Shares of the junior explorer Nevada King Gold Corp. (TSX-V: NKG) (OTCQX: NKGFF) shot up by approximately 38 per cent following news of the company’s best drill result to date at the Atlanta gold mine project.

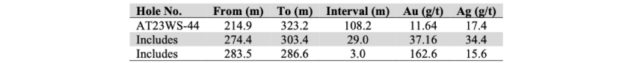

On Monday, Nevada King announced that it had intercepted 11.64 g/t gold over 103.3 metres, including an exceptionally rich interval of 169.8 g/t Au within 1.5 metres.

“Today’s high-grade interval in Hole AT23WS-44 gives us another starting point for tracking higher-grades proximal to high-angle feeder structures cutting up through the flat lying horizons that correlate to stratigraphy hosting most of the gold at Atlanta – namely the silica breccia and overlying silicified volcanic horizons,” said Nevada King’s Exploration Manager Cal Herron.

Nevada King shares are currently worth $0.42 on the TSX Venture Exchange and the company has a market capitalization of approximately $111 million. The miner acquired the Atlanta gold project in southeast Nevada from Meadow Bay Gold in 2018 for roughly $1 million.

Nevada King is the third largest mineral claim holder in the state of Nevada and its portfolio there also includes the Lewis, Iron Creek and Horse Mountain-Mill Creek projects.

New drill results. Image via Nevada King

Read more: Calibre Mining publishes open pit gold estimate for Cerro Volcan Gold, Nicaragua

Read more: Calibre Mining expands high-grade gold mineralization zones within Limon mine complex

Nevada is the world’s number one mining jurisdiction to invest in, according to Canada’s Fraser Institute. Other companies that have entered the state since 2020 include Newcrest Mining Limited (ASX: NCM) (TSX: NCM), Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) and Calibre Mining (TSX: CXB) (OTCQX: CXBMF).

Calibre’s operations in Nevada have been a significant contributor to its recent financial successes.

Gold production at Calibre’s Pan mine in east central Nevada continues to increase year-over year and the open pit operation is estimated to hold 359,000 ounces of measured and indicated mineral resources.

Calibre reported a 32 per cent sequential increase in its cash balance at the end of Q2 this year, bringing its position to US$77 million.

The company’s shares have risen by nearly 24 per cent over the past year and are currently trading for $1.25 on the Toronto Stock Exchange.

Calibre’s stock is also listed on the OTCQX top tier market from OTC Markets Group Inc. (OTCQX: OTCM).

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com