Where were you during the Rogers Communications (TSX.RBI.B) blackout of 2022?

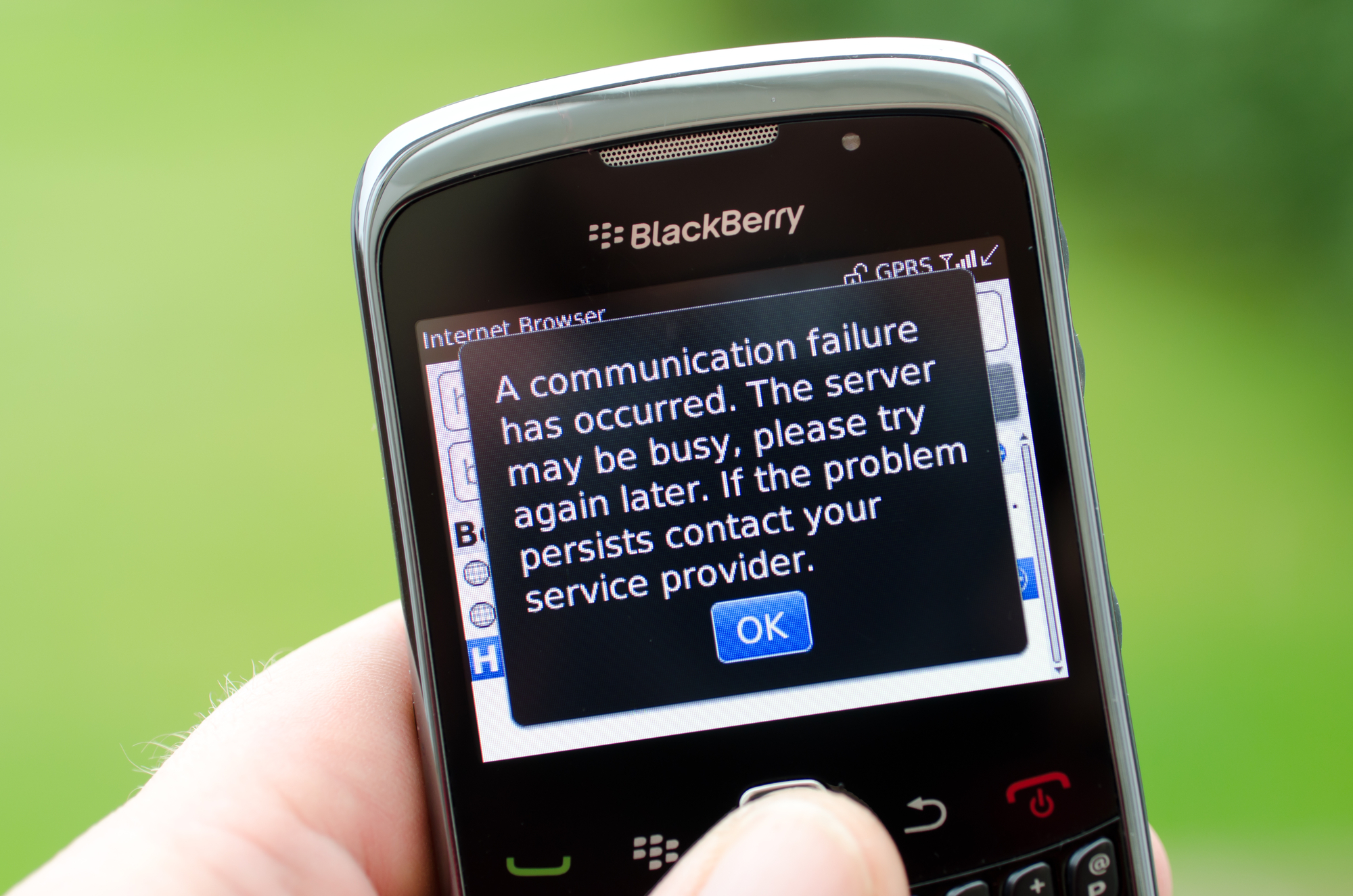

If you were a commuter in Vancouver you may have been advised you may not be able to pay transit fares with debit cards. Maybe you were forced to work from a cafes and library that offered WiFi (from another wireless service)? Regardless, any convenience to working from home evaporated for those relying on the telecom giant’s services.

It’s the second major Rogers disruption in about 14 months and it effected 11 million people, businesses and even some essential services like 911 emergency response, prompting the question being asked by lots of folks on Twitter about what’s in store if the proposed merger between Shaw Communications (TSX.SJR.B) and Rogers Communications goes through.

When telecommunications such as Rogers Communications Inc. aren’t up to the task in maintaining their current services and letting down Canadians, this sole called Shaw Telecommunications company, takeover deal should be rejected by the CRTC and by the Industry minister!!!!!!!! pic.twitter.com/V5AbI6ktMO

— Gus T (@easyOntario) July 16, 2022

Naturally, heads rolled at Rogers as the company replaced Jorge Hernandez with Ron McKenzie as its new chief technology and information officer in the wake of the 19-hour outage that shut down banking, transport and government access for millions of Canadians. But does that really do anything except give the company some convenient scapegoat?

The real crux of this, though, is that the outage may have had negative consequences for the merger.

The early mediation between Rogers and Shaw and the Commissioner of Competition, set for July 4 and 5, did not find a resolution to the commissioners objections to the merger. The two companies want the commissioner to realize that this merger would be the benefit of all Canadians, including maintaining a strong and sustainable fourth wireless carrier across Canada after Rogers agrees to sell Freedom Wireless to Quebecor.

Except not everyone agrees.

Jagmeet Singh, the leader of the New Democratic Party, has launched a petition to stop the merger and “break up these monopolies,” while numerous tweets have also highlighted the dangers of a telecommunications industry overwhelmed by only a few major players.

Instead of helping you, the Liberals are fixated on protecting the profits of telecom giants

The Rogers outage that impacted millions is a prime example of the dangers of a telecom monopoly

A Rogers – Shaw merger will only increase prices & create an even larger monopoly

— Jagmeet Singh (@theJagmeetSingh) July 13, 2022

It is worth pointing out that Reuters, Rogers, Telus and BCE, control 90 per cent of the market share in Canada.

What’s next? Clearly Rogers and Shaw are going to continue to convince Canada’s regulators that the merger should go through, but the bid is running out of time, as the deadline is July 31 to close the deal. If that doesn’t happen then Rogers will pay Shaw a fee of CAD$1.5 billion.

But is the media really that concentrated?

The answer is yes, according to a Canadian Media Concentration Research Project put out by Carleton University in 2021.

The communications infrastructure media category consists of wireline telecommunications, mobile wireless services, internet access and cable, satellite and IPTV distribution networks.

Through most of Canada’s history these were regulated and governed under a natural monopoly in wireline telecoms, and the practice of segmenting telecoms, broadcast markets and cable distribution from one another which is the way it had been throughout most of the last century went away courtesy of a few decisions from the Canadian Radio-television and Telecommunications commission (CTRC) and federal policy changes in the 1980’s and ’90’s. Concentration levels plummeted and independent ISPs took off in the late 1990’s, and for the first ever, there was a serious amount of competition.

Unfortunately, since then we’ve seen concentration arise.

“Since the turn of the century, the mobile wireless market in Canada has been dominated by three national carriers: Rogers, Bell, and Telus. Early efforts by Industry Canada to introduce a degree of competition ultimately ended up with consolidation when Clearnet and Fido—two new mobile carriers granted licences in 1995—were bought by Telus (2001) and Rogers (2004-5), respectively. Industry Canada revived its efforts to increase competition again in 2008, bringing a handful of “new entrants” into the market at the onset of the deployment of mobile broadband networks,” according to the project.

Today, the remaining competitors appear to have gained a strong foothold, while others took exits as they were absorbed by national carriers.

“The national carriers’ collective market share did drop noticeably in the years following the entrants’ debut. However, their dominant position has mostly held steady since 2013, stubbornly remaining above 90 per cent. Last year, however, the share collectively held by Rogers (30.4 per cent), Bell (30.9 per cent) and Telus (28.4 per cent) dipped slightly to 89.7 per cent of the market by revenue, while their subscriber share dipped to 87.2 per cent,” said the report.