As the legal cannabis industry continues to grow, Neptune Wellness Solutions Inc. (NASDAQ: NEPT) (TSX: NEPT) has chosen to relinquish ties to the market due to difficulties turning over an adequate profit.

On Wednesday, the Quebec-based firm said that it would be launching a new Consumer Packaged Goods (CPG) focused plan of action to improve revenue-generating potential and augment current shareholder worth.

Neptune’s new plan builds on a strategic assessment from last fall and consists of two primary courses of action.

The first will be a calculated and accelerated divestiture of company assets tied up in the Canadian cannabis business. The second will be a reassessment of company priorities and financial restructuring of operational resources distributed within the organization. The company has concluded that its consumer products business is yielding greater potential than its cannabis sector.

Read more: Neptune reports Q3 revenue up 17% to $18.4M, net loss of $21M

Read more: Legal cannabis market projected to have steady growth into 2030: report

The planned divestiture organized by Neptune will include selling the company’s $21 million facility in Sherbrooke, Quebec. Additionally, Neptune will be parting ways with its Pan Hash and Mood Ring cannabis brands.

This course of action taken by the company is intended to reduce company spending while optimizing operational capabilities. Ultimately, Neptune will be cutting its workforce in half and reducing its total payroll expenses by 30 per cent, resulting in an estimated savings rate of C$5.8 million annually.

Neptune’s planned divestiture is also anticipated to enable the company to acquire broader financing options. Many conventional banks and other financial institutions have policies that prohibit engaging with businesses that are involved with regulated cannabis production and distribution.

However, with the company’s exit from the cannabis industry and an inherently improved revenue-generating potential, it is unlikely that Neptune will need to take advantage of those broader financing options.

“This strategic divestiture greatly simplifies our overall structure, enabling us to hyper-focus on those areas of the business we believe are best positioned for profitability and growth,” Neptune CEO Michael Cammarata said.

Neptune now plans to hone its focus on Sprout Organics and Biodroga Solutions – a rapidly expanding organic toddler food brand and a nutraceuticals business.

The company has stated that it will provide further details regarding its business plans in the months to come.

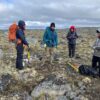

Photo via Neptune Wellness Inc.