Calibre Mining Corp (TSX: CXB) (OTCQX: CXBMF) has increased its mineral reserves at the Limon mine’s VTEM gold corridor in Nicaragua by a substantial 36 per cent since the end of 2022. The mid-tier mining company had its fourth consecutive year of mineral reserve growth in 2023.

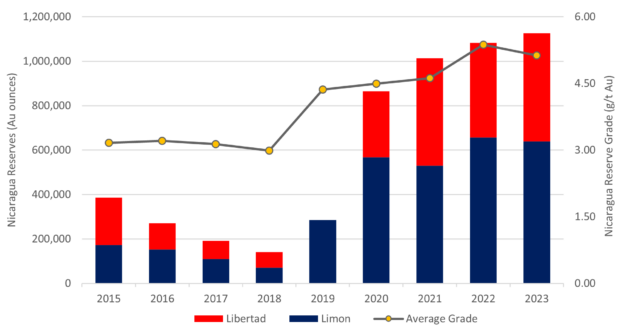

Calibre announced Tuesday that it now has 4.1 million ounces (Moz) of collective gold reserves at its Nicaragua, Nevada and Newfoundland operations. The company’s Nevada reserves increased by 12 per cent to 300 kilo ounces (koz) while Nicaragua’s rose by 4 per cent to 1.13 Moz last year.

Furthermore, the VTEM gold corridor now contains 332 koz with several kilometres of strike potential and an ongoing 50,000 metre drill program. Calibre’s aggregate measured and indicated resources total 8.6 Moz, inclusive of reserves.

Nicaragua mineral reserves as of December, 2023. Chart: Calibre Mining

The gold producer has more than 130,000 metres of ongoing resource expansion and discovery drill programs across its operations.

“I am very pleased to see another year of reserve growth net of depletion in both operating jurisdictions,” CEO Darren Hall said. “With our recent acquisition of the Valentine Gold Mine, our company-wide consolidated reserves stand at 4.1 Moz, a more than 10-fold increase since Q4 2019 net of 825 koz of production.”

Calibre’s cash flow from its asset portfolio last year totalled US$200 million.

The company continues to produce a stream of high-grade drill results, particularly in Nicaragua and Newfoundland. Calibre announced intercepting 68.7 g/t gold over 2 metres at Limon in late February and 46.5 g/t Au over 5.3 metres at Valentine earlier that month. Moreover, an eye-turning 111.9 g/t Au in a 4.1 metre length was pulled from Limon as well in late January.

Since 2020, we’ve been on a steady growth path, increasing our annual production, reserves and assets, and meeting or exceeding our commitments. 📈We’re proud of our track record in delivering for our investors. Here’s how 👉 https://t.co/zq1mrmeo0F pic.twitter.com/QphKK34ltp

— Calibre Mining Corp. (@CalibreMiningCo) March 13, 2024

Read more: Calibre Mining intercepts rich gold mineralization at Nicaragua’s Limon complex

Read more: Calibre Mining reports 96% net income rise for 2023, exceeds production guidance

Calibre’s director steps down

The mid-tier producer announced last week that Matthew Manson had stepped down from his role as Director at the company to pursue other endeavours. Manson was instrumental in facilitating completion of the Marathon Gold acquisition in late January.

“I wish Calibre much success as it progresses the Valentine gold mine to production in H1/2025,” Manson said.

“As Calibre builds on the Marathon team’s excellent work to date, we aim to deliver on Matt’s vision to build a successful 200 koz/year gold mine in Newfoundland and Labrador,” Chairman Blayne Johnson added.

Calibre’s share price is the highest it has been since 2021 at C$1.80.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com