The U.S. Army is betting on a new generation of compact refineries to secure antimony for weapons production, starting with ore from Perpetua Resources (NASDAQ: PPTA) (TSE: PPTA) USD$1.3-billion Stibnite project in Idaho.

Announced on Friday, the effort reflects a shift in defence strategy as the military moves to rebuild a domestic supply chain for a mineral long viewed as both critical and vulnerable.

The Army has invested about CAD$30 million into a refinery that fits inside four shipping containers and produces 7–10 tonnes per year of antimony trisulphide. Engineers designed the system to operate close to raw ore sources. Additionally, Idaho National Laboratory is preparing to host a separate modular pilot plant for Perpetua that will process Stibnite material about 150 km northeast of Boise.

BMO Capital Markets noted that the volumes will remain modest. It added that the small-scale approach will still advance U.S. refining technology. The bank recently placed antimony near the top of its critical minerals list. Analysts stressed that domestic intellectual property matters as much as raw output.

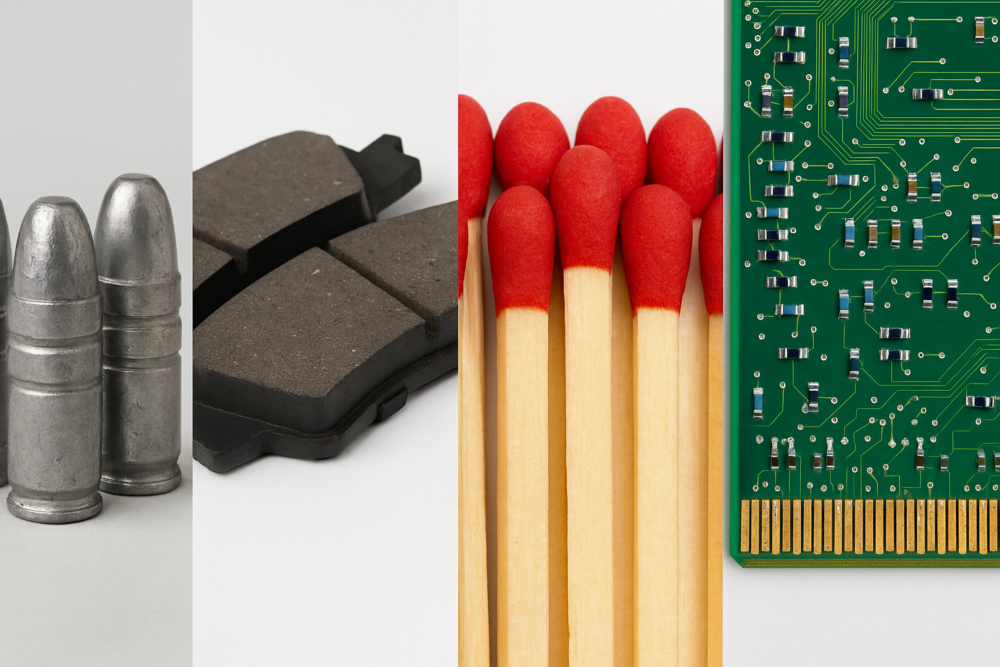

Perpetua’s partnership with the Army continues to expand through the Defense Ordnance Technology Consortium, which awarded the company up to USD$22.4 million to advance domestic processing. The combined initiatives aim to reduce reliance on foreign suppliers. Antimony remains essential because it hardens bullets and shell casings, and antimony trisulphide forms the base of primers and detonators. There is no viable replacement in several defence systems. Furthermore, the United States imports nearly all of its supply.

Read more: NevGold delivers major growth at Idaho gold project

Read more: Antimony recovery results from NevGold’s Limo Butte project exceed expectations

Idaho can help supply minerals required for national security

Perpetua CEO Jon Cherry said the pilot plant will help build long-term mineral resilience in the United States. He stated that a successful demonstration will strengthen the country’s ability to secure materials needed for national defence. Shares in Perpetua jumped 14 per cent on Thursday to close at CAD$40.21 in Toronto, giving the miner a value of CAD$4.9 billion.

Perpetua began early-works construction in October at Stibnite in central Idaho. The Trump administration accelerated the project as part of the Army’s objective to create a fully domestic “ground-to-round” antimony trisulphide supply chain.

The agreement with Idaho National Laboratory, managed by Battelle Energy Alliance, directs the lab to host, commission and operate a pilot plant capable of recovering defence-related minerals from Stibnite ore. The program will produce antimony trisulphide concentrate for munitions and advanced military systems.

U.S. Representative Mike Simpson said Idaho can help supply the minerals required for national security. He noted that the initiative shows the state’s potential to support critical-mineral independence.

Antimony carries geopolitical weight because global supply remains concentrated in a few regions, with China and Russia controlling most production and refining capacity. The United States views this concentration as a strategic risk.

Additionally, antimony supports munitions, communications gear and several advanced defence materials.

Policymakers treat the mineral as a priority because any disruption could slow weapons manufacturing during a conflict. Furthermore, antimony often moves through trade routes vulnerable to diplomatic tension.

Washington also sees the mineral as part of a broader effort to rebuild domestic industrial capacity across critical minerals. Analysts note that secure access influences both military readiness and economic stability.

Read more: Lithium Americas doubles on Trump equity stake talks

Read more: Perpetua Resources moves to bolster United States antimony production

Antimony trade routes vulnerable to diplomatic tension

Antimony carries geopolitical weight because global supply remains concentrated in a few regions, with China and Russia controlling most production and refining capacity.

The United States views this concentration as a strategic risk. Additionally, antimony supports munitions, communications gear and several advanced defence materials. Policymakers treat the mineral as a priority because any disruption could slow weapons manufacturing during a conflict.

Furthermore, antimony often moves through trade routes vulnerable to diplomatic tension. Washington also sees the mineral as part of a broader effort to rebuild domestic industrial capacity across critical minerals.

Analysts note that secure access influences both military readiness and economic stability. Consequently, the Army and other agencies have increased investments in modular processing technology that can operate inside the country and reduce reliance on foreign supply.

This geopolitical pressure has pushed U.S. agencies to widen their approach to securing critical minerals. Officials now treat supply-chain gaps as national security issues rather than simple market weaknesses. Additionally, the government has expanded programs designed to accelerate permitting, financing and domestic processing.

Washington has taken several steps to meet rising mineral demand. The FAST-41 permitting framework aims to shorten approval timelines for large resource projects, giving developers clearer paths to construction.

The federal government also increased its direct involvement in strategic mining ventures. It committed significant backing to Lithium Americas (TSE: LAC) (NYSE: LAC) at Thacker Pass, securing a position in one of the country’s most important lithium projects.

Furthermore, agencies have supported early-stage processing research through the Department of Defense and the Department of Energy, which now fund pilot facilities for minerals considered critical to defence.

Read more: NevGold targets U.S. critical mineral supply chain with new antimony-gold find

Read more: NevGold expands high-grade antimony discovery at Nevada’s Limousine Butte Project

Multiple companies looking to get an advantage

Several junior and mid-tier gold companies could receive future attention as Washington searches for domestic antimony sources. Policymakers increasingly examine multi-commodity producers that can supply both precious metals and critical minerals. Additionally, companies with established U.S. projects may gain an advantage because regulators prefer assets already moving through permitting.

NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) sits among the contenders. The company controls projects in Nevada and Idaho, where ongoing exploration has identified zones containing antimony alongside gold. Analysts note that NevGold’s technical work could align with future federal objectives if the company advances deposits capable of producing defence-related concentrates. Furthermore, its assets sit inside established mining jurisdictions, which may support faster development.

Perpetua remains the most advanced example, but mid-tier players such as Kinross Gold Corporation (TSE: K) (NYSE: KGC) have also reviewed critical mineral potential within certain U.S. properties.

Kinross has examined byproduct streams that could yield small volumes of antimony or related minerals from legacy zones. Meanwhile, smaller firms such as U.S. Gold Corp. (NASDAQ: USAU) continue to evaluate polymetallic targets in Wyoming and Nevada that contain antimony-bearing minerals. These companies could attract federal interest if their deposits demonstrate reliable grades suitable for modular refining systems.

.

NevGold Corp is a sponsor of Mugglehead news coverage

.