Extractor MediPharm Labs Corp. (TSX: LABS) saw its revenues crater in the first quarter, pegging its losses on the continued growing pains of the Canadian legal market.

The Ontario-based company reported earnings on Thursday for the three months ending March 31, posting net revenues of $11.1 million, a 65 per cent decline from the $32.4 million recorded in the fourth quarter of 2019.

It’s the second straight quarter of declining sales for the extractor, as its fourth quarter sales dropped 25.4 per cent from $44.3 million booked in the third quarter of last year.

Read more: MediPharm blames slow cannabis 2.0 rollout for Q4 revenue drop

MediPharm CEO Pat McCutcheon blamed declining sales yet again on the industry’s inability to produce and wholesale big orders of new cannabis 2.0 products.

“As expected with any new market, there were underlying growing pains that emerged in the Canadian market which were also heightened and exacerbated by Covid-19,” McCutcheon said on the company’s earnings call. “Manufacturers are unable to convert bulk concentrate into finished consumer products at scale. This is just a fact.”

And like many other Canadian players in the space, the chief executive cited how “an agonizingly slow roll-out of cannabis stores in Ontario” also hurt sales.

The company said these factors created an oversupply of bulk resin and distillate on the market, which put downward pressure on its pricing, sales and margins.

NEWS: MediPharm Labs reports Q1 2020 Results; “Focus on innovation, pharma approach, capital investments & very high standards…allow us to pursue medicinal & wellness markets, & int'l opportunities.” $LABS $MEDIF $MLZ. https://t.co/fljQbgWSsn pic.twitter.com/Ak1V2Aj97y

— MediPharm Labs (@MediPharmLabs) June 18, 2020

MediPharm says $35 million counter lawsuit has been filed against them

MediPharm reported a first-quarter net loss of $22 million, dragged down by a $12.8 million write-down of inventory due to the supply glut of concentrates.

Executives said revenues were also hurt because of its ongoing dispute with Ottawa-based producer Hexo Corp. (TSX: HEXO), which led to MediPharm filing a $9.8 million lawsuit against Hexo in January.

However, the company disclosed in its Q1 filings that Hexo has filed a counter lawsuit for $35 million on Feb. 26. The company served a reply and defence to the counterclaim, as well as serving a motion for summary judgment in March.

“Without sounding as if I’m making an excuse,” CFO Bobby Kwon said. “In Q1, for the one customer you know that we’re in litigation with — had that contract been honored, it would have obviously softened the reduction we saw in quarter one as reported.”

The extractor posted a negative gross profit of $10.9 million in the first quarter, as well as an adjusted earnings before interest, taxes, depreciation, and amortization loss of $5.7 million. That’s after MediPharm posted four straight quarters of positive adjusted EBIDTA in fiscal 2019, which McCutcheon told analysts “was no small feat.”

But after posting the big sales drop in Q1 on Thursday, MediPharm stock fell 14 per cent on the Toronto Stock Exchange, closing at $1.46.

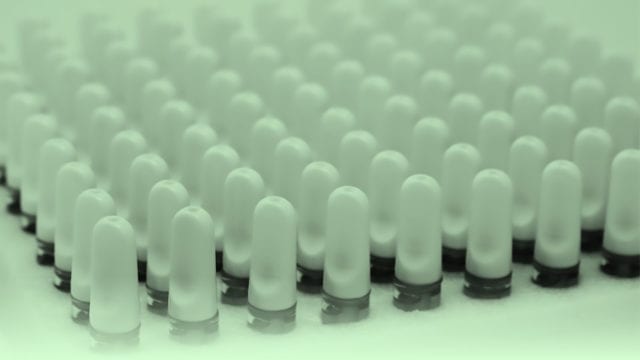

MediPharm said its automated vape pen line is being used to introduce the company’s own branded vape products. Press photo

MediPharm lays out plans for sales rebound, second wave of profits

In the earnings call, McCutcheon remained upbeat while laying out the company’s strategy to address a challenging national market.

The firm’s first priority is to focus more on developing its own brand of finished cannabis 2.0 products instead of relying on third-party contracts, the CEO said.

In the first quarter, MediPharm introduced three of its own products, like topical hand lotions, into five provinces. The company has added another eight products so far in Q2 that include a line of vape cartridges and CBD oil drops.

The company said its supply deal with Shoppers Drug Mart that it signed in the first quarter will help it get more of its branded products into Canada’s medical market.

“We were the first company actually to have our vape SKUs added to the shelf at Shoppers,” McCutcheon said.

The CEO also highlighted how its pharmaceutical approach to cannabis will help it secure more contracts in both Canadian and international markets.

In the first quarter, MediPharm signed a white-label CBD deal with Avicanna, a medical cannabis company that works with pharmaceutical giant Johnson & Johnson.

Roth Capital analyst Scott Fortune asked the company if it was focsuing on any other deals with big pharma to make up for the lack of sales in the Canadian market.

Company president Keith Strachan said they’ve been approached by four companies, including Purdue Pharma and Apotex Inc. to discuss future contracts.

“When a large pharmaceutical company comes to MediPharm, what they see is a mirror of what they’re used to in their own manufacturing space,” president Keith Strachan said. “It just gives them that comfort and the cohesion for us to work together on future contracts.”

McCutcheon added that the company’s pharmaceutical approach extends into its subsidiary, MediPharm Labs Australia, which secured four white label contracts in Australia and New Zealand in 2020.

He said Covid-19 has slowed down inspections at its Barrie, Ontario facility to help it gain EU GMP certification. But the company still secured two new longer-term contracts in the United Kingdom and Germany via its GMP-certified Australian platform, the CEO noted.

When analysts asked for any guidance for the second quarter, MediPharm executives offered few details and subtle warnings.

“With respect to looking forward into Q2, again I think it will be more in line with what we saw in Q1 in terms of the number of contract customers, not necessarily the volumes,” CFO Kwan said.

McCutcheon said MediPharm will continue to also cut costs in fiscal 2020 to help offset lower demand. General and adminstrative costs dropped in the first quarter to a reported $5.5 million, from $6.4 million in the previous quarter.

But the company’s top boss said to expect continued uncertainty due to the impact Covid-19 on the economy and the slow pace of recreational retail development.

“For many in the Canadian industry, it is a survival of the fittest moment. For us, we are built to survive and ready to grow sustainably,” he said.

The company reported a cash balance of $21.4 million at the end of the first quarter, highlighting it secured $37.8 million in a private placement financing deal after the end of the fiscal period.

Top image via MediPharm Labs

jared@mugglehead.com

@JaredGnam