Prelude Therapeutics Incorporated (NASDAQ: PRLD) shares tanked on Friday based on the market’s reaction to the Phase 1 trial results for experimental drug, PRT3789, which works to break down the protein building properties of the SMARCA2 gene.

SMARCA2, also called BRM or Brahma-related gene 1, is a gene that helps control how DNA is packed and unpacked in cells. This affects how genes are turned on or off. It’s important for normal cell functions like DNA repair and growth. Specifically, SMARCA2 is part of a group of proteins that reshape chromatin, the material that makes up chromosomes. Changes or mutations in SMARCA2 can lead to certain cancers or developmental issues, because it affects how key genes are regulated.

The drug in question is also presently being tested in an ongoing dose-escalation Phase 1 trial for patients with solid tumours carrying any SMARCA4 mutation that are resistant to standard treatments. Most of these patients have already undergone multiple lines of therapy. Researchers have treated 65 patients with advanced cancer across eight different dose levels.

The standard of care for solid tumours with SMARCA4 mutations typically involves a combination of chemotherapy, surgery, and targeted therapies and immunotherapies.

Read more: Breath Diagnostics takes aim at lung cancer with One Breath

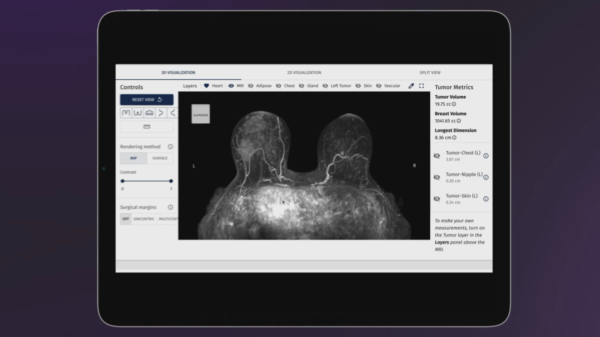

Read more: Microsoft and AI company join forces to build cancer diagnosis platform

Reasons why stock is down aren’t immediately apparent

SMARCA4-deficient tumours, particularly in lung and thoracic regions, often present with aggressive characteristics and are resistant to traditional treatments. Therefore, drugs called immune checkpoint inhibitors are sometimes used alongside chemotherapy to enhance response rates. Early studies also suggest some success in cases of SMARCA4-deficient undifferentiated tumours with this approach.

However, treatment regimens vary depending on the tumour’s location, stage, and individual patient factors. The ongoing research into SMARCA4 degraders like PRT3789 is part of efforts to find more specific therapies for this mutation.

The reasons why the stock is down are rather opaque and due to factors that may not even be in the company’s control.

For example, social media responses often reflect real-time sentiment. There have been posts expressing concern over potential dilution and the company’s financial health. While Prelude wasn’t directly mentioned, fears of dilution—where issuing new shares reduces the value of existing ones—are common in the biotech sector, especially for companies needing additional funding for trials or operations.

Speculation around declines in revenue, net income, and cash reserves, as seen in similar biotech firms. These may have also contributed to investor unease. Broader market trends and macroeconomic factors, such as investor sentiment toward healthcare stocks and fluctuating interest rates, likely added pressure to Prelude’s stock.

Read more: Breath Diagnostics pioneers novel lung cancer breath test

Read more: Artificial intelligence proven to help in cancer screening

Consumer sentiment could be affected by efficacy data

Conversely, interpreted widely, the specifics gleaned from the most recent press release suggest adverse effects and efficacy issues.

The median age of the patients in this study was 62. Also, the median number of prior treatments was 3, ranging from 1 to 10. Among these patients, 34 (52.3 per cent) had a Class 1 (loss of function) SMARCA4 mutation. Additionally, 24 (36.9 per cent) had a Class 2 (missense, VUS) SMARCA4 mutation, and 7 (10.8 per cent) showed a loss of SMARCA4 protein.

The initial safety data show that PRT3789 was generally well-tolerated by the 65 patients treated. However, adverse events were reported regardless of their link to the study drug. To date, the most common adverse events include nausea (24.5 per cent), decreased appetite (18.5 per cent), fatigue (18.5 per cent), abdominal pain (16.9 per cent), anemia (16.9 per cent), and constipation (15.4 per cent). Researchers observed no dose-limiting toxicities and reported no serious adverse events related to the study drug.

This type of news often triggers immediate sell-offs as investors adjust their expectations for the drug’s commercial success.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com