In a recent analyst report by a research arm of Bank of Montreal Financial Group (TSE: BMO), Calibre Mining’s (TSX: CXB) (OTCQX: CXBMF) Q1/23 financials were analyzed, revealing in-line earnings and setting the stage for substantial growth in 2023.

The company’s earnings per share (EPS) stood at $0.04, closely aligning with expectations. The initiation of open pit mining at the Eastern Borosi Project (EBP) and the Pavon Central mine, as highlighted in the BMO report, is expected to enhance production and cash flow throughout the year.

Despite these new ventures, Calibre has maintained all guidance. Following a comprehensive evaluation, BMO has slightly increased its target price for Calibre from $1.80 to $2.00 per share. The Outperform rating for Calibre Mining is upheld in the BMO report, indicating a promising year ahead.

The report was published last month by BMO Nesbitt Burns Inc. analyst Brian Quast and sheds light on four key aspects that are integral to understanding the company’s current standing and future trajectory.

Firstly, the report underscores that Calibre’s earnings and costs for Q1 were approximately in line with expectations. The Earnings Per Share (EPS) stood at $0.04 per share, which was in alignment with the consensus estimate of $0.04 per share and BMO’s estimate of $0.06 per share. The earnings were slightly lower than the estimates, primarily due to slightly higher-than-expected operating costs.

The company reported Total Cash Costs (TCC) of $1,164 per ounce and All-In Sustaining Costs (AISC) of $1,302 per ounce, compared to the estimated TCC of $1,112 per ounce / AISC of $1,339 per ounce and consensus TCC of $1,113 per ounce / AISC of $1,346 per ounce.

Secondly, the report emphasizes the substantial contribution of Nicaragua assets in driving robust Q1 production. The consolidated gold production was 65.8 koz, which was primarily due to the production of 37.4 koz at La Libertad and 17.6 koz at El Limon. The strong quarter production in Nicaragua can be attributed to better-than-expected grade at El Limon and better-than-expected throughput at La Libertad.

The third key point pertains to the progress of key growth projects. On April 18, Calibre announced the commencement of mining at the open pit Eastern Borosi Project (EBP). With open pit mining ramping up at both EBP and the Pavon Central mine, the company is strongly positioned to deliver on its 2023 guidance.

Table via BMO Financial Markets.

Lastly, the report indicates an expected improvement in Calibre’s cash position. For the first quarter, the company spent $15.5 million on growth projects and $5.6 million on exploration, both lower than the expectations of $22 million and $6.5 million respectively. As of March 31, the company had a cash balance of $58.3 million, which represents a slight $1.8 million increase from Q4/22.

The report anticipates the cash position to improve significantly throughout the second half of 2023 as the company is planning for stronger cash flow in the latter part of the year due to lower growth and sustaining costs.

“We view the hub-and-spoke approach as a clever operational initiative that has the potential to create substantial value through the addition of further spokes. The company’s Nicaraguan operations pose some headline risk,” reads the report thesis.

Read more: Calibre reports high-grade results from Talavera deposit in Nicaragua

Read more: Calibre Mining’s discoveries at Eastern Borosi hold promise for extended lifespan

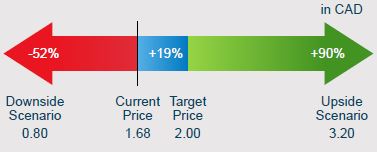

BMO sets target price at C$2.00, with an upside potential of $3.20 and downside risk of $0.80

BMO’s target price for Calibre Mining is set at C$2.00, derived from a 50 per cent weighting assigned to a 0.75x Price/Net Present Value (P/NPV) multiple and a 50 per cent weighting given to a 4.8x Price/Next Twelve Months Cash Flow Per Share (P/NTM CFPS) multiple. Currently, Calibre trades at 0.9x P/NPV and 3.2x P/NTM CFPS, compared to the intermediate peer group trading at 1.2x P/NPV and 7.8x P/2023E CFPS.

In an upside scenario, BMO projects a potential price of $3.20, based on higher target multiples of 1.3x P/NPV and 8.0x P/NTM CFPS, which aligns with peer averages. This scenario could be realized through strong execution of Calibre’s hub-and-spoke approach, promising potential for the Borosi District, and resource conversion across the company’s portfolio.

Graph via BMO Financial Markets.

On the other hand, a downside scenario could see the price drop to $0.80, based on lower target multiples of 0.3x P/NPV and 2.0x P/NTM CFPS. This could occur if complications arise with the proposed hub-and-spoke operations or if progress at the Borosi District stalls.

Key catalysts for Calibre’s growth include continued exploration drilling in Nevada and Nicaragua, further advancement of the Eastern Borosi Project, and the addition of more “spokes” to the “hub and spoke” approach currently being used in Nicaragua. In Nevada, ongoing optimization efforts at Pan, plus Gold Rock technical reports, are also expected to drive growth.

Calibre Mining operates, explores and develops gold mines in North America and Latin America. It currently operates the El Limon and La Libertad mines in Nicaragua, as well as the Pan Mine in Nevada. The company also has interests in several other projects at various stages of exploration and development in Nicaragua and the United States.

Read more: Calibre Mining delivers first shipment of Eastern Borosi ore at La Libertad mill

Read more: Calibre Mining 2022 sustainability report shows strong support for ESG initiatives

On May 24, Calibre held its second TIME OUT FOR SAFETY of 2023, focusing on effective methods to evaluate risks associated with process and activity changes. Photo via Calibre Mining.

Praised for ESG efforts, company eyes future GHG and energy initiatives

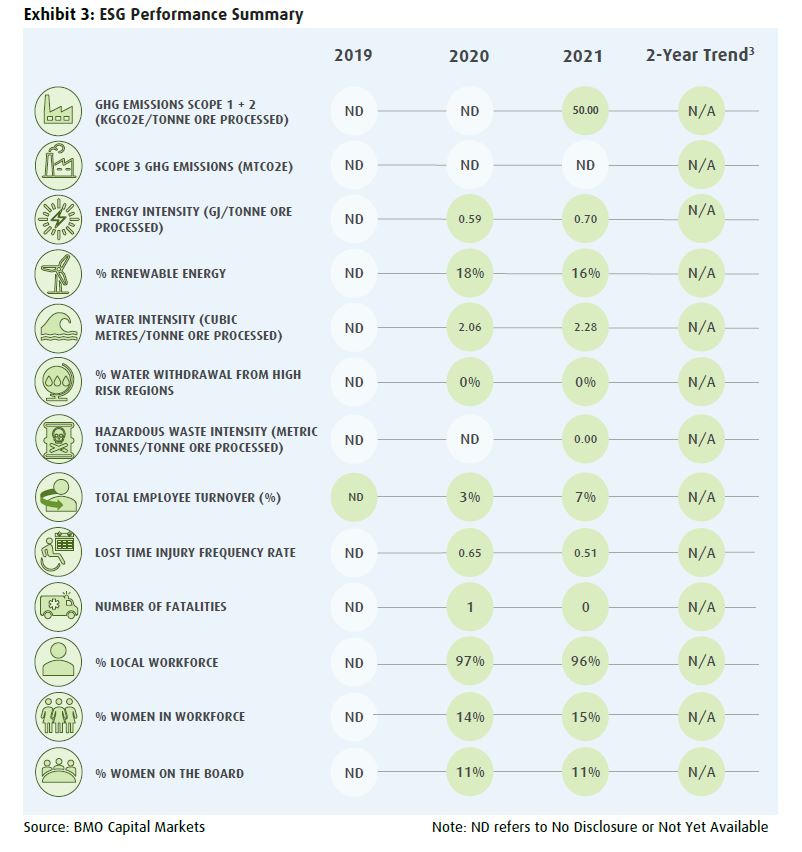

The company released its inaugural sustainability report in 2020 and has been lauded for its ESG initiatives, despite being relatively new to reporting. BMO anticipates further initiatives related to Greenhouse Gas (GHG) emissions and energy usage in the future.

Calibre Mining’s ESG initiatives span across climate change, water management, extraction management, stakeholder engagement and ESG governance. The company has made significant strides in improving electricity services and identifying GHG inventories and water footprints. It is also launching a five-year environmental strategy (2022-2026) and aims to establish energy and climate change-related targets.

In terms of water management, Calibre has enhanced the potable water system in El Limon and introduced a new vent fan in Santa Pancha, which has improved underground conditions. The company has also invested in the local community by expanding the sewage system and has made efforts to minimize fresh water use.

Calibre’s extraction management initiatives include a cyanide code gap assessment at El Limon and La Libertad, recycling of non-mineral waste, and plans to align its tailings management standards with the Global Industry Standard on Tailing Management.

The company has also been active in stakeholder engagement, working on various resettlements and infrastructure investments, including improvements to local schools and roads. It has also held presentations with Indigenous Peoples’ representatives to provide early information on Calibre’s concession requests.

Table via BMO Capital Markets.

In the area of ESG governance, Calibre has developed a five-year sustainability strategy and trained 99 per cent of its employees on its Code of Conduct and Whistleblower Policy. The company also plans to introduce an environmental legal compliance monitoring system and conduct a human rights impact assessment for all Nicaraguan assets.

Despite being new to ESG reporting, Calibre Mining’s comprehensive activities and disclosures demonstrate a commitment to sustainability and responsible business practices. BMO Capital Markets expects the company to continue its focus on GHG emissions and energy usage in the coming years.

“Although the company did provide Scope 1 & 2 GHG emission figures, they were specific to only La Libertad and El Limon,” wrote Quast in the report. “The company is planning to identify GHG emissions at all sites and we hope to also see some consideration of Scope 3 GHG emissions. Calibre Mining has demonstrated a dedication to various infrastructure projects near its operations.

The company is currently involved in local infrastructure improvements to multiple schools, roads and electricity services.

“Additionally, Calibre made considerable improvements to its water management with the enhancements to the water system at El Limon in 2021. We look forward to seeing further improvements in this year’s report as the company plans to make similar enhancements at La Libertad.”

Calibre Mining is a sponsor of Mugglehead news coverage