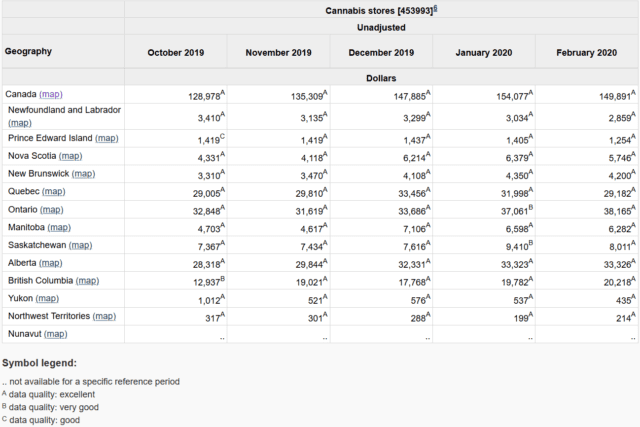

The latest cannabis sales figures from Statistics Canada came in noticeably flat in February, the last full month before the pandemic began hammering global economies.

On Tuesday, the federal agency reported $149.9 million in adult-use sales for the month, a 2.7 per cent drop from January’s $154 million sales.

Eight out of 13 provinces and territories saw sales drop, including an 8.8 per cent decline in Quebec. It should be mentioned that February having fewer shopping days also played a role.

On a daily basis, sales actually grew. Canadians scooped up $5.16 million worth of legal weed in February, compared to $4.97 million purchased each day in January.

The latest data shows an annualized adult-use sales rate of $1.9 billion, which would more than double the $908 million sold in 2019.

Canadian cannabis retail sales data via Statistics Canada

January and February were the first full months that cannabis 2.0 products, such as vapes and edibles, were available on the Canadian market.

But the rollout of 2.0 products was slower than anticipated, as companies reportedly struggled to convert bulk concentrate into finished consumer products.

Read more: MediPharm blames slow cannabis 2.0 rollout for Q4 revenue drop

Ontario sales rose 3 per cent to $38.2 million, continuing to lead Canadian markets for the 11th month in a row.

During the early days of legalization, Canada’s most populous province was expected to get the lion’s share of national weed purchases. BDS Analytics estimated last summer that Ontario would bring in 40 per cent of Canadian pot sales by 2024.

But a slow bricks-and-mortar store rollout has reportedly hampered sales growth in the province.

Ontario has 54 sanctioned cannabis stores, trailing far behind Alberta’s 446 and British Columbia’s 181. The two western provinces lead the country in store openings.

The Ontario government said Wednesday it will resume issuing new store licences for shops that have met regulatory requirements. The provincial regulator paused new approvals in early April due to emergency measures enacted in Ontario to battle COVID-19.

High Tide’s Canna Cabana weed store in Toronto operating in summer 2019 when social distancing rules were unheard of. Photo by Hector Vasquez

Will COVID-19 help or hurt March and April sales?

Statistics Canada’s February data came before provinces started implementing measures to contain the novel coronavirus in mid-March.

Private stores and provincial wholesalers reported sales surging during that time, as provinces began issuing public lockdown orders.

Seattle-based data firm Headset reported that sales in Alberta, British Columbia and Ontario climbed 60 per cent above average on March 16. However, 10 days later — when most provinces designated cannabis businesses as essential — purchases actually dipped below average.

As for April, Headset said COVID-19 likely cut into 4/20 sales, even though transactions usually spike by 100 per cent on the weediest day of the year.

But Alberta-based retailer High Tide Inc. (CSE: HITI) reported an increase over last year’s sales. According to a statement, the company brought in $789,000 in gross revenues from April 18–20, 2020, up 79 per cent from $441,000 over last year’s 4/20 weekend.

High Tide said its 31 physical Canna Cabana stores in Canada contributed 68 per cent of its 4/20 sales, while e-commerce accessories generated the remaining 32 per cent.

Top image via Hobo Cannabis Company

jared@mugglehead.com

@JaredGnam