Vancouver-based Lundin Gold Inc. (TSX: LUG) (Nasdaq Stockholm: LUG) (OTCQX: LUGDF) reported significantly improved year-over-year (YoY) gold production and sales for Q2, 2023.

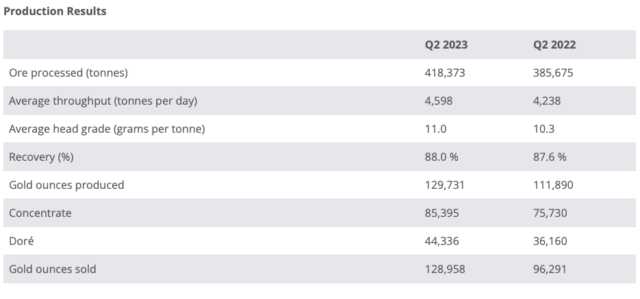

The mining company announced production results for the quarter ending June 30 on Thursday prior to publishing its quarterly financial report on August 9. Lundin produced 129,731 ounces of gold from its Fruta del Norte mine in Ecuador and sold 129,958 ounces during the quarter, a 15.9 per cent production increase and 30.8 per cent sales increase in comparison to Q2, 2022.

The company produced 85,395 ounces as concentrate and 44,336 ounces in doré bars from the flagship underground mining operation. During Q2, the mill successfully processed a total of 418,373 tonnes with an average daily throughput rate of 4,598 tonnes. The material had an average grade of 11.0 grams per tonne and an average recovery rate of 88 per cent.

“Higher than expected grade and mill throughput in the second quarter have offset lower recoveries, which were caused by changes in ore type and oxidation impacts on the coarse ore stockpile,” said Lundin’s President and CEO Ron Hochstein.

“In the first half of 2023, mill performance has been excellent resulting in the achievement of an average throughput rate of 4,479 tonnes per day,” he added. However, Hochstein believes that recoveries will be impacted in Q3 this year.

Q2 production results. Table via Lundin Gold

Read more: Gobsmacked by Calibre Mining’s high grades from Palomino, Nevada: Haywood Securities

Read more: Calibre Mining assays at Palomino property in Nevada may improve mineral resource

Fruta del Norte is Lundin’s flagship asset and only mining operation. In Q1 this year Lundin reported all-time high production of 140,000 ounces.

The company acquired the mine in 2014, started construction in 2017, poured its first gold near the end of 2019 and declared commercial production the following year.

The project spans approximately 5,556 hectares and has 5 million gold ounces in probable reserves at a grade of 8.7 grams per tonne. On average, the mine produces 340,000 ounces of gold annually.

Lundin had a cash position of approximately US$209.7 million at the end of Q1 this year, a 42.3 per cent decrease from the US$363.4 million the company had at the end of Q4, 2022.

Lundin recently sponsored research on ancient civilizations in Ecuador’s Amazon rainforest dating back as far as 7,000 years ago.

The company’s shares rose by 3.85 per cent Friday to $16.20 on the Toronto Stock Exchange.

Mill at Fruta del Norte. Photo via Lundin Gold

Calibre Mining (TSX: CXB) (OTCQX: CXBMF) is another Vancouver-based gold producer with well-established mining infrastructure in Latin America. Recent financial reports from the Bank of Nova Scotia (TSX: BNS) and Bank of Montreal Financial Group (TSX: BMO) indicated that the company’s initiation of open-pit mining at the Pavon Central and Eastern Borosi operations in Nicaragua would accelerate Calibre’s gold and cash flow for the remainder of 2023.

Additional reports earlier this year from Raymond James, Canaccord Genuity, VIII Eight Capital and Cormark Securities all had a positive take on Calibre’s operations and hub-and-spoke model in Nicaragua as well.

Calibre’s stock rose by 2.9 per cent Friday to $1.42 on the TSX.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com