Panamanian authorities have approved a refreshed mining concession contract for the Cobre Panamá copper-gold-silver mine run by First Quantum Minerals Ltd. (TSX: FM), a decision that provoked a series of protests from locals.

On Friday, the law permitting the new contract was published in the Official Gazette of Panamá following the country’s National Assembly approving the required bill and President Laurentino Cortizo signing it into law.

The new deal is expected to provide Panamá with over US$375 million in revenue annually and the contract will remain in effect for two decades with the option to renew once that period has concluded.

Hundreds were out publicly voicing their opposition of the open pit mine and its environmental impact in Panama City, including many students. Access roads into the city were blocked periodically on Friday as a result of the demonstrations along with several other streets and police resorted to using tear gas on protestors who approached the premises of the National Assembly, according to local media reports.

“The damage to the environment is devastating, open-pit mining is one of the most harmful,” said Saul Mendez, Secretary General of Panama’s largest union — SUNTRACS.

Las manifestaciones contra el #ContratoMinero se multiplican. Colón, Chiriquí, Veraguas, Pacora. En la capital, via Tocumen, corredores, avenida Balboa, Transístmica. Un aplauso para los estudiantes que se han sumado.

¡Fuera @Cobre_Panama! #noalaminería #PanamaValeMasSinMineria pic.twitter.com/8Aspa1kVyQ— Ana Teresa Benjamín Miranda (@anatebenjamin) October 23, 2023

The mining operation is 90 per cent owned by First Quantum with Korea Mine Rehabilitation and Mineral Resources Corporation holding the remaining 10 per cent stake. Toronto’s Franco-Nevada Corporation (TSX: FNV) contributed approximately $1.4 billion to the construction of Cobre Panamá and holds two precious metals streams on the project.

“We are pleased that the revised contract establishes the basis for a renewed long-term relationship between Panamá and First Quantum,” said Tristan Pascall, CEO of First Quantum Minerals in a statement.

Acciones a nivel nacional Cumplimiento del fallo de la Corte, el contrato es inconstitucional. Moratoria minera. Debate democrático, amplio y televisado Referéndum YA #MineríaEsMuerteHacia el parque Porras y a la asamblea pic.twitter.com/0x2L8u3fZw

— Suntracs Panama ⚒ (@SuntracsPanama) October 19, 2023

The mine is expected to produce over 400,000 tonnes of copper annually going forward and employs over 8,000 people. Commercial production started at the operation in February, 2019 and as of the end of 2022 it was expected to have a 32-year mine life.

“It is about attending to the defense of national interests, to ensure that we would receive greater and better benefits based on what we had in the 1997 contract and above all the protection of the jobs of thousands and thousands of Panamanians,” said Panama’s Minister of Commerce and Industries, Federico Alfaro.

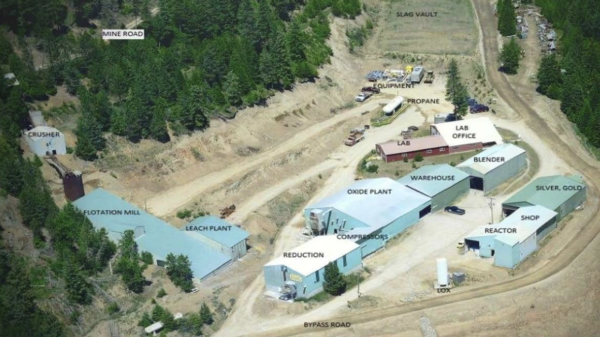

Cobre Panamá. Image via First Quantum Minerals

Read more: Calibre Mining outshines expectations with robust Q3 gold production: BMO Capital Markets

Read more: Calibre Mining to achieve high-end gold production guidance by end of 2023: TD Securities

First Quantum shares have steadily risen by over 20 per cent in the past year and are currently trading for $29.51 on the Toronto Stock Exchange.

The company’s cash balance dropped by over 40 per cent year-over-year at the end of Q2 to US$1.09 billion.

Franco Nevada’s stock has also risen significantly over the past year, by nearly 16 per cent. The company’s shares are currently trading for $191.25 on the TSX.

At the beginning of this year, Franco Nevada increased its quarterly dividend payment by 6.25 per cent for the duration of 2023 — representing $0.027 per share.

rowan@mugglehead.com