Artificial intelligence (AI) is rapidly transforming how economies function, how people work, and how decisions are made. Once confined to research labs and science fiction, AI now powers everything from financial systems and healthcare tools to customer service chatbots and creative content generation.

Its ability to process vast amounts of data, identify patterns, and make predictions has opened the door to innovations across nearly every industry. As a result, many view AI as a powerful engine for productivity, personalization, and problem-solving.

However, the rise of AI also presents serious challenges.

Concerns about job displacement, data privacy, misinformation, and regulatory oversight are growing. Algorithms can inherit or even amplify existing biases, while rapid automation threatens to replace roles in both blue- and white-collar sectors.

Furthermore, as AI becomes more integrated into critical infrastructure, the risk of misuse, accidents, or intentional harm increases. These consequences raise important ethical and economic questions that society has yet to fully address.

Ultimately, AI is not inherently good or bad—it is a tool, shaped by how we choose to use it. The key lies in managing its development and deployment responsibly. As AI continues to evolve, so too must our understanding of its benefits and risks. Striking the right balance will determine whether it serves as a net force for progress—or disruption.

Positive – AI Accelerates Drug Discovery

Artificial intelligence is transforming how biotech companies discover new drugs. BenevolentAI, based in the UK, uses machine learning to analyze massive biological datasets. It identifies new therapeutic targets and designs novel drug compounds faster than traditional methods. The company works closely with AstraZeneca (NASDAQ: AZN) and has produced promising leads for chronic kidney disease and pulmonary fibrosis. These are diseases that conventional research often overlooks. AI-driven models also reduce the time and cost of early-stage drug discovery. Additionally, they allow researchers to test more hypotheses in less time. This shift energizes the biotech sector and gives investors fresh reasons to stay optimistic.

BenevolentAI’s platform continuously learns and improves as it processes more data. This feedback loop makes each drug discovery cycle faster and more accurate. The company also integrates clinical trial data to refine its predictions. By doing so, it increases the chances of a compound reaching approval. Furthermore, AI allows scientists to explore disease pathways that were once too complex to study. This leads to breakthroughs in rare and difficult-to-treat conditions. Investors have taken notice. The biotech sector is seeing renewed interest thanks to these tools. As AI continues to evolve, it will likely reshape every stage of pharmaceutical development.

Read more: Number of students using AI to cheat grows at alarming rate

Read more: Synaptogenix pumps $100m into artificial intelligence token

Negative – Amazon’s Shift to AI Cuts Jobs

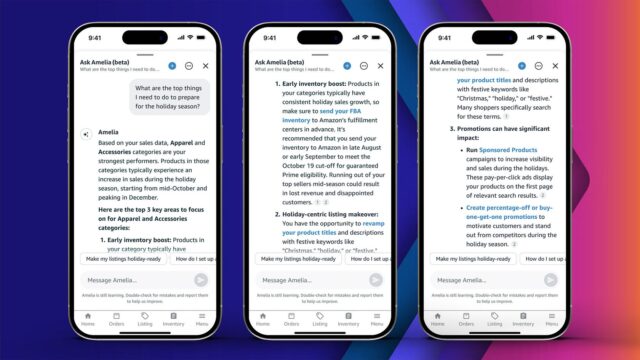

Amazon.com inc (NASDAQ: AMZN) has been quietly replacing workers with AI systems — from warehouse automation to generative AI tools that replace product writers and customer service roles. In 2024, the company laid off thousands of employees across its Alexa and AWS divisions, citing an internal pivot toward machine learning tools that streamline operations.

The market may applaud the efficiency, but the human toll is real. For retail and tech workers, AI is beginning to look less like a tool and more like a pink slip.

“We will need fewer people doing some of the jobs that are being done today, and more people doing other types of jobs,” wrote Andy Jassy, Amazon CEO, in a memo.

“It’s hard to know exactly where this nets out over time, but in the next few years, we expect that this will reduce our total corporate workforce as we get efficiency gains from using AI extensively across the company.”

At the end of last year, Amazon directly employed more than 1.5 million people worldwide.

The majority of its workforce lives in the United States, where Amazon ranks as the country’s second-largest employer after Walmart. While many employees work in the company’s e-commerce warehouses, roughly 350,000 also hold office roles.

These office workers support Amazon’s operations in areas like logistics, cloud computing, and marketing. Additionally, Amazon continues to expand its automation and AI tools, which may impact future hiring trends. Despite growing reliance on technology, the company still depends on a massive global workforce to maintain its business.

Amazon Project Amelia – their AI. Image via Amazon.

Positive – Cancer Diagnosis, Faster and Smarter

Breath Diagnostics Inc. is developing AI-powered breath tests that offer earlier, less invasive detection of cancer.

The company uses a microreactor that takes advantage of artificial intelligence and machine learning to analyze volatile organic compounds in breath samples to identify biomarkers for lung and other cancers.

This technology could significantly shorten diagnostic timelines and improve early-stage detection, where treatment is most effective. It’s a potential breakthrough in oncology, and a signal that AI isn’t just generating insights — it’s saving lives. This allows faster, non invasive detection of lung and other cancers. Extensive trials involving over 800 patients showed 94 per cent sensitivity and 85 per cent specificity—outperforming low dose CT scans.

Here is Breath Diagnostics CEO Ivan Lo speaking on the benefits of the OneBreath technology.

Breath Diagnostics Inc. has raised approximately US $7.7 million in prior funding, with its latest US$3 million Regulation CF crowdfunding round offering shares at US$3 each.

Additionally, Breath Diagnostics plans to use both its crowdfunding proceeds and earlier capital to drive clinical trials, refine its AI algorithm, and push toward FDA approval and commercialization.

Read more: Qure.ai offers artificial intelligence training in US to transform clinical operations

Read more: Artificial intelligence and the mining industry: A Mugglehead roundup

Negative – Deepfakes Threaten Market Stability

In January 2024, markets briefly panicked after a realistic AI-generated video appeared to show a senior U.S. Federal Reserve official hinting at an emergency rate hike.

Bond yields spiked before the clip was proven fake. The incident marked a turning point. We learned that generative AI can now move markets by manipulating public perception.

As deepfake quality improves, so do the risks associated. Subsequently, that means more spoofed earnings calls, fake government statements, and deliberate disinformation campaigns. The SEC and other regulators are watching, but the tech is evolving faster than policy.

The incident also exposed a new kind of financial vulnerability.

Within minutes of the fake video’s release, algorithms picked up the false signal and began trading based on its implications. Bond yields jumped, the dollar fluctuated, and market volatility spiked before human analysts could verify the video’s authenticity.

This event was a targeted disruption.

Additionally, deepfakes can undermine confidence in legitimate communications, making investors second-guess real news. Regulators like the SEC and CFTC have begun issuing guidance on AI-driven misinformation. However, enforcement remains difficult without real-time authentication tools.

Meanwhile, firms are investing in deepfake detection systems, but few have fully deployed them. As generative AI becomes more accessible, the threat to market integrity increases considerably.

A Tom Cruise deepfake. Image via Chris Ume

Positive – AI Democratizes Market Access

Once reserved for the elite, high-quality financial tools are now within reach thanks to AI.

Platforms like Upstart use AI to assess credit risk more accurately than traditional models, expanding access to loans for underserved borrowers. Meanwhile, Kensho and AI-powered robo-advisors provide market analytics and personalized investment strategies to retail investors. The result is a gradual leveling of the playing field. It means a shift where people can participate in financial markets without needing a CFA or a Wall Street connection.

AI is lowering barriers that once kept everyday investors and borrowers on the sidelines. Traditional financial systems relied heavily on rigid credit scores, high account minimums, and expensive advisory services. Today, AI-driven platforms analyze a broader set of data, including income trends, education, and employment history.

This benefits younger and underbanked individuals who may lack a long credit history but are otherwise financially responsible.

Additionally, robo-advisors powered by AI offer automated portfolio management with low fees, often requiring just a few dollars to get started.

These tools can rebalance portfolios, manage risk, and even harvest tax losses without human intervention. On the investment side, AI is also powering retail-friendly platforms that offer real-time insights once available only to hedge funds. As these technologies scale, they help close the gap between retail and institutional finance. In short, AI isn’t just transforming markets — it’s opening the door to more participants.

Read more: Breath Diagnostics pioneers novel lung cancer breath test

Read more: Breath Diagnostics takes aim at lung cancer with One Breath

Negative – AI Hype Creates Risky Asset Bubbles

The AI boom has triggered a gold rush in equities, with companies rebranding or pivoting toward AI simply to boost valuations.

In 2023 and 2024, dozens of firms saw shares spike after announcing vague AI initiatives — often without viable products. This echoes the dot-com bubble, where investor enthusiasm outpaced fundamentals.

For every real Nvidia (NASDAQ: NVDA), there’s a handful of pretenders. The risk isn’t just mispricing — it’s retail investors buying the hype and holding the bag when reality sets in.

Additionally, some companies add “AI” to press releases without changing their core business model.

These superficial pivots mislead investors who chase headlines instead of fundamentals. Venture capital also fuels the hype, backing AI-adjacent startups before clear proof of concept.

Meanwhile, media coverage amplifies the frenzy. Analysts warn that overvalued stocks could crash once earnings disappoint. Regulators have taken notice, but disclosures still lag behind promotional language.

Investors need to be cautious about AI stocks because not every one of them is going to have staying power.

.

joseph@mugglehead.com