The CEO of a planned San Francisco cannabis store says his pending permit has been illegally flipped and sold three times, all within a recent two-month span.

Alexis Bronson alleges that the latest shady transaction involving his store has taken place in the blockbuster deal between High Times and multi-state operator Harvest Health & Recreation Inc. (CSE: HARV).

On April 28, Hightimes Holdings Corp., the parent company of the long-running cannabis culture magazine, said it will buy more than a dozen California dispensaries from Arizona-based Harvest Health in a mostly stock-based deal worth US$80 million.

But experts say High Times has been navigating several feeble attempts to drum up equity over the last three years and likely doesn’t even have the funds to buy the stores.

Bronson alleges the deal is nothing more than an ‘elaborate pump and dump scheme’ between the two enterprises. He says he didn’t even have knowledge that his dispensary was one of the 13 in the announced agreement until a local reporter informed him that day.

What made Bronson’s blood boil further was when he saw High Times chairman Adam Levin quoted in Bloomberg News, touting his weed shop as the crown jewel in the deal because it’s located in San Francisco’s ritzy Union Square shopping district next to a Chanel store.

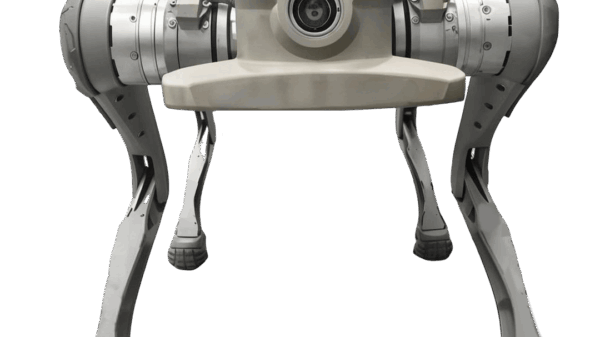

The proposed dispensary called HAH 2 CA is located on 152 Geary Street in the former John Varvatos building in San Francisco’s ritzy Union Square shopping district. Photo courtesy of San Francisco Social Club

“I’m like, ‘Hey, I know nothing about this and High Times didn’t even mention me, and this is my social equity licence — so why are you stealing my thunder?'” Bronson said in a phone interview with Mugglehead.

Attorney Omar Figueroa, who’s been at the vanguard of California cannabis law for more than 20 years, says High Times has a history of promoting deals and events without doing proper due diligence. He says Levin should have stressed to the media that the high-end pot shop wouldn’t be theirs until the deal meets all the regulatory approvals.

San Francisco’s Office of Cannabis designed its equity program to lower barriers to cannabis licensing for people of colour that have been negatively impacted by the decades-long war on drugs.

But Bronson, who qualified due to a previous cannabis arrest and meeting the program’s income guidelines, says he’s being victimized again by “caucasian canna-bro greed” in the new legalization era.

He said he’s now seeking full ownership of the licence and if he succeeds, he’ll choose new partners that’s he’s comfortable working with.

The alleged ‘elaborate pump and dump scheme’

When he first applied for the licence two years ago, Bronson said he partnered with Seattle-based dispensary chain Have a Heart, which at the time ran 10 stores in Washington, California and Iowa. He explained how it’s common for equity licence applicants to team up with larger cannabis corporations because of the deep pockets required to open up stores in California’s highly regulated weed market.

Bronson became 40 per cent owner and was appointed CEO of the proposed dispensary at 152 Geary Street, which is the minimum ownership stake required for an equity owner under San Francisco’s rules. Former Have a Heart CEO Ryan Kunkel took a 51 per cent stake, and his partner, Todd Shirley, was assigned the remaining 9 per cent.

In February, the store called HAH 2 CA, LLC received approval from the city’s planning commission, and Bronson said that took long hours of him negotiating with Chanel and the local chamber of commerce, since both were opposed to having a cannabis store in a luxury zone. The dispensary still needs local and state permits before it can open.

However, Bronson alleges that in March his business partners went behind his back and sold their shares in the entity to a newly formed shell company called Core Competencies, LLC, which acted as a subsidiary of Interurban Capital Group, the parent company of Have a Heart dispensaries.

Alexis Bronson says he’s kept documents to support that show he rejected any sale of his cannabis social equity licence. Submitted document

He provided Mugglehead with a document stating that he rejected the deal on March 6.

Interurban subsequently sold the dispensary to Harvest Health in US$86 million merger agreement announced on March 11.

“A deal that I had no knowledge of, nor did my company receive any considerations from the multi-million dollar sale,” Bronson said.

Just over a month later, the asset then was flipped from Harvest Health to Hightimes Holdings in the proposed purchase deal.

“This proposed acquisition, without holding any contingent rights to ownership of my cannabis dispensary asset, reeks of corporate desperation and quite frankly does not pass the smell test,” he said. “I’m just a straw CEO, they think this whole equity thing is a joke and they’re playing us.”

San Francisco Office of Cannabis to determine dispensary owner

Bronson claims Kunkel and Shirley violated a number of provisions in the San Francisco Police Code when they handed over their rights to the proposed cannabis business permits, specifically in article 16, section 1608.

“In the event that, prior to the award of a permanent Cannabis Business Permit or within ten years thereafter, an aggregate ownership interest of 50 per cent or more in a Permittee is transferred to any Person or combination of Persons who were not Owners of the Permittee at the time that a Cannabis Business Permit was awarded, the Permittee shall promptly surrender the permit to the Director,” the code reads.

Cannabis lawyer Figueroa says Bronson’s interpretation of the code is likely correct.

“I looked up that section of the police code and he’s right. If more than 50 per cent gets transferred by operation of the law then the permit is surrendered to the director of the Office of Cannabis in San Francisco,” he said in a phone interview.

And the weird part of this law, Figueroa adds, is that Kunkel and Shirley handing over their ownership stake doesn’t automatically make Bronson the owner. It means the permit is surrendered to the office of cannabis and the director there has to decide what to do with it. The office can then choose to revoke the licence or keep it and give it to Alexis, he said.

Bronson said the San Francisco cannabis office is in the final stages of processing the licence, which is done by the Department of Building Inspections. The COVID-19 pandemic has caused some delays in the process, he added.

In a number of recent Zoom meetings, Bronson says he’s asked the office who they recognize as the owner of the cannabis licence application and they told him it’s the original people from 2018 — him, Kunkel and Shirley.

But, “they were saying that they had my back,” and “know what’s going on,” Bronson said. Although he didn’t want to discuss details of the meetings for fear of implicating the other stakeholders, he said he’s “100 per cent” confident Kunkel and Shirley will be removed from the licence once it’s approved leaving him with sole ownership.

Alexis Bronson (L) with his friend “Freeway” Rick Ross (R), a famed former drug trafficker from Los Angeles. Both have been advocating that black people should a have bigger piece of California’s legal weed industry. Submitted photo

It’s important to note, Bronson says, that Kunkel and Shirley both revised their names on application as private citizens, without any affiliation to Have a Heart, because it would speed up the approval process.

The office of cannabis confirmed with Mugglehead that the licence has been approved by San Francisco’s planning commission and is in the final stages of inspections. But it could not answer questions about who will end up owning the entity.

“As it is a pending application, we cannot provide any additional comments,” the office said in an email.

High Times and Harvest Health deal a ‘Hail Mary’ for both

Both Ryan Kunkel and Interurban Capital Group were also contacted to comment on Bronson’s allegations, as well as Harvest Health and High Times. However, Harvest Health was the only one to respond.

“We cannot confirm whether specific locations are included, but we can confirm that nothing will take place until the deal closes,” a Harvest Health spokesperson said in an email.

In its press release, High Times did acknowledge that the deal to acquire the 13 retail licences is subject to certain closing conditions, including the receipt of certain regulatory third-party consents. Both enterprises are aiming to close the acquisitions no later than June 30, High Times said.

But industry onlookers say the deal has almost no chance at closing.

“This is a ‘Hail Mary’ deal for both Harvest Health and High Times. Nobody in the industry anticipates this deal actually closing,” said Jacqueline McGowan, owner of the cannabis consulting firm G Street Consulting.

McGowan, who helps businesses navigate California’s complex cannabis licensing system, says High Times has become a running joke in the industry.

https://www.facebook.com/HighTimesMag/photos/a.391413203444/10158126273483445/?type=3&theater

She said after looking into the U.S. Securities Exchange Commission filing for High Times’s purchase agreement, she found that only five of the 13 retail licences listed in the deal were actual operational stores.

Also, some of locations listed are in rural parts of California and only have sales of “US$1,000 a day and probably less now during a pandemic,” she added.

She explains that High Times offered to pay US$67.5 million of the US$80 million deal in shares that don’t even exist yet.

Since July 2017, High Times has attempted to go public on seven separate occasions with the original plan to be listed on the U.S. Nasdaq exchange.

But the parent company of the 47-year-old magazine scrapped those ambitions in 2018, after it couldn’t generate enough interest from traditional investors.

Instead, it switched to a mini-IPO option to have its HITM ticker listed on the penny stock exchange run by the U.S. OTC Markets Group.

McGowan calls the effort a “glorified crowdfunding campaign,” which High Times has elected to extend until June 30 after not gaining enough interest from smaller investors. The company has publicly stated that it has raised more than US$20 million, but its initial goal was US$50 million.

“High Times can’t purchase those dispensaries until they go public; they can’t go public until they fool enough people into signing up for their crowd sharing drive to invest in the company,” she said. “Which is hard not to call a scam.”

High Times has been known in the cannabis industry for cancelling various events and being a money loser since 2017. Photo via Flickr & Cannabis Culture

McGowan said High Times has been bleeding money with several of its cannabis events being shut down or cancelled since Levin took over as chairman in June 2017. At that time, Levin and a group of entertainers and industry players bought the media firm in a deal valued at US$70 million with a number of bold ambitions.

The company named its third CEO in little over a year on May 6. Peter Horvath joined High Times after resigning as CEO of Ohio-based CBD company Green Growth Brands (CSE: GGB) in March. Green Growth’s stock has fallen more than 95 per cent in the last year and now faces bankruptcy.

For Harvest Health, McGowan says the deal with High Times showed investors it plans to exit California, which has become a “hot potato” for U.S. multi-state operators because the state’s strict rules and high taxes makes it hard to turn a profit. Shares of Harvest Health have rallied 102 per cent since the deal was announced.

Bronson alleges ‘stock fraud’

In a fast-moving industry, McGowan notes how many deals fall apart and end up in one party filing litigation against another.

Harvest Health has a history of both issues, she said.

In the last two earnings calls for the company, CEO Steve White noted that Harvest Health is in litigation with Interurban Capital Group based on disagreements after merger deal had closed. While no details were provided, White said he expects to “ultimately prevail.”

Bronson says he’s looked into that court case, but there is no public record because it’s currently in arbitration at a Washington state court.

Once details are released to the public, Bronson says it could trigger a shareholder class action lawsuit for disseminating false information and committing “stock fraud.”

Harvest Health & Recreation’s dispensary located in Venice, California is among the 13 listed in Hightimes Holding Corp.’s U.S. SEC filing for the purchase agreement. Press photo

He has filed a formal complaint with the British Columbia Securities Commission, the principal regulator for Harvest Health as its shares are listed on the Canadian Securities Exchange. Bronson also filed a complaint with the U.S. SEC regarding High Times’ involvement.

The BCSC told Mugglehead that companies listed on the CSE must accurately and completely disclose information on acquisitions, mergers or sales, as well as ensuring the ownership of any assets acquired or sold.

In the meantime, Bronson says he’s entertaining offers from different investors to partner with and he’ll make his decision if the San Francisco cannabis office awards him with sole ownership of the licence.

Bronson added that the licensing asset is portable under San Francisco’s regulations, so he may choose to abandon the upscale location because “the rent is just too damn high.”

Bronson says the store will never be branded with a High Times logo and he will likely change the Have a Heart name, which was settled on in February with Chanel and the Union Square business district.

“I thought I was signing up with Have a Heart not have-a-heart attack,” Bronson said with a laugh.

Top image: Alexis Bronson in his Medicinal Organic cannabis grow facility, which supplies clones to San Francisco-area dispensaries. Submitted photo

jared@mugglehead.com

@JaredGnam

Ben King

May 27, 2020 at 2:12 pm

I used to work for Have a Heart and Core Competencies!

I am not sure if these people are stupid or just corrupt, maybe both.

The corporate leadership of Have a Heart need to be investigated for crimes! Especially the people in charge of Core Competencies!

I know for a FACT that the “lawyer” they had working all their deals wasn’t licensed in California, Washington, or any other state they were operating in! This is just the tip of the iceberg!

J

May 27, 2020 at 3:19 pm

Ben King your an idiot Nd you got fired for being a lazy drug addict

Onlooker

May 29, 2020 at 11:43 am

J sounds a little upset that someone is slandering him

M

May 29, 2020 at 12:41 am

Great article. Thanks for taking the time to articulate the full story.

N

May 29, 2020 at 2:32 pm

Ryan Kunkel is corrupt and is a crook. Hope he ends up in JAIL for everything he has done and continues to do.

Ben M'Fing King

August 13, 2020 at 2:28 pm

LOL

Boy, you all really should have got me to sign thay NDA.

Spilling my guts to everyone who will listen.

Never touched a “drug” in my life, and i worked circles around everyone at that HQ, especially the “Apps” team and the HR team I was part of.

A bunch of you are gonna go to jail.

Have fun!

Can’t wait to testify!

Ben M'Fing King

August 13, 2020 at 2:31 pm

LOL

Boy, you all really should have got me to sign that NDA.

Spilling my guts to everyone who will listen.

Never touched a “drug” in my life, and i worked circles around everyone at that HQ, especially the “Apps” team and the HR team I was part of.

A bunch of you are gonna go to jail!

Have fun!

Can’t wait to testify!