The United Kingdom continues to invest vast amounts of money in the nuclear industry.

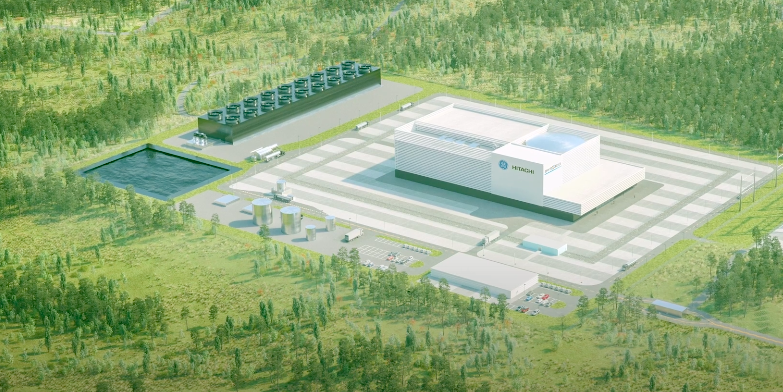

Building on a half-a-billion dollar investment in enriched uranium production and a commitment to quadruple its nuclear capacity, the nation has now awarded C$49 million to GE Hitachi Nuclear Energy (GEH) for small modular reactor development.

The General Electric (NYSE: GM) and Hitachi (TYO: 6501) partnership announced the investment Thursday. The country’s Department of Energy Security & Net Zero provided the UK Future Nuclear Enabling Fund grant.

“Today’s £33.6 million in funding for GE Hitachi will help develop their design, putting us in an excellent position to become one of the first to deploy this game-changing tech,” nuclear minister Andrew Bowie said.

There are only a small number of SMRs in operation worldwide in countries like Russia, India and China. North America’s first small modular power unit, the GE BWRX-300, is expected to be brought online in 2029 at Ontario Canada’s Darlington nuclear site.

Britain’s engineering and aerospace company Rolls-Royce Holdings PLC (LON: RR) is currently developing an SMR for the UK as well.

“We will continue to work closely with the UK Government to deliver a fleet of reactors here which can help meet the country’s target of adding up to 24 gigawatts of nuclear capacity to the grid by 2050,” GEH Executive Vice President, Advanced Nuclear, Sean Sexstone, said.

In conjunction with the new grant, GEH will be engaging in an SMR design assessment process with UK regulators. It will determine the reactor’s safety, environmental impact and overall security. The major engineering firm Jacobs Solutions Inc. (NYSE: J) will help support the process.

Today at #POWERGEN24 GEH’s Brian Hunt discussed the BWRX-300 and the role of small modular reactors in the energy transition. pic.twitter.com/wedtVoGCJS

— GE Hitachi Nuclear Energy (@gehnuclear) January 25, 2024

Read more: ATHA Energy applies for listing on TSX Venture Exchange, gives update on 92 and Latitude merger

Read more: ATHA Energy discovers strong uranium mineralization at North Valour-East

Uranium to ascend above US$160 per pound this year, Sprott says

The price of uranium recently ascended above US$100 per pound for the first time since 2007. As the number of reactors throughout the globe increases and demand for nuclear fuel grows, its value isn’t expected to drop anytime soon.

In fact, recent predictions have indicated the exact opposite. Sprott Asset Management’s CEO John Ciampaglia told attendees of an online conference last week that the radioactive element could be worth up to US$160 per pound by the end of this year. The investment firm runs the Sprott Physical Uranium Trust (TSX: U.U).

“Even though the price is broken out to US$100, there’s a lot of opportunity here because you need to basically double production globally between now and 2040,” Ciampaglia said. He firmly believes its price will stay high for the foreseeable future.

“We’re very optimistic that the prices are going to remain elevated for an extended period of time. We don’t really see a catalyst that can knock this back.”

Ukraine just announced that it will build four more reactors this year and several other nations are ramping up their nuclear activities as well. In addition, twenty-two countries recently agreed to triple their nuclear capacity at the COP28 climate change conference in Dubai.

A major survey with over 20,000 respondents throughout the globe found that most people support nuclear power.

This unprecedented rate of nuclear activity has caused a highly accelerated rate of uranium exploration. In Canada, three of the nation’s top explorers are in the process of merging their businesses.

Once ATHA Energy Corp. (CSE: SASK) (FRA: X5U) (OTCQB: SASKF) completes its acquisition of Latitude Uranium Inc. (CSE: LUR) and 92 Energy Limited (ASX: 92E), the combined company will have over 7 million acres of exploration tenements in Canada’s top uranium mining jurisdictions.

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com