Equinox Gold Corp. (TSE: EQX) (NYSE American: EQX) and Calibre Mining Corp. (TSE: CXB) (OTCMKTS: CXBMF) are set to combine later on this year into Canada’s second largest gold producer in an all-stock deal worth CAD$2.6 billion.

The companies announced the signed arrangement agreement for an at-market business combination on Sunday. Further, the new combined company will use the name Equinox Gold Corp. The two companies are also co-hosting a conference call and webcast on Monday, Feb 24, at 7:30 EST to discuss the merger.

The transaction will establish a diversified gold producer focused on the Americas, with operating mines in five countries and two high-quality, long-life, low-cost Canadian gold mines as its cornerstone assets.

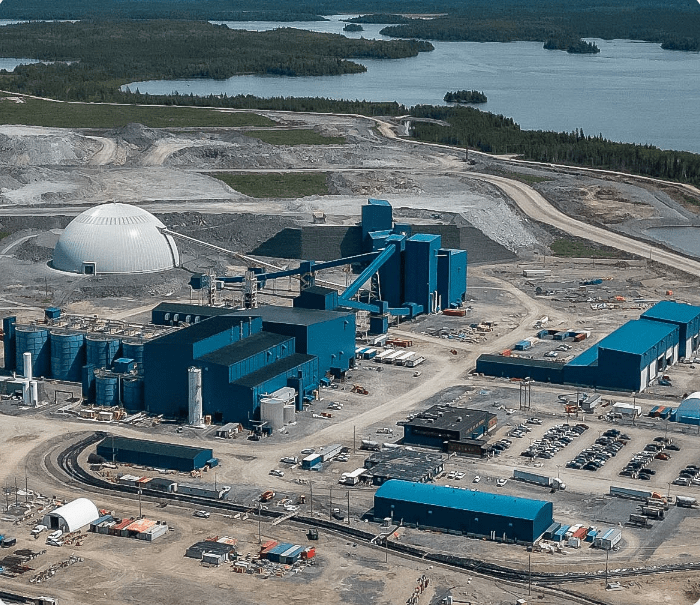

The Greenstone Mine in Ontario achieved commercial production in November 2024. Meanwhile, the Valentine Gold Mine in Newfoundland & Labrador is nearing construction completion, targeting its first gold pour by mid-2025. Once fully operational, these two mines are expected to produce an average of 590,000 ounces of gold annually.

The combined company expects to produce approximately 950,000 ounces of gold in 2025, excluding production from Valentine and Los Filos.

The company will also hold a large gold endowment of Mineral Reserves and Mineral Resources, along with a highly prospective pipeline of development, expansion, and exploration projects to drive low-risk, sustainable growth.

Read more: Calibre Mining beats gold guidance for 2024 in Nevada and Nicaragua

Read more: High grades in Nicaragua expected to raise Calibre Mining’s mineral resource

New company will become second-largest gold producer

Merging Equinox and Calibre will create a major diversified gold producer in the Americas. Furthermore, it will have the potential to produce more than 1.2 million ounces of gold annually from a portfolio of mines across five countries.

In Canada, the combined company will become the second-largest gold producer. The companies expect the Greenstone and Valentine mines to produce a total of 590,000 ounces per year once operating at full capacity.

The merger will immediately increase production at record-high gold prices, generating substantial free cash flow to accelerate debt reduction. Growth will continue with the ramp-up of Valentine and a strong pipeline of development and expansion projects.

Upon closing the transaction, executives from both Equinox and Calibre will manage the combined operations.

Greg Smith will transfer his role of Equinox CEO over to the combined company. Darren Hall, Calibre’s current president and CEO, will transition into a role as president and chief operating officer.

The company’s greater scale, lower risk, near-term production growth, and superior free cash flow position it for a significant valuation re-rate compared to its peers. Additionally, an industry-leading team with a proven track record of execution and shareholder value creation will lead the company, with Ross Beaty, Blayne Johnson, and Doug Forster of Featherstone Capital serving on the Board of Directors of New Equinox Gold.

“This merger represents a transformative step forward for both Equinox and Calibre, bringing together two complementary companies with strong production, growth potential, operational expertise, and a shared commitment to responsible mining,” said Greg Smith, president and CEO of Equinox.

Read more: Calibre Mining beats updated gold production guidance with 242,487 ounces

Read more: Calibre Mining’s mineral resource estimate in Talavera gives reasons for optimism

Combined company strengthens capital markets profile

Combining Equinox and Calibre unlocks benefits for both sets of shareholders that would not be possible on a standalone basis.

The merger provides full ownership of two cornerstone Canadian gold mines at the beginning of their mine lives. Furthermore, this ensures long-term production stability. It also increases production and cash flow in a record gold price environment while enhancing portfolio diversification and reducing risk.

Shareholders will gain exposure to several significant growth opportunities within the portfolio.

The combined company will also strengthen its capital markets profile, increasing its relevance for indices and investors. A reinforced leadership team, with key additions to both the Board and management, will guide the company.

“The combination of two new, long-life, low-cost, open-pit gold mines, Valentine and Greenstone, will be the cornerstone of an exciting new major Canadian gold producer that will be positioned to generate substantial shareholder value,” said Hall.

Under the arrangement agreement, Calibre shareholders will receive 0.31 Equinox common shares for each Calibre common share.

Furthermore, after completing the transaction, existing Equinox shareholders will own approximately 65 per cent of the combined company’s outstanding common shares. Former Calibre shareholders will hold about 35 per cent, based on a fully diluted in-the-money basis.

The combined company’s implied market capitalization is estimated at CAD$7.7 billion.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.