Lithium Americas has completed its strategic split and is now comprised of two publicly traded companies — Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) and Lithium Americas (Argentina) Corp. (TSX: LAAC) (NYSE: LAAC).

The company announced the close of the separation on Tuesday, a move aimed at promoting enhanced focus among the two companies in their respective areas of operation. The split received shareholder approval at the end of July.

Lithium Americas will be solely focused on development of the Thacker Pass project in Nevada and Lithium Argentina will be concerned with advancing its Caucharí-Olaroz joint venture project to full production capacity while also developing the Pastos Grandes and Sal de la Puna projects in the South American nation.

Lithium Argentina holds a 44.8 per cent stake in Caucharí-Olaroz, China’s Ganfeng Lithium (SHE: 002460) has a 46.7 per cent interest and a state power company owns the remainder. Ganfeng also has a 35 per cent stake in the Sal de la Puna project.

Lithium Argentina is currently advancing a US$30 million development plan at Pastos Grandes, which is situated in the Salta province within the Lithium Triangle.

“The separation offers investors two unique and highly focused pure-play lithium companies with world-class assets in our respective regions of operation,” said Jonathan Evans, President and CEO of Lithium Americas.

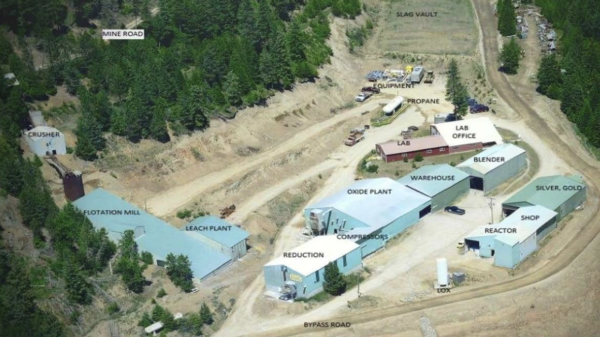

Lithium Americas began construction at Thacker Pass in March this year following protests from Nevada Indigenous groups, court proceedings and other regulatory hurdles prior to receiving a notice to proceed from the United States Bureau of Land Management.

Thacker Pass is the largest known measured and indicated lithium resource in the country and the mine is expected to have a 40-year life span, producing 80,000 tonnes of the element annually upon achieving full operational capacity.

Michigan’s General Motors Co. (NYSE: GM) will be purchasing approximately US$330 million worth of Lithium Americas stock now that the split has been finalized. The company previously invested US$650 million into the mine in January to help establish a reliable supply chain for its electric vehicles.

Lithium Argentina’s Caucharí-Olaroz operation produced its first lithium carbonate this year. The project was a 50/50 joint venture with Sociedad Quimica y Minera de Chile (NYSE: SQM) before it sold its stake in 2018.

Lithium Americas shares shot up significantly Wednesday by over 15 per cent following the split and are currently worth $16.01 on the Toronto Stock Exchange.

Lithium Argentina stock is now worth $8.26 on the New York Stock Exchange.

Read more: Thacker Pass court case judge rules in favour of Lithium Americas mine

Read more: U.S. government gets backlash from Nevada Indigenous groups over controversial lithium project

rowan@mugglehead.com