Toronto-based cannabis retailer Fire & Flower Holdings Corp. (TSE: FAF) (OTCMKTS: FFLWF) reported declining revenue during the fourth quarter as retail competition increased.

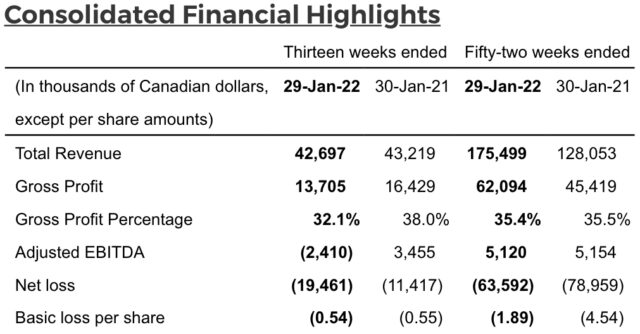

On Tuesday, the company reported results for its fourth quarter and fiscal year ended Jan. 29. Revenue for the quarter was $42.7 million, down 6 per cent from the previous quarter.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for the fourth quarter was negative $2.4 million.

Retail revenue for the fourth quarter decreased 5 per cent to $31.7 million from $33.2 million during the fourth quarter of 2020.

“In the fourth quarter of fiscal 2021, while we have continued to see growth in our Hifyre digital-business segment, we saw a decline in our retail revenue due to increased competitive pressures within the Canadian cannabis retail landscape,” Trevor Fencott, Fire & Flower CEO, said in a statement.

Read more: Fire & Flower launches ‘virtual dispensary’ portal for LPs

Read more: Fire & Flower ups sales 6% to $45M in Q3, offset by surge of new Ontario stores

The technology-focused retail chain reported annual revenue of $175.5 million, up 37 per cent over the previous fiscal year. Consolidated adjusted EBITDA for the fiscal year was $5.1 million, consistent with the previous year.

Fire & Flower’s Hifyre cannabis consumer technology platform generated $14.3 million for the fiscal year, an increase of 129 per cent year-over-year. However, the company’s quarterly net loss was $19.5 million, with an annual net loss of $63.6 million.

Retail revenue increased 29 per cent to $130.8 million for the 2021 fiscal year up from $101.5 million in the 2020 fiscal year.

Fire & Flower posted a net loss of $19.5 million during the fourth quarter. Chart via Fire & Flower

The company opened 32 stores during the past year, with 105 locations operating as of the end of January. Fire & Flower also acquired Canadian cannabis delivery service Pineapple Express, as well as marijuana websites PotGuide and Wikileaf to expand logistics capabilities and web traffic.

On April 20, Fire & Flower announced its intent to exercise Series B warrants by strategic partner Alimentation Couche-Tard (TSE: ATD) (OTCMKTS: ANCTF), owner of Circle K convenience stores, resulting in a post exercise ownership stake of approximately 35 per cent.

“This year, we have refined our vision to ‘Deliver Cannabis to the World’, positioning our business as a consumer e-commerce platform, supported by a distributed retail network enhanced by our Circle K store co-location program,” Fencott said.

Read more: Fire & Flower to get up to $30M in loans from Circle K owner

Read more: Fire & Flower to buy Pineapple Express Delivery

The company recently completed one of the final steps in preparation for listing on the NASDAQ, including filing of the 40-F registration statement and DTC eligibility for common shares.

More than 420,000 Canadians are signed up for the Fire & Flower loyalty program, the company said in a presentation to investors.

Company stock was down more than 15 per cent Tuesday following the news, falling to $3.60 on the Toronto Stock Exchange.

ryan@mugglehead.com