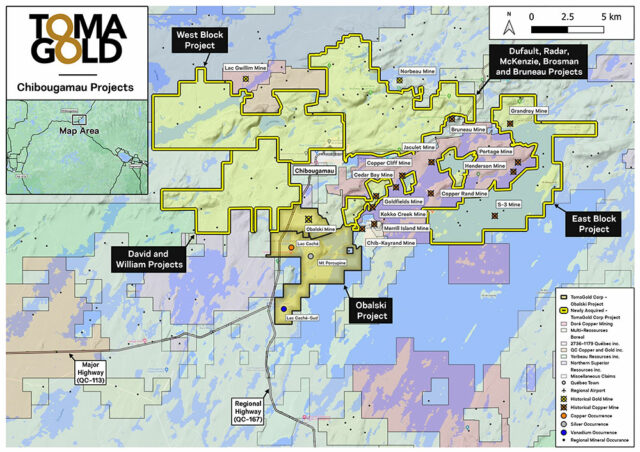

Montreal’s TomaGold Corp (TSX-V: LOT) (OTCQB: TOGOF) has inked an agreement to acquire 20 mining properties in northern Quebec’s Chibougamau Mining Camp, a move the company’s leadership considers to be a game-changing strategy.

The company announced the deal with Soquem Inc, Chibougamau Independent Mines Inc. (TSX-V: CBG), and Globex Mining Enterprises Inc. (TSX: GMX) on Monday. The 20 properties being obtained from the three companies contain a mix of copper, gold, silver and zinc mineralization — six of which host past-producing mines.

For the acquisition, TomaGold will be required to issue a total of $26.4 million in cash and stock to the three miners over the next two to five years.

“Never in its last 75-year history has the Chibougamau Mining Camp been controlled and developed by one operator with a global vision. With these acquisitions, we have achieved a first step towards that goal,” said TomaGold’s President and CEO David Grondin.

“This game-changer strategy will allow TomaGold to optimize the allocation of financial, human and technical resources under one roof for exploration, development and potentially production.”

Grondin added that through the consolidation of the assets, TomaGold would have an improved chance of attracting interest from first-tier miners looking for large projects to expand their resource base. He says that those companies would ideally help finance the mining camp’s development through TomaGold.

TomaGold also says it is currently in advanced discussions with certain financial and mining partners to help finance the acquisition, exploration and development of the properties.

Map of properties being acquired. Photo via TomaGold Corp

Read more: Calibre Mining reports record breaking sales and increased net income in Q2

Read more: Calibre Mining expands resources from open pit at Nevada’s Pan Gold Mine

TomaGold has a cash balance of over $2 million and is focused on the development of gold, copper, rare earth and lithium projects. The company has 1.8 million issued and outstanding shares with a market capitalization of $5.4 million.

Other mining companies active in Quebec include Olympio Metals (ASX: OLY), MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF), Kenorland Minerals (TSX-V: KLD) (OTCQX: KLDCF), Eldorado Gold Corporation (TSX: ELD) and Wesdome Gold Mines Ltd. (TSX: WDO).

TomaGold shares stayed flat at $0.02 on the TSX Venture Exchange Monday and have dropped by 50 per cent since the beginning of this year.

rowan@mugglehead.com