Calibre Mining Corp. (TSE: CXB) (OTMRKTS: CXBMF) produced a consolidated 242,487 ounces of gold for fiscal year 2024, beating its updated 2024 guidance by a wide margin.

The company made this announcement on Wednesday as part of its financial results for both the fourth quarter and full year ended December 31, 2024.

Construction of the multi-million-ounce Valentine Gold Mine remains on schedule for first gold production in the Q2, 2025.

The Tailings Management Facility is now complete and actively receiving water while work on the SAG and Ball Mill continues to advance toward pre-commissioning.

Meanwhile, structural, mechanical, and piping activities progress in the Grinding, ADR, Reagents, and Gold Room areas.

Additionally, crews have completed construction of the CIL leaching tanks and have begun mechanical and electrical work, and the overland and coarse ore stockpile conveyor is taking shape.

The reclaim tunnel is also preparing for apron feeder installation and the primary crusher is fully installed.

All of this means pre-commissioning efforts are underway across the site, and initial project capital costs, excluding sunk costs, remain at approximately CAD$744 million.

President and CEO, Darren Hall said that as of mid February, the year was off to a good start. Production is trending higher than budget projections and the company’s cash position increased to USD$161 million.

“We hired a high quality, experienced operating team through 2024 and are working with Reliable Controls Corporation to conduct pre-commissioning and commissioning to ensure operational readiness,” Hall said.

Read more: Calibre Mining needs skilled crew for Valentine, prepares to host Newfoundland open house

Read more: Calibre Mining’s mineral resource estimate in Talavera gives reasons for optimism

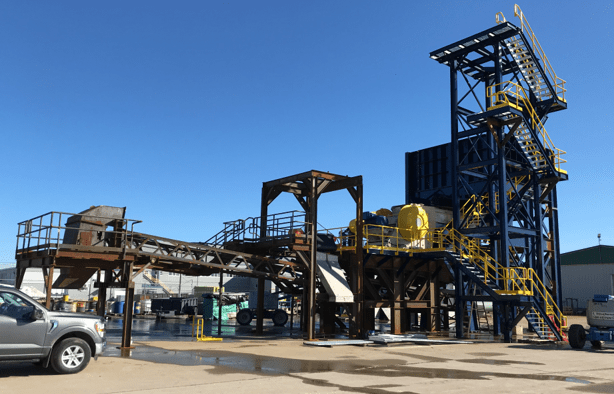

Overview of the Process Plant in 2025.

Valentine project secured Federal Environmental Assessment approval

Drilling from the expanded 100,000-metre program at Valentine has confirmed significant gold mineralization beyond the known Mineral Resource estimate, extending up to 1,000 metres southwest of the Leprechaun open pit with grades exceeding the Mineral Reserve grade by more than 40 per cent.

Highlights included:

-

2.43 g/t Au over 172.8 metres including 3.84 g/t Au over 90.9 metres; and

-

2.12 g/t Au over 95.4 metres; 2.26 g/t Au over 78.3 metres;

Ore control drilling at the Marathon Pit at Valentine revealed 44 per cent more gold at 47 per cent higher grades than the 2022 Mineral Reserve estimate, strengthening confidence in the deposit.

The project also secured Federal Environmental Assessment approval for the Berry Pit, Valentine’s third open pit, with construction beginning in the fourth quarter of 2024.

Gold production in Nicaragua reached one million ounces since operations began in late 2019. The company declared an initial Inferred Mineral Resource estimate for the Talavera Gold Deposit, located three kilometres from the Limon mill, with 3,847,000 tonnes averaging 5.09 g/t gold, yielding 630,000 ounces.

High-grade gold mineralization and new discoveries continue across the Limon Mine Complex, with recent drilling at Talavera and the VTEM Gold Corridor delivering some of the best results to date, further demonstrating Limon’s exceptional potential.

Altogether, the 242,542 ounces of gold produced over the year generated approximately USD$574.4 million in gold revenue at an average realized gold price of $2,369 per ounce. The company’s projects in Nicaragua contributed 207,224 ounces and Nevada made up the rest with 35,228.

Read more: Calibre Mining demonstrates gold standard for principled mining

Read more: Calibre Mining beats gold guidance for 2024 in Nevada and Nicaragua

Primary crushing plant. Image via Calibre Mining.

Analysts remain cautiously optimistic

Despite the positive production news, Calibre’s stock has experienced volatility.

Over the past 12 months, its share price on the Toronto Stock Exchange ranged from a low of CAD$1.18 to a high of CAD$2.90, with a recent peak of CAD$3.05 on February 14, 2025.

As of February 15, 2025, it closed at CAD$2.93, a 3.93 per cent drop from that high.

Analysts remain cautiously optimistic. The consensus price target holds at CAD$3.64, and earnings per share forecasts for 2025 have surged to USD$0.46 from USD$0.30, buoyed by expected production growth.

However, Simply Wall St noted a high level of non-cash earnings and a drop in profit margins from

16.9 per cent in 2023 to 5.6 per cent in 2024, signalling potential vulnerabilities that could temper enthusiasm.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.