Centerra Gold (TSX: CG) (NYSE: CGAU) lost USD$73.5 million during Q1, 2023 due to a mix of maintenance, exploration and mining costs at its various properties.

After a number of setbacks, the Toronto-based gold miner now anticipates its production will come in at the lower end of its guidance.

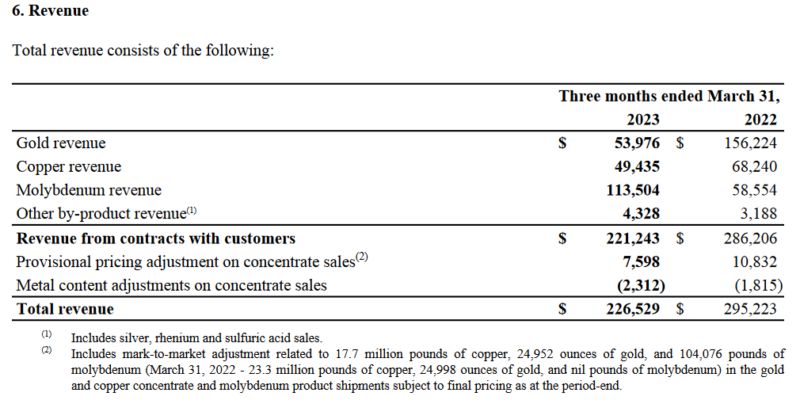

The company pulled in total revenue of USD$226.5 million in revenue, but during the quarter, there was a cash deficit of USD$99.8 million in operating activities and a free cash flow deficit of USD$105.9 million. These deficits were mainly attributed to the working capital requirements of the Molybdenum Business Unit and the suspension of production at the Öksüt Mine.

The overall operating cash flow deficit for the quarter was primarily driven by a USD$75.8 million increase in working capital. However, the Mount Milligan Mine managed to generate cash from mine operating activities, amounting to USD$27.6 million, and had a free cash flow of USD$24.6 million for the quarter.

The Öksüt Mine also had a cash deficit of USD$20.8 million in operating activities, while the Molybdenum Business Unit had a cash deficit of USD$76.6 million, mainly due to the increase in working capital resulting from higher molybdenum prices. It is anticipated that this situation will partially reverse throughout the remainder of the year if molybdenum prices remain stable at their current levels.

Gold production and copper production at the Mount Milligan Mine during the quarter amounted to 33,215 ounces and 13.4 million pounds, respectively.

Paul Tomory explained that the Mount Milligan Mine faced obstacles that affected copper and gold production in the first quarter. These challenges included the grade profile and lower metal recoveries. Also, a planned mill maintenance shutdown and difficulties in material handling during winter.

As a result, the company is now forecasting gold production to be near the lower end of guidance while copper production remains on track for the mid-point of guidance. The mine sequencing plan, however, remains unchanged, with the company aiming to tap into higher-grade copper and gold ore in the latter half of the year, resulting in a shift towards increased production during that period.

Chart via Centerra Gold.

Read more: NevGold intercepts quartz veining on the surface of Nutmeg Mountain

Read more: Gold is still the best hedge against inflation: NevGold CEO

Environment impact assessment for Öksüt Mine going planned

The sequencing of mining phases during the quarter led to lower-than-expected ore grades and variations in the ore-waste transition zone. These factors also had an impact on feed grades and metal recoveries. Despite these challenges, the company’s mining activities remained on track to access higher-grade copper and gold from Phase 7 and Phase 9 in the second half of the year.

However, due to the lower production experienced in the first quarter, the company anticipates that its 2023 gold production will likely be near the lower end of the guidance provided. On the other hand, copper production for the year is expected to align with the mid-point of the guidance.

The regulatory review of the amended Environmental Impact Assessment (EIA) for the Öksüt Mine is progressing as planned. In late April, the company posted the EIA for public comment following the completion of its technical review meeting with local authorities in March. Notably, there were no significant comments received during the public comment period. Having concluded all necessary review steps, the EIA has now been submitted for final approval by the ministry.

The retrofit for the mercury abatement system at the Öksüt Mine’s ADR (Adsorption, Desorption, and Recovery) plant has been successfully completed by the company. In March 2023, the system underwent testing under the supervision of the Turkish Ministry of Environment, Urbanization, and Climate Change. Once the final regulatory approvals are obtained and the ADR plant is restarted, the company will be able to commence processing the existing gold-in-carbon inventory, which is estimated to be around 100,000 recoverable ounces. The ADR plant has the capacity to produce approximately 35,000 ounces of gold per month.

In the first quarter of 2023, the Goldfield Project made significant progress in its drilling activities, incurring a large portion of the planned drilling costs for the year. As a result, the company is on schedule to release an initial resource estimate by mid-year 2023. Subsequently, an updated resource estimate will be issued alongside a feasibility study.

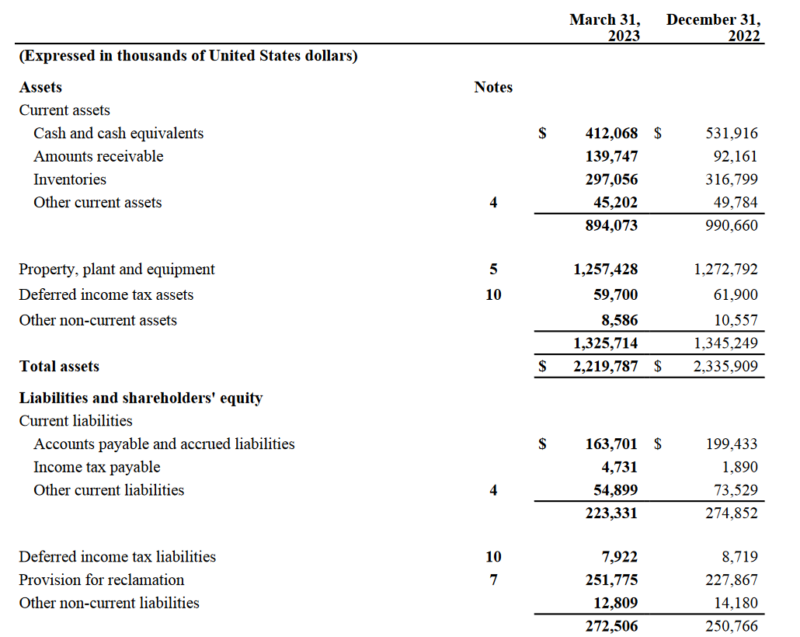

Chart via Centerra Gold.

Read more: NevGold finds high-grade gold underneath the surface at Nutmeg Mountain

Read more: NevGold assays high-grade silver at Ptarmigan, expands copper trend

Centerra finished Q1 with strong cash position

The company finished the quarter with a strong balance sheet, holding a cash and cash equivalents position of USD$412.1 million. It’s assets to liabilities spread also vastly favours the asset column, which is a strong indicator for future positive cashflow.

Gold production costs for the quarter amounted to USD$1,124 per ounce, primarily influenced by changes in the relative market prices of gold and copper, as well as mill shutdown activities.

Copper production costs were USD$2.66 per pound. The all-in sustaining costs on a by-product basis for the quarter reached USD$1,383 per ounce, driven by higher gold production costs at the Mount Milligan Mine.

In March 2022, Centerra announced a temporary suspension of gold doré bar production at the Öksüt Mine. This decision was made in response to the detection of mercury in the gold room at the ADR plant. Following the suspension of gold room operations, the company accumulated an inventory of approximately 100,000 recoverable ounces of gold-in-carbon, along with 200,000 recoverable ounces of gold in ore stockpiles and on the heap leach pad.

Notably, the production costs for the gold-in-carbon inventory have already been incurred. Upon resuming operations, the ADR plant is expected to have sufficient capacity to process approximately 35,000 ounces of gold per month.

Subsequently, the company successfully completed the construction of a mercury abatement system, which will enable the processing of mercury-bearing ores. The ADR facility underwent inspection and testing by the Turkish Ministry of Environment, Urbanization, and Climate Change, as well as the Ministry of Labour and Social Security, during February and March 2023.

The company is actively collaborating with the relevant authorities to secure the necessary approvals for the resumption of gold room operations at the ADR plant.

Centerra Gold shares dropped 14.9 per cent on Monday to trade at $7.65 on the Toronto Stock Exchange.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com