BMW‘s (FWB: BMW) partnership with Livent Corporation (NYSE: LTHM) is a strategic move aimed at securing a stable and reliable supply of lithium. It ensures that BMW can meet the growing demand for electric vehicles (EV) and contribute to the global green shift toward more sustainable transportation.

In March 2021, the German carmaker struck a deal with Livent to secure lithium for battery cells, signing a multi-year contract valued at €285 million (approximately CAD$420 million). Afterwards, Livent started supplying the extracted lithium to BMW Group’s battery cell manufacturers.

During the first quarter of 2023, BMW doubled its sales of electric vehicles compared to the same period in the previous year. This led to the company expanding its EV quota to 2 million cars and it now expects half of its sales to be electric cars by 2025.

This corresponds with the European Union’s requirement for new cars and vans to achieve zero CO2 emissions by 2035, and this increase in demand is also responsible for elevating Argentina’s position on the global lithium map. Argentina possesses significant lithium reserves in its Salta, Jujuy and Catamarca provinces. The government is also actively implementing initiatives to attract foreign investment.

A few of these include Ford Corporation (NYSE: F) and General Motors Company (NYSE: GM), which disclosed their investments in Argentina in 2022, following in the course set by BMW and Toyota (TYO: 7203).

According to a report by Fortune Business Insights, the global automotive battery market is expected to grow from USD$45 billion in 2021 to USD$65 billion by 2028. Additionally, the International Energy Agency (IEA) forecasts a significant surge in electric vehicle battery demand, from approximately 340 gigawatt-hours (GWh) today to over 3,500 GWh by 2030.

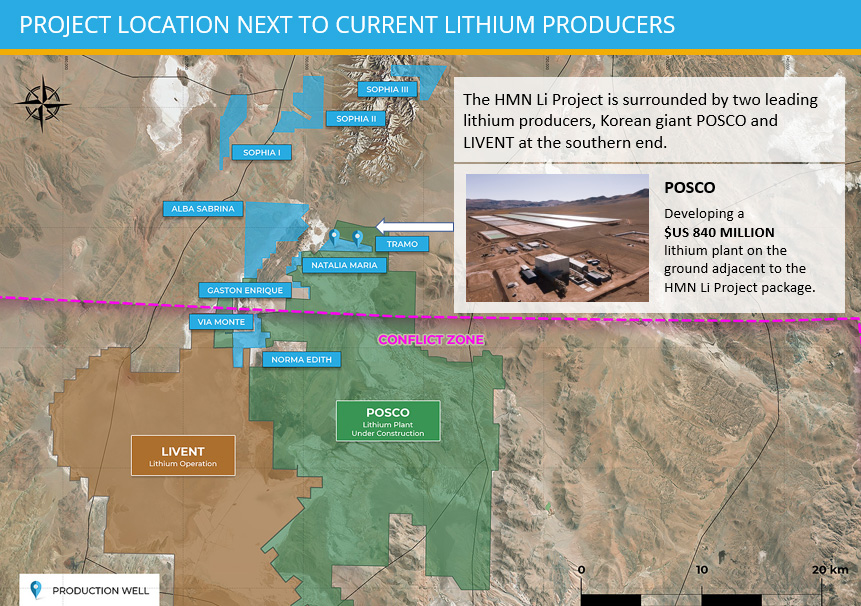

Map showing the region and two of the key lithium producers. Image via Lithium South Development Company.

Read more: Lithium South Development first production well installed at Hombre Muerto lithium project

Read more: Lithium South Development expands production goals, updates PEA on Hombre Muerto lithium project

Livent operates one of the largest brine resources in the world

Livent has expanded its production capacity in Argentina, where it manages one of the largest brine resources in the world. Livent also anticipates that its Zhejiang facility in China will double its production capacity, and enjoyed year-over-year revenue growth last year. However, as lithium prices have retreated from their 2022 rally, Livent’s rapid revenue growth in 2023 has significantly diminished.

Livent’s merger with rival Allkem (ASX: AKE) is on track to close by the end of the year. The combined company will be called Arcadium Lithium.

The company’s third quarter for 2023 earnings dipped 10 per cent compared to the previous quarter, and a 9 per cent decrease over Q3, 2022.

Argentina ranks as the fourth-largest lithium producer globally, trailing behind Australia, Chile and China. It also stands as the second-largest in terms of lithium resources, with Bolivia being the only country surpassing it.

In the category of reserves, it holds the third position, falling behind Chile and Australia. Argentina boasts an installed production capacity of 37.5 thousand tons of lithium carbonate and achieves an average annual production of 33 thousand tons.

Livent’s Fenix lithium mine at Salar del Hombre Muerto is wedged in with a number of other lithium-seeking companies, both large names and juniors. The Fenix lithium quadrant shares a border with properties like Albemarle Corporation’s (NYSE: ALB) Antofalla, Posco‘s (KRX: 005490) Sal de Vida, Lithium Americas (TSX: LAC) (NYSE: LAC) and Sociedad Química y Minera de Chile (NYSE: SQM) joint venture, Cauchari and Lithium South Development Company‘s (TSXV: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ) Hombre Muerto North property.

According to its recent technical filing, Lithium South’s Alba Sabrina, Natalia Maria, and Tramo properties collectively hold an estimated 297,400 tonnes of measured and indicated lithium resources, considering a 500 mg/L cut-off grade.

As the electric vehicle market grows, companies like Livent and Lithium South are expanding their production capacity, although fluctuating lithium prices impact their revenue growth.

Ultimately, though, it’s the partnerships between car companies like BMW and providers like Livent that have been elevating Argentina’s prominence in the global lithium market.

.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com