i-80 Gold Corp. (TSX: IAU) (NYSE: IAUX) inked a merger agreement with Paycore Minerals (TSXV: CORE) today.

i-80 Gold expanded its land package at Ruby Hill by another 14,272 acres adding exposure to carbonate replacement deposit (CRD) districts.

A carbonate replacement deposit is polymetallic which simply implies that they have various metals in them such as copper, gold, silver, lead, manganese and zinc

Gold often comes in carbonate replacement deposits because its highly soluble and can easily be transported by the mineral-rich solutions that make up these deposits. Carbonate replacement deposits are also well known for their high gold grades, which make them attractive mining and exploration targets.

“In the immediate area surrounding the Archimedes pit, we have identified oxide gold, Carlin-type refractory gold, base metal skarn and polymetallic carbonate replacement mineralization. Older mineralizing events are often overprinted by Carlin-type mineralization resulting in precious metal rich deposits not found elsewhere in the Great Basin,” said Ewan Downie, CEO of i-80.

The deal also has unanimous board approval and support from Waterton Nevada Splitter and Water Nevada Splitter II, which are Paycore’s largest shareholder at 25 per cent of the company’s outstanding shares.

Read more: Calibre Mining Pan Mine assays show strong potential for Coyote mine target

Read more: Calibre Mining 2022 operating results show year round gold production of 222K ounces

i-80 Gold intersects high grade mineralization in 2022 targets

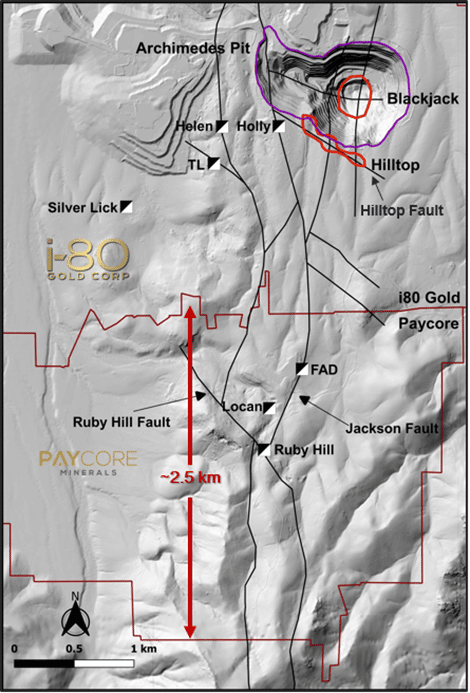

Hilltop Corridor Surface Plan. Image via I-80 Gold.

The company intersected high-grade mineralization in each of its 2022 targets, all of which are still open for expansion. The consolidation of the core part of the Ruby Hill district allows the company to optimize production for its multi-year development plan. This aims to create one of the largest United States focused diversified mineral producers.

Since the 1960’s, exploration in the district has been focused on finding Carlin-style deposits. Now more than 50-years later, i-80 and Paycore has started looking for polymetallic deposits with their respective 2021 and 2022 drilling campaigns.

Paycore shareholders will get 0.68 of an i-80 common share for each Paycore share. This represents a premium of 36 per cent based on the 20 day volume weighed average price (VWAP) of both Paycore and i-80 shares for February 24, 2023. It also represents a 26 per cent premium based on the closing prices of both companies on the same date.

The two companies focused on the upper, lower and east hilltop zones, which are presently being drilled by i-80. These newly discovered CRD zones in the Hilltop Zones returned substantial grades.

-

515.3 g/t Ag, 28.9 per cent Pb, 10.5 per cent Zn & 0.9 g/t Au over 28.3 m in hole iRH22-43 (Upper Hilltop)

-

1.9 g/t Au, 631.3 g/t Ag, 7.4 per cent Zn & 33.0 per cent Pb over 18.3 m in hole iRH22 53 (Upper Hilltop)

-

60.2 g/t Au, 908.7 g/t Ag, 1.1 per cent Zn & 15.7 per cent Pb over 10.0 m in hole iRH22-55 (Upper Hilltop)

-

12.3 per cent Zn over 39.4 m in hole iRH22-61 (East Hilltop)

Ruby Hill expansion includes strong historical grades

The Eureka District had been a successful property before the discovery of Carlin-type mineralization by Homestake in the 1990’s.

The years 1864-1966 resulted in some of the highest-grade CRD mines in the world from the Eureka District.

Ruby Hill reported historical production of 1.65 million gold ounces with average grades of 0.83 ounces per ton.

Also 39 million ounces of silver have come from the project with an average grade 19.5 ounces per ton.

The FAD deposit is the down-faulted, polymetallic-rich, extension of the original Ruby Hill Mine. Paycore drilled it originally in 2022, which was a program that expanded mineralization with multiple high grade intercepts.

-

PC22-07 – 1.06 g/t Au, 155.5 g/t Ag, 22.0 per cent Zn & 1.5 per cent Pb over 12.5 m and 03 g/t Au, 231.6 g/t Ag, 6.3 per cent Zn & 3.7 per cent Pb over 44.8 m

-

PC22-08 – 7.1 g/t Au, 376.3 g/t Ag, 6.3 per cent Zn & 10.3 per cent Pb over 14.8 m

Shares of i-80 rose $0.075 and are now trading at $3.10 on the Toronto Stock Exchange.

Read more: Calibre Mining gold discovery could breathe life into historic mining community

Read more: Calibre Mining budgets $29M for 2023 exploration in Nevada and Nicaragua

Calibre Mining (TSX: CXB) (OTCQX: CXBMF) is another junior gold explorer operating in the Eureka Battle Creek property in Nevada.

Recently, mineral reserves at the Pan Mine grew by 23 per cent to 234,000 ounces of gold. Additionally, there was a 12 per cent increase in the measured and indicated mineral resource at Pan Mine to 359,000 ounces of gold.

Calibre shares rose $0.05 and are now trading at $1.06 on the Toronto Stock Exchange.

Calibre Mining is a sponsor of Mugglehead news coverage

Follow Joseph Morton on Twitter

joseph@mugglehead.com