Neptune Digital Assets Corp. (TSXV: NDA) (OTCQB: NPPTF) (FSE: 1NW) is expanding its proof of stake (PoS) operations to include the strategic addition of Polkadot (DOT) and Solana (SOL) to its collection of tokens.

The company said on Thursday that its long-term holding of Cosmos (ATOM) consistently yields nearly 20 per cent, and the company channels the proceeds into either enhancing its Bitcoin balance or reinforcing its PoS operations.

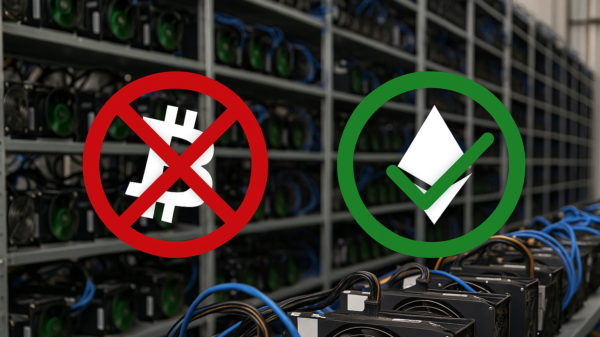

Neptune uses an Ethereum (ETH) validator to generate yield rewards, taking responsibility for data storage, transaction processing and the addition of new blocks to the Ethereum blockchain. These activities are integral components of Neptune’s strategy for growth in the realms of proof of stake and blockchain node operations.

Investors delegate these tokens to validators, which ensure consistent yields while automatically reinvesting, thus compounding growth.

“We believe that positioning the company at the heart of blockchain transactions brings long-term sustainability and significant revenue opportunities,” said Cale Moodie, CEO of Neptune.

“Our growing expertise in managing nodes, validators, and other blockchain software, bodes well for Neptune’s value.”

Neptune is actively building investments in artificial intelligence tokens like Graph (GRT) and Ocean. When the GRT position reaches its full potential, Neptune plans to integrate it into its PoS revenue stream. Neptune is presently staking Ocean and earning rewards as a part of its ongoing PoS operations.

Read more: Volcano Energy launches sustainable Bitcoin mining pool in El Salvador

Read more: Binance and Israeli police close Hamas cryptocurrency accounts

Proof-of-Stake could present regulatory problems

A number of questions regarding the legal status of cryptocurrency, and specifically, proof-of-stake mining have arisen in previous years. These have been spearheaded primarily by the United States’ Securities and Exchange Commission chair, Gary Gensler.

During a period of disagreement between the Commission and the Commodity Futures Trading Commission (CFTC), Gensler stressed the importance of treating all Proof-of-Stake (PoS) tokens and digital assets as securities.

In an interview with the New York Intelligencer, Gensler stated his reason for believing most crypto and staking in particular are tokens are that cryptocurrency investors “might drop their tokens overseas at first and contend or pretend that it’s going to take six months before they come back to the U.S. But at the core, these tokens are securities because there’s a group in the middle and the public is anticipating profits based on that group.”

Canadian regulators, however, take a different approach.

The Canadian Securities Administrators (CSA) has confirmed that it doesn’t explicitly prohibit staking. Instead, it expects fund managers to remain vigilant about the possibility of liquid crypto assets becoming illiquid during staking and ensuring compliance with illiquidity restrictions.

In the spring of 2023, the regulatory climate led to some major crypto exchanges freezing operations in Canada. In April, decentralized exchange dYdX announced the winding down of its services for Canadian users. In May, Binance proactively withdrew from the country along with another platform, Bybit.

.