Stallion Uranium Corp. (TSXV: STUD) (OTCQB: STLNF) (FSE: FE0) returned the Richmond Mountain gold project to Bronco Creek Exploration Inc, which is a subsidiary of EMX Royalty Corporation (TSXV: EMX), after failing to find anything worth noting.

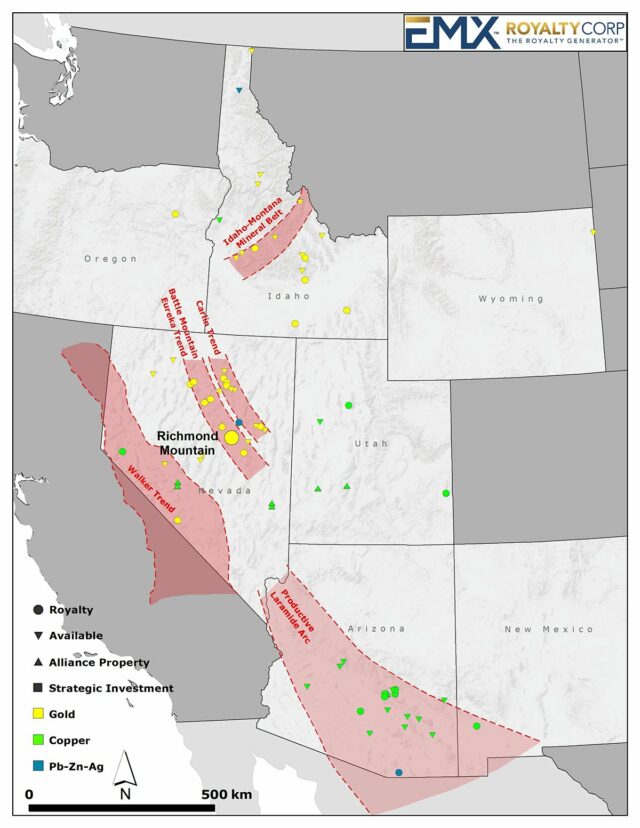

The project has 117 mining claims over 950 hectares at the southern end of the Battle Mountain-Eureka Trend in Nevada.

According to results released late last week, the project targeted rock formations thought to have significant potential for gold mineralization, initially identified through a Controlled Source Audio-frequency Magneto-Tellurics (CSAMT) geophysical survey. This survey indicated their presence beneath the volcanic cover. In 2010, a previous company drilled a hole to 1,500 feet, ending within the post-mineralized volcanic cover.

In 2023, Stallion conducted a deep-penetrating TITAN MT survey, which suggested that the Graveyard Flats might begin just past the 1,500-foot depth. To test these new geophysical findings, Stallion drilled hole RM-24-001 to a depth of 2,282.8 feet. The upper 673.8 feet consisted of colluvium and overburden, followed by a sequence of volcanic rocks.

Despite drilling to 2,282.8 feet, Stallion did not intercept the anticipated Paleozoic sedimentary formations or the Graveyard Flats intrusive. The unexpectedly deep volcanic cover prompted Stallion to halt drilling and ultimately release the project.

Nevada’s Battle Mountain-Eureka Trend is well known for its rich mineral deposits and active mining projects.

The Cortez Hills Project, operated by Barrick Gold Corporation (TSX: ABX) (NYSE: GOLD), is one of the largest operations in this area. This is one of the largest gold mines globally that encompasses both open-pit and underground mining operations.

Map of the Richmond mountain project. Image via EMX Royalty Corp.

Read more: Calibre Mining’s Valentine Mine in Newfoundland nearly complete

Read more: Big name shareholder sells high percentage of its stake in Calibre Mining

Stallion has a partnership with ATHA Energy

Another notable project on the trend is the Pan Mine, operated by Calibre Mining Corp (TSX: CXB) (OTCQX: CXBMF).

This open-pit mining operation focuses on extracting oxide gold deposits. Picked up in an acquisition with Fiore Gold in 2022, the Pan Mine has proven to be a consistent producer of gold and remains an important asset in Calibre Mining’s portfolio.

The company reported a total of 58,754 ounces of gold this quarter. This further divides down to 49,208 ounces coming from Nicaragua and 9,546 ounces from Nevada. For the year to date, the company’s consolidated production totals 120,521 ounces of gold, with Nicaragua contributing 104,215 ounces and Nevada contributing 16,306 ounces.

Additionally, i-80 Gold Corp. (TSX: IAU) (NYSE: IAUX) is advancing the Ruby Hill Project with the objective of developing a large, high-grade gold deposit. The project includes both surface and underground exploration targets, showcasing substantial potential for gold mineralization.

However, despite the exception of the projects in Nevada and a world class gold deposit in Idaho, Stallion is typically a uranium explorer with a primary stake in the Athabasca Basin.

It has a joint venture with ATHA Energy Corp (TSX.V: SASK) (FRA: X5U) (OTCQB: SASKF). Together, both companies holds the largest contiguous project in the Western Athabasca Basin, adjacent to multiple high-grade discovery zones.

The company’s leadership and advisory teams consist of experts in uranium and precious metals exploration, combining capital markets experience with the technical skills necessary for acquiring and exploring early-stage properties.

Calibre Mining and ATHA Energy Corp are sponsors of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com