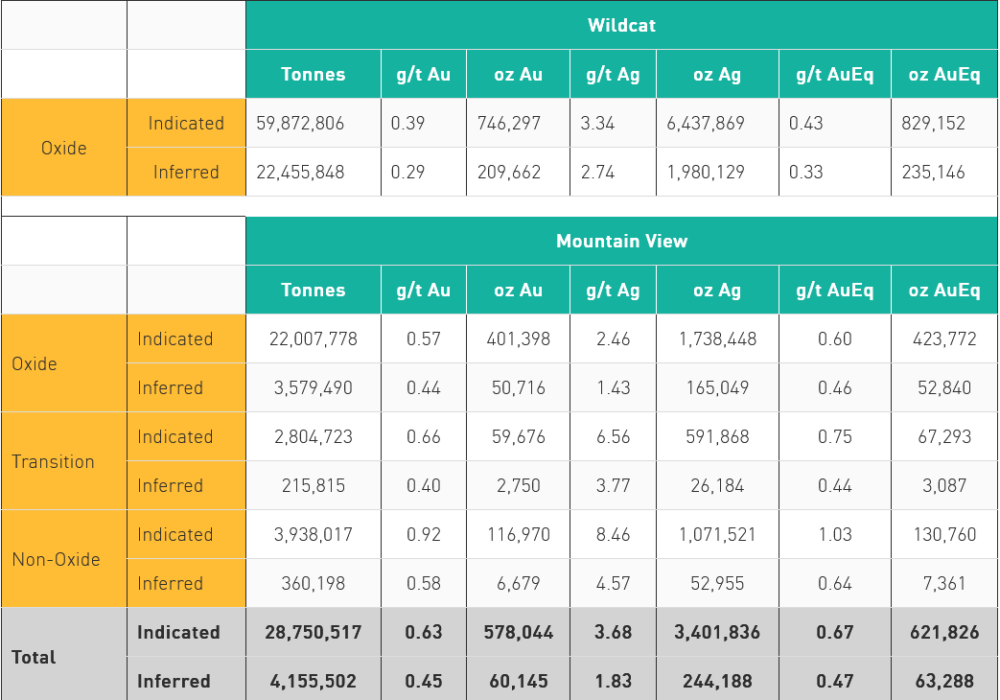

Mineral resource chart. Image via Integra Resources.

Read more: NevGold finds high-grade gold underneath the surface at Nutmeg Mountain

Read more: NevGold assays high-grade silver at Ptarmigan, expands copper trend

Each project will have dedicated heap leach pads

Each of the Wildcat and Mountain View projects will have dedicated heap leach pads and waste rock facilities. To optimize operations and maximize value, the mining equipment and fleet will be relocated between the two projects as needed. Initially, an Adsorption/Desorption/Recovery (ADR) plant will be situated at Wildcat, and then it will be moved to Mountain View in the eighth year. During this transition, the loaded carbon from production for the eighth and nineth years at Wildcat will be transported to Mountain View for processing.

Mining operations will employ 90-tonne haul trucks, as well as 200-tonne and 250-tonne shovels. At Wildcat, the material will undergo crushing to a particle size of 9 millimeters, while at Mountain View, the particle size will be reduced to 19 millimeter using a three-stage crushing circuit. It is anticipated that neither project will require agglomeration processes.

The total site costs, encompassing mining, processing, and general administration expenses, for both Wildcat and Mountain View projects amount to USD$8.19 per tonne processed over the LOM. The site-level cash costs, excluding the value of silver by-product, are estimated at USD$862 per ounce of gold and US$882 per AuEq, on a co-product basis for Wildcat and Mountain View.

When considering the all-in sustaining costs, which incorporate capital investments for heap leach expansion at Wildcat in the second year and at Mountain View in nineth, the figures stand at USD$956 per ounce of gold on a by-product basis and USD$973 per ounce of AuEq on a co-product basis.

Read more: NevGold discovers oxide gold from the surface at Nutmeg Mountain

Read more: NevGold forms B.C. subsidiary to focus on Ptarmigan

All in costs projected to be US$1,163 per ounce

The all-in cost for both Wildcat and Mountain View, taking into account the initial capital expenditure, heap leach expansion capital, sustaining capital, reclamation, and closure costs, is projected to be US$1,162 per ounce of gold on a by-product basis and US$1,175 per ounce of AuEq on a co-product basis.

The Wildcat project will need an initial investment of $115 million. In the second year, an additional $31 million will be spent to increase the size of the heap leach pad. The Mountain View site will require an initial investment of $49 million in the seventh year for the heap leach pad and processing facility. In the ninth year, another $18 million will be spent to increase the heap leach capacity at Mountain View.

Throughout the project’s life, other costs totaling $92 million will be needed for things like mining equipment, maintenance, reclamation costs and bonding.

As part of the PEA, Integra conducted an updated resource estimate for the Wildcat and Mountain View projects. This update incorporated drilling data from the 2021-2022 drill programs and employed a new geological interpretation, encompassing both lithological and oxidation models. The resource estimation process involved twinning historical drill holes, relogging, and re-assaying of available historical data. These efforts provided sufficient information to upgrade a significant portion of the resources into the Indicated category.

The classification of resources was determined manually, considering various factors such as geology, grade and recovery continuity, interpolation parameters, and drilling spacing. The company adopted guidelines of 50 meters by 50 meters spacing for the Indicated resource and 100 meters by 100 meters for the Inferred resource.

The updated resource estimate showed an increase in the total in-pit AuEq ounces. This was primarily driven by the drilling conducted in 2021-2022, which allowed for a re-interpretation of the oxidation profile at Wildcat, improved constraint of the high-grade breccia body at Mountain View, consideration of new geotechnical parameters and metallurgical recoveries, and a higher gold price assumption. Consequently, approximately 80 per cent of the resources for Wildcat and Mountain View are now classified as Indicated.

While the PEA study utilized the resource estimate block model as a basis, additional “modifying factors” were considered. These factors included gold prices and pit designs, among others. The incorporation of these modifying factors in the PEA resulted in a significant difference between the mineral resource estimate and the production plan outlined in the assessment.

Shares of Integra rose 12 per cent to $1.40 on Wednesday on the TSX Venture Exchange.

Resurrection Ridge could have a million ounces

Nevada has a long history of gold production and is renowned for its significant mineral endowment. The state has abundant gold deposits, including world-class gold mines such as Carlin, Cortez, and Goldstrike. These deposits contain substantial gold resources and have been consistently productive, attracting the attention of gold miners globally.

Earlier this year, junior mining research and analysis firm, Caesars Report, released a report analyzing NevGold Corp‘s (TSXV: NAU) (OTCQX: NAUFF) (Frankfurt: 5E50) drilling campaign at both the Limousine Butte property in Nevada.

The report showed that NevGold’s 2022 drilling campaign gave them a much stronger understanding of the mineralization around Limousine Butte.

Currently, the mineralized area stretches for a distance of more than 700 meters along the strike and approximately 350 meters laterally. Assuming an average thickness of 60 meters for the mineralization, this corresponds to an estimated volume of nearly 40 million tonnes of rock. Considering an average grade of 0.50 grams per tonne (g/t), the projected gold content amounts to approximately 600,000 ounces.

The report stated that the Resurrection Ridge target could theoretically host a million ounces by itself, which could push the greater Limousine Butte project closer to the 2 million ounce mark, after considerations for NevGold’s Cadillac Valley target.

NevGold shares were flat at $0.40 on Wednesday on the TSX Venture Exchange.

Nevgold is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com