Shares of Palantir Technologies (NASDAQ: PLTR) jumped by approximately 25 per cent on the back of a positive quarterly earnings report, which beat Wall Street’s expectations and showed a pathway for growth.

This dramatic uptick comes on the heels of the company’s latest quarterly earnings report, released on Monday.

Palantir delivered fourth-quarter earnings that far exceeded projections. Social media discussion centered around the company’s 36 per cent year-over-year revenue growth, which brought quarterly revenue close to USD$1 billion.

Strong demand in both its commercial and government segments fuelled this expansion, driven by the company’s AI-driven software solutions. CEO Alex Karp described the growth as “untamed organic growth” during the earnings call.

Palantir reported USD$828 million in revenue for the quarter, surpassing the LSEG consensus estimate of USD$776 million. Adjusted earnings per share reached 14 cents, beating the expected 11 cents.

Although Palantir is primarily known as a contractor for defense and intelligence agencies, its U.S. commercial business is driving significant growth. Revenue for this segment rose by 64 per cent over the past year, and the backlog nearly doubled. Total bookings increased by 134 per cent.

Revenue from U.S. government contracts grew by 45 per cent from 2023.

Earnings per share rose by 75 per cent year-over-year to 14 cents, beating Wall Street’s consensus estimate of 11 cents, according to FactSet.

Palantir stock closed 24 per cent higher at USD$103.83, surpassing Monday’s record of USD$83.74, according to Dow Jones Market Data.

Read more: Palo Alto Networks collaborates with fellow travellers to prepare for quantum threats

Read more: Four researchers aim to democratize quantum computing research

Recent performance driven by rising demand for AI

Palantir’s expertise in AI and big data analytics has positioned it uniquely in the market.

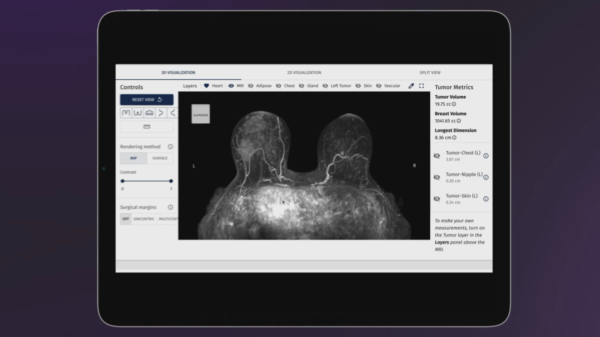

The company’s platforms, Gotham and Foundry, have been increasingly adopted for complex data analysis tasks by both government entities and private enterprises. The surge in demand for AI solutions, particularly in sectors like national security, health care, and business intelligence, has been a significant driver for Palantir’s recent performance.

The company’s forward-looking statements were another catalyst for the stock’s leap. Palantir provided an optimistic outlook for 2025, with expectations of sustained growth in U.S. commercial sales by at least 54 per cent. This bullish guidance reflects confidence in Palantir’s continued expansion into new markets and its ability to scale its operations, particularly in the generative AI space.

Despite concerns about Palantir’s high valuation, with a price-to-earnings ratio of 173, the market sentiment remains positive. Information on the web suggests that analysts are anticipating further price increases, with some predicting a stock price of USD$91.53 by the end of 2025, representing a potential 28.38 per cent increase from current levels.

However, there are also warnings from some quarters about valuation risks, with William Blair reiterating an “Underperform” rating, pointing to past multiple compressions as a cautionary note.

The political environment under the Trump administration, focusing on national security and immigration, might continue to benefit Palantir. The company’s involvement in government contracts, especially those related to defense and security, could see further growth.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com