Americas Gold and Silver (TSX: USA) (NYSE: USAS) lost $10.5 million for Q1, 2023, an increase in net loss of $10.2 million compared to the same time last year.

On Monday, the company released its financial and operational results for Q1, 2023 detailing the company’s operations in the United State and Mexico.

The rise in loss was primarily attributed to a 17-day maintenance shutdown at the Cosalá Operations, elevated interest and financing charges, a stronger Mexican peso in Q1-2023, and a singular gain resulting from the US Government’s loan forgiveness, which reduced the net loss in Q1-2022. This shutdown was conducted to address remedial work on the decant tunnel at the Cosalá Operations tailings facility, as part of the operations’ long-term environmental plan.

The temporary shutdown provided an opportunity for the San Rafael Mine to replenish its stockpiles, which had been depleted in 2022. Additionally, scheduled maintenance was carried out at the Los Braceros mill during this period. These measures have positioned the operation for a promising performance in the remainder of 2023.

Americas Gold and Silver Corporation also made $22.1 million in revenue in Q1, which is $4.3 million less than last year. During Q1, 2023, there was a notable improvement in net cash generated from operating activities, which amounted to $1.7 million compared to a net cash usage of $1.8 million in Q1-2022. This positive change reflects a significant turnaround in the company’s financial performance.

The Galena Hoist project continues to progress as planned, with the installation of hoist ropes completed last week. The upcoming activities involve inspecting and repairing the shaft, which are scheduled to commence this week. The project remains on track to achieve full operational capacity by the end of Q2, 2023.

“The Galena Hoist project is making excellent progress with not only the major capital obligations and technical components completed but the shaft repair work about to start,” said Darren Blasutti, Americas Gold and Silver president and CEO.

“Once operational, the Galena Hoist will not only add flexibility but also support plans to significantly increase silver production at the Galena Complex moving forward starting in Q3, 2023.

Despite shutdown at the Cosalá Operations, the consolidated attributable production for the quarter amounted to approximately 1.2 million ounces of silver equivalent. This includes 0.5 million ounces of silver, 7.2 million pounds of zinc, and 5.5 million pounds of lead. Notably, the consolidated attributable silver production experienced a significant year-over-year increase of 66 per cent.

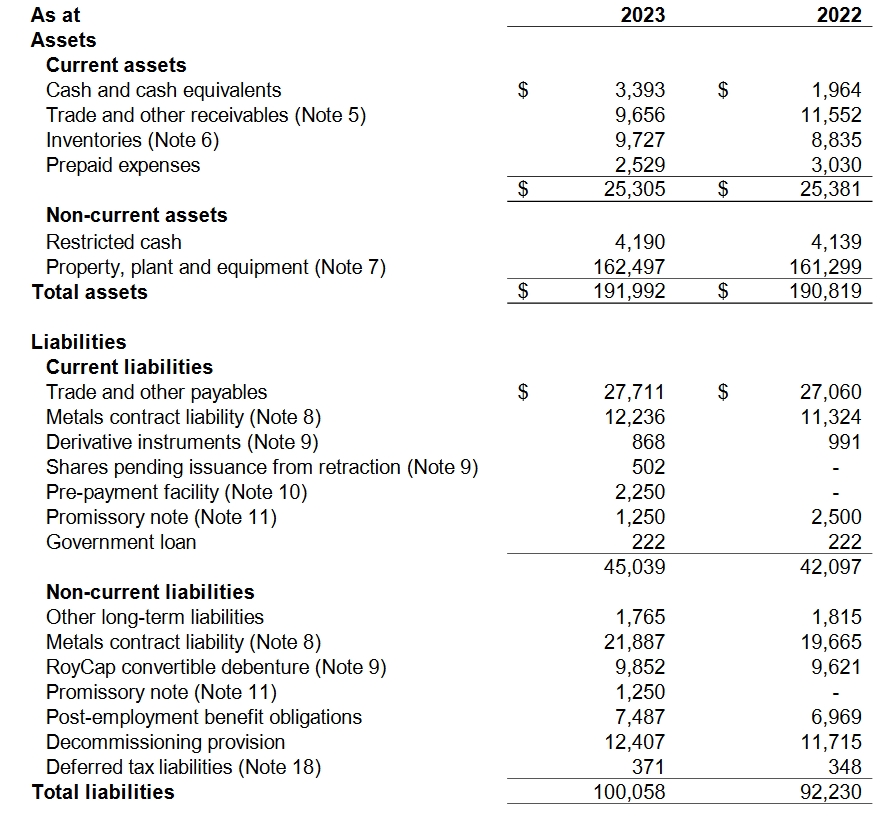

Chart via Americas Gold and Silver.

Read more: Calibre Mining’s discoveries at Eastern Borosi hold promise for extended lifespan

Read more: Calibre Mining starts drilling high-grade gold at Eastern Borosi open pit

Production guidance unchanged despite setbacks

During the quarter, the cash costs for producing silver were reported at $11.18 per ounce, while the all-in sustaining costs totalled $16.87 per ounce. These figures shed light on the company’s cost structure and performance throughout the period.

Looking ahead, the production guidance for 2023 remains unchanged. The company anticipates consolidated attributable silver equivalent production to fall within the range of 5.5 to 6.0 million ounces, signifying a significant increase compared to 2022. Additionally, consolidated attributable silver production is projected to range between 2.2 and 2.6 million ounces, showcasing remarkable growth of over 80 per cent in comparison to the previous year.

In Q1-2023, the operations yielded approximately 265,000 ounces of silver, 2.7 million pounds of lead, and 7.2 million pounds of zinc. This represents a significant increase of approximately 110 per cent in silver production compared to Q1-2022, which saw around 127,000 ounces of silver. The boost in silver production was attributed to enhanced output from the higher-grade silver areas in the Upper Zone of the San Rafael mine.

However, the increased silver production and decreased production of by-product zinc and lead resulted in higher cash costs and all-in sustaining costs during Q1-2023. The cash cost per silver ounce amounted to $4.61, while the all-in sustaining cost per silver ounce was $9.52. These figures signify an increase when compared to Q1-2022.

The anticipated silver production from the Cosalá Operations in 2023 is projected to range between 1.2 and 1.4 million ounces. This expected increase is attributed to enhanced production from the higher-grade silver areas in the Upper Zone of the San Rafael mine.

Furthermore, zinc production from the Cosalá Operations is estimated to be approximately 33 to 37 million pounds, while lead production is expected to range between 11 and 13 million pounds. These projections provide insights into the expected output from the operations in the coming year.

Chart via Americas Gold and Silver.

Read more: Calibre Mining’s new drill results help solidify a 2M oz resource potential at Golden Eagle

Read more: Calibre Mining reports record gold production in Q1 2023

Galena Complex range 1.0 to 1.2 million ounces

In Q1, 2023, the Galena Complex contributed approximately 235,000 ounces of silver and 2.8 million pounds of lead to the company’s attributable production. This marks an increase of approximately 35 per cent in silver production compared to Q1-2022, which recorded around 174,000 ounces of silver and 2.5 million pounds of lead. The cash cost and all-in sustaining cost for the Galena Complex remained largely unchanged from Q1, 2022, standing at $18.59 per silver ounce and $25.18 per silver ounce, respectively.

The ongoing Galena Hoist project has made significant progress, with hoist ropes installed recently. This milestone paves the way for shaft inspection and repair, which is scheduled to commence this week. Completion of this phase of hoist commissioning reduces project risks and validates the mechanical integrity of the hoist system. Preliminary inspections of the Galena shaft indicate that it remains in reasonable condition without substantial deterioration during the period of inactivity. The project remains on track for completion by the end of Q2, 2023, enabling increased production, operational flexibility, and improved economics.

Looking ahead, attributable silver production from the Galena Complex in 2023 is anticipated to range between 1.0-1.2 million ounces. Additionally, attributable lead production is expected to fall within the range of 11-13 million pounds. Notably, the Galena Complex’s attributable production for 2022 amounted to 672,000 ounces of silver and 9.3 million pounds of lead. These projections highlight the expected output from the Galena Complex and underscore the company’s plans for production growth and operational enhancements.

Americas Gold and Silver shares dipped 1.6 per cent on Tuesday to trade at $0.62 on the Toronto Stock Exchange.

Follow Joseph Morton on Twitter

joseph@mugglehead.com