Teck Resources Ltd. (TSE: TECK.B) (TSE: TECK.A) (NYSE: TECK) intends to increase its copper production to approximately 800,000 tonnes per year by 2030. This represents a 79 per cent increase from the company’s original prospective target—which was 446,000 originally set in 2024.

The Vancouver-based metals giant based its forecast on production from its core four key operations, and is contained in the company’s Q4 production results for 2024. The company said on Wednesday it can achieve these goals with planned project capital expenses between USD$3.2 billion to US$3.9 billion on its four key copper projects.

In 2024, Teck reported copper production of 446,000 tonnes, a 50 per cent increase from 2023, primarily due to the ramp-up of Quebrada Blanca (QB), which achieved design throughput rates by the end of the year. This included record fourth-quarter copper production of 122,000 tonnes, a 19 per cent increase compared to the same period in 2023, with QB contributing 60,700 tonnes.

Teck produced 615,900 tonnes of zinc in concentrate in 2024, a 4.0 per cent decrease from the previous year. This decline was primarily due to a higher proportion of copper-only ore relative to copper-zinc ore at the Antamina mine in Peru.

However, a 3.0 per cent increase in annual production at the Red Dog mine in Alaska, which produced 555,600 tonnes, largely offset this. Refined zinc production in 2024 totaled 256,000 tonnes, a 4.0 per cent decrease from the previous year, due to a localized fire at the electrolytic zinc plant in Trail, B.C. in September 2024, which impacted production in the fourth quarter.

Read more: Osisko Gold Royalties bumps interest in Gibraltor copper mine to 100%

Read more: FireFly Metals scoops approval for TSX listing; reports best copper intercept to date

Teck intends to raise production over its four chief projects

Teck owns 60 per cent of the QB project in Chile, which is undergoing optimization and debottlenecking. This low capital intensity option could potentially increase throughput by 15 per cent to 25 per cent, with an estimated attributable capital cost of USD$100 million to USD$200 million.

Furthermore, Teck fully owns the Highland Valley copper mine in British Columbia.

This brownfield project will extend the life of Canada’s largest copper mine to the mid-2040s, with an estimated life-of-mine copper production of 137,000 tonnes per annum after 2024. The estimated attributable capital cost is between USD$1.3 billion and USD$1.4 billion.

Additionally, Teck holds an 80 per cent stake in the Zafranal project in Peru.

This long-life, competitive capital cost, and lower complexity copper-gold project received SEIA approval. It is also prepared for a potential sanction decision in the second half of 2025. The company expects the problem will produce 126,000 tonnes of copper annually over the first five years, with substantial gold by-product credits. The estimated attributable capital cost is between USD$1.5 billion and USD$1.8 billion.

Finally, Teck owns 50 per cent of the San Nicolas project in Mexico. It’s a low capital intensity, lower complexity copper-zinc project in partnership with Agnico Eagle Mines (TSE: AEM) (NYSE: AEM).

The company expects the project will produce 63,000 tonnes of copper and 147,000 tonnes of zinc annually on a 100 per cent basis during the first five years. The feasibility study and execution strategy are progressing toward a potential sanction decision in the second half of 2025, with Teck’s estimated funding requirement between US$300 million and US$500 million.

Read more: Calibre Mining finds high grade gold mineralization outside of its Valentine Mine resource

Read more: Calibre Mining shuffles strength into its board for future growth

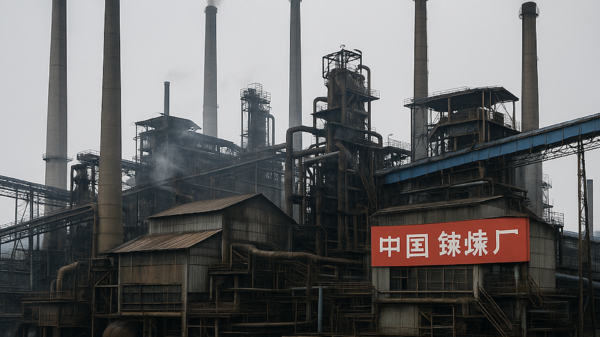

Copper is swiftly becoming a flashpoint in global geopolitics

Copper is a critical component in electrical wiring, renewable energy infrastructure, and various industrial applications. It’s also become a focal point in global geopolitics.

In the United States, the Resolution mine in Arizona, a joint venture between Rio Tinto Group (NYSE: RIO) and BHP Group (ASX: BHP) (NYSE: BHP), has faced a prolonged permitting process, but the recent political climate, with pro-industry policies under the Trump administration, has sparked renewed optimism for its approval.

This project could potentially meet over a quarter of U.S. copper demand. At the same time, the copper market is also anticipating potential trade policy shifts, with some analysts predicting a 50 per cent chance of a 10 per cent tariff on copper imports in the near future, reflecting broader trade strategies in play.

In Latin America, copper mining has led to significant social and environmental debates. Ecuador’s Mirador mine, developed with Chinese investment, has sparked opposition from Indigenous communities, particularly the Shuar people, due to concerns over environmental damage and land rights violations.

In Panama, the Cobre Panamá mine, operated by First Quantum Minerals (TSE: FM), remains closed following a constitutional dispute, though security measures continue to restrict access to local villages, which raises questions about the long-term social impacts on Indigenous populations in the area.

Meanwhile, in Zambia, the continent’s second-largest copper producer, saw a 12 per cent increase in copper output in 2024, with foreign investment, particularly from China, playing a crucial role in the growth. Zambia aims to boost annual copper production to 3 million tonnes within the next decade, emphasizing the strategic importance of copper for economic development.

joseph@mugglehead.com