Japanese tech giant, SoftBank is investing USD$40 billion into generative artificial intelligence mainstay, OpenAI , effectively edging Microsoft Corporation (NASDAQ: MSFT) as the firm’s biggest investors.

Announced on Monday, part of the funding will be used for the Stargate Project recently announced by President Donald Trump.

Microsoft has shifted away from being OpenAI’s exclusive cloud computing provider, prompting OpenAI to turn to Oracle Corp (NYSE: ORCL), Coreweave, and other companies. Revenue growth in Microsoft’s Azure cloud computing unit has fallen short of expectations due to data center capacity constraints.

OpenAI recently secured USD$6.6 billion in new funding, raising its valuation to USD$157 billion. New investors include SoftBank and Nvidia (NASDAQ: NVDA). The company plans to adopt a for-profit business structure in 2025 and establish a Delaware public benefit corporation to oversee its commercial operations.

Anthropic, OpenAI and other startups are urgently seeking cash infusions from well-capitalized tech giants to sustain operations. In November, Amazon (NASDAQ: AMZN) increased its investment in Anthropic by USD$4 billion, bringing its total investment to USD$8 billion.

The AI boom has depended largely on large language models (LLMs), which require vast amounts of data and computing power for training. These models enable users to interact with AI systems without writing algorithms.

Chinese startup DeepSeek’s low-cost, open-source artificial intelligence training models have roiled the tech industry. Controlled by Chinese hedge fund High Flyer, DeepSeek competes with Meta Platforms‘ (NASDAQ: META) open-source AI models.

OpenAI released generative AI-based ChatGPT in late 2022 and has been adding new LLMs to its family.

Read more: Palantir Technologies shares surge 25% on strong artificial intelligence demand

Read more: Palo Alto Networks collaborates with fellow travellers to prepare for quantum threats

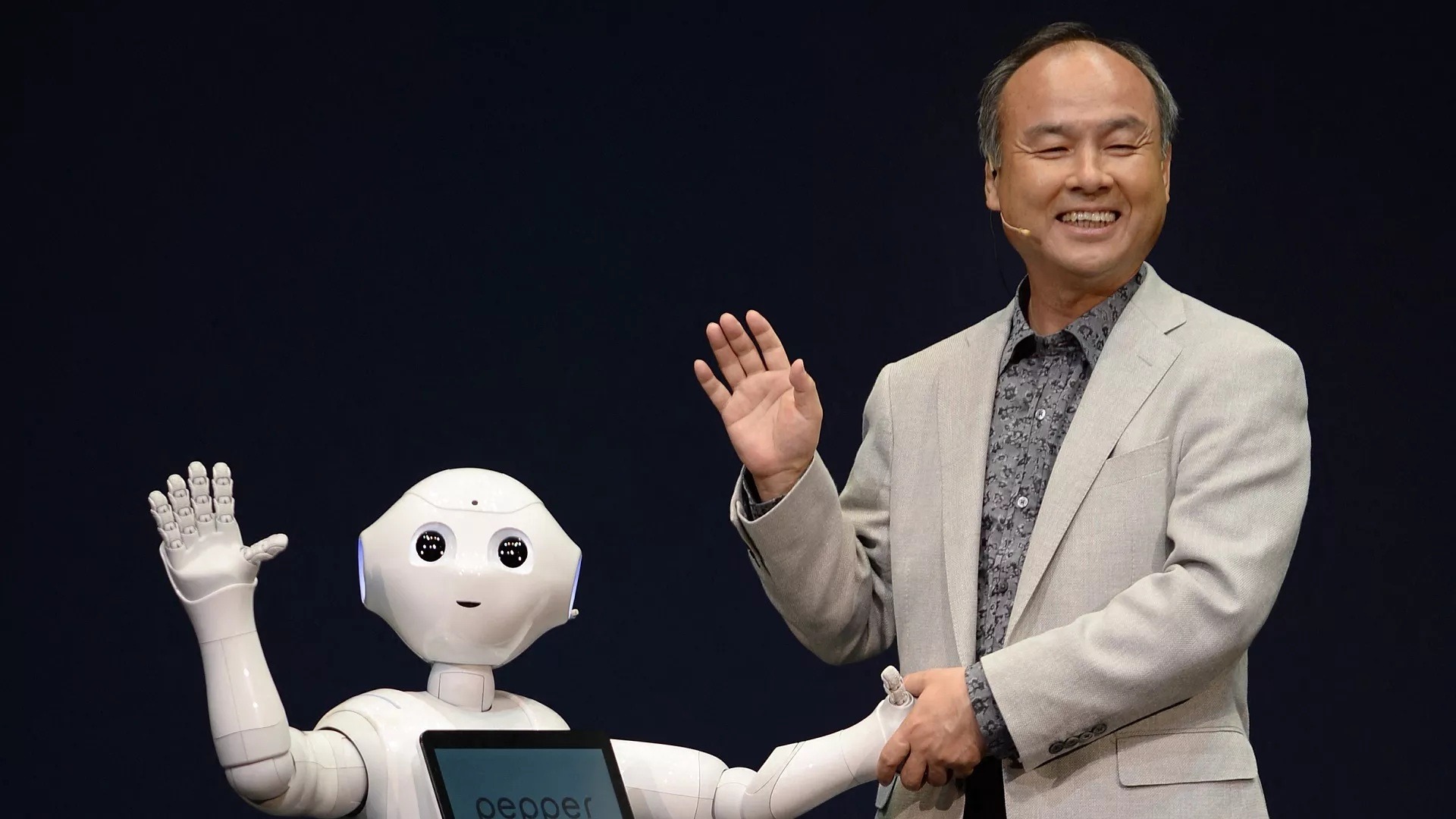

Mayasoshi Son has had a long string of investment successes

Softbank is a Japanese multinational conglomerate that invests heavily in technology companies worldwide. Masayoshi Son is Softbank’s founder and CEO.

Son has built SoftBank into one of the largest and most influential venture capital firms. His approach has been driven by a vision of a connected, tech-driven future, which has led him to fund transformative companies in various sectors, including AI, telecommunications, and robotics.

Son’s most notable investment vehicle is the Vision Fund. It was launched in 2017 with an initial size of USD$100 billion. The fund’s purpose is to invest in high-growth companies with disruptive potential, particularly in the fields of artificial intelligence and robotics.

WeWork represents one of Son’s most infamous investments and biggest failures. WeWork is an office-sharing startup founded by Adam Neumann. SoftBank invested heavily in WeWork during its rapid rise, valuing the company at USD$47 billion at its peak.

However, WeWork’s eventual failed IPO in 2019 exposed deep financial and managerial issues, leading to a dramatic decline in its value. Despite this setback, Son’s vision of a flexible office space model was ahead of its time, but WeWork’s unsustainable growth model and corporate governance issues caused SoftBank’s stake to lose significant value.

Another major investment was in Chinese e-commerce titan Alibaba Group (NYSE: BABA).

Son first invested in Alibaba in 2000, purchasing a stake worth USD$20 million. This bet proved to be one of the most lucrative in tech history, as Alibaba’s growth led to massive returns, with SoftBank’s stake eventually worth over USD$100 billion.

Son also invested in Arm Holdings (NASDAQ: ARM), a British semiconductor design company, which SoftBank acquired in 2016 for USD$31 billion. Arm’s technology is foundational to the smartphone and computing industries.

.