Supply chain issues, project delays and seasonal weakness contributed to decreased revenue for cannabis company Delta 9 Cannabis Inc. (TSE: DN) (OTCMKTS: DLTNF) during the first quarter.

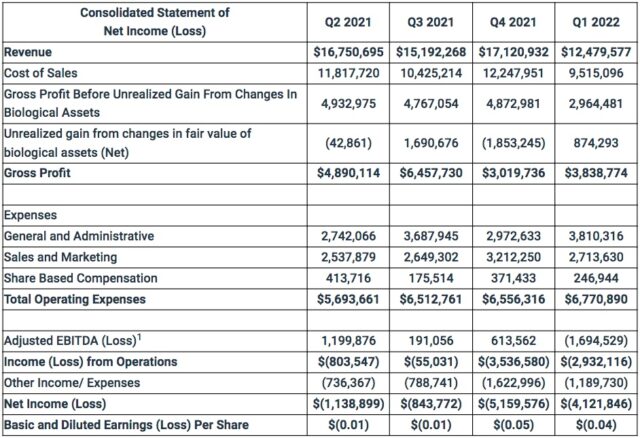

On Monday, the company announced its earnings for the first quarter ended March 31, with net revenue of $12.5 million down 27 per cent from $17.1 million compared to the previous quarter and 6 per cent year-over-year from $13.2 million during Q1 2021.

Delta 9 reported gross profit of $2.9 million (24 per cent of net revenue), declining 39 per cent compared to $4.8 million (29 per cent of net revenue) in the previous quarter and decreasing 20 per cent from $3.7 million during the first quarter of 2021.

Read more: Delta 9 to launch Canada’s first mobile cannabis store

Read more: Delta 9 CEO talks first profitable quarter and relative calm in Manitoba: Q&A

Operating expenses for the first quarter were $6.5 million versus $5.7 million during the first quarter of 2021.

The company posted a net income loss of $2.9 million during the first quarter, compared to a loss of $3.5 million during the previous quarter.

Delta 9’s adjusted EBITDA was a $1.7 million loss compared to a $613,562 gain during the previous quarter.

The company reported $11.5 million in cash, with working capital of $15 million and total assets of $106.9 million.

“In the first quarter of 2022 we saw a degree of seasonality and industry headwinds relating to supply chain issues and overall weakness in the Canadian cannabis market affecting our business and impacting sequential revenue growth,” Delta 9 CEO John Arbuthnot said in a statement. “However, we remain bullish that the remainder of 2022 looks to be a promising year for Delta 9.”

Chart via Delta 9

During the first quarter, Delta 9 completed the acquisition of 17 cannabis retail stores in Edmonton from Uncle Sam’s Cannabis Ltd. The company now has 35 retail stores operating in Alberta, Saskatchewan and Manitoba.

The company completed a strategic financing of $10 million with Sundial Growers Inc. (Nasdaq: SNDL) by way of a convertible debenture that matures on March 30, 2025 and bears an interest rate of 10 per cent per annum.

Read more: Delta 9 details deal to expand retail to Alberta

Read more: Delta 9 Reports Record Q4 Revenues of $5.27 Million

Delta 9 also announced the closing of a $32 million credit facility with connectFirst Credit Union. The credit facility consists of a $23 million commercial mortgage, a $5 million M&A facility, and a $4 million working capital line of credit.

“Delta 9 recorded a transformative first quarter of 2022, closing on our 17-store acquisition of Uncle Sam’s Cannabis as well as a $42 million balance sheet re-structuring through a $10 million strategic investment and $32 million credit facility,” Arbuthnot said.

In April, Delta 9 announced plans to launch Canada’s first mobile cannabis store, selling products on-site this summer at the Dauphin Countryfest and Rock the Fields Minnedosa music festivals.

Company stock was up nearly 2 per cent Monday to $0.27 on the Toronto Stock Exchange.

ryan@mugglehead.com