Twenty-two national leaders signed a declaration to triple their nuclear power capacity by 2050 from a base year of 2020.

The United States, Canada, Sweden, Ghana, United Arab Emirates and France are among the nations that signed this year’s Declaration to Triple Nuclear Energy. The move took place during the 28th session of the Conference of the Parties (COP28).

Under the pledge, to be reviewed each year at COP meetings, countries commit to extend the life of existing plants and support newer nuclear technologies such as small modular reactors. The countries also commit to mobilizing investment and encouraging financial institutions to back nuclear power, including world central banks.

The U.S. Department of Energy said that the declaration recognizes the key role of nuclear energy in achieving global net-zero greenhouse gas emissions by 2050 and keeping the 1.5-degree goal within reach.

“Nuclear is the safest source of energy,” Chief Executive of Westinghouse Patrick Fragman said at the COP28. “Of course, for the first-of-their-kind reactors, there were problems and cost overruns. We know: we have the scars.”

When it comes to safety, nuclear power carries a stigma given the impact of previous nuclear disasters such as Chernobyl or Fukushima. However, a 2016 Harvard report showed that in the 70 years of nuclear technologies, it has resulted better compared to wind power and way better than fossil fuels.

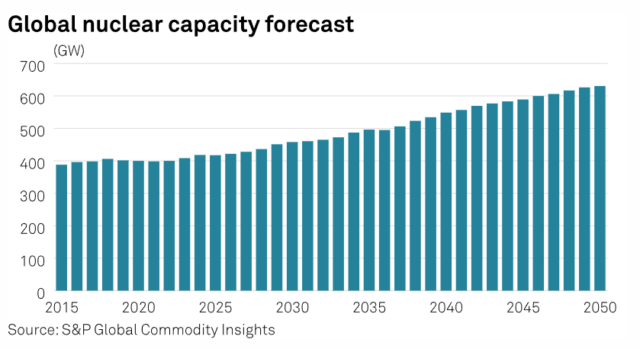

S&P Global Commodity Insights’ analysts say global nuclear capacity will grow by 58 per cent in 2050. Graph via S&P Global Commodity Insights.

Atomic Energy Agency Director General Rafael Mariano Grossi said the goal of global net-zero carbon emissions can only be reached by 2050 with swift, sustained and significant investment in nuclear energy.

“Since the beginning of the 21st century, nuclear power has avoided the release of some 30 gigatonnes of greenhouse gasses,” Grossi said. “Today, it provides a quarter of the world’s clean electricity and contributes to the achievement of the sustainable development goals.”

Nuclear power can help to decarbonize district heating, desalination, industry processes and hydrogen production.

Read more: Over half of U.S. citizens support nuclear power: ecoAmerica survey

Read more: Japan launches world’s first experimental nuclear fusion reactor

Global electricity production lowest since the 1980s

Last year, nuclear energy generated around 2,500 terawatt-hours of electricity worldwide, 9.2 per cent of total gross electricity generation. This is according to the annual World Nuclear Industry Status Report (WNISR).

However, analysts found that global electricity production using nuclear energy dropped by 4 per cent from 2021, falling to the lowest since the 1980s.

The decrease was attributed to outages caused by weld problems in old French reactors and phase-outs in Germany. The war in Ukraine further impacted the drops in output. Currently, 200-420 nuclear reactors are scheduled for decommissioning before 2050.

Asia saw an increase in nuclear electricity generation with six reactors connected to the grid in 2022. These included two in China and one each in Finland, South Korea, Pakistan and the United Arab Emirates.

“These additions are welcome, but a far faster rate of construction and commissioning will be needed,” World Nuclear Industry Director General Sama Bilbao y Leon said. He added that it will require at least a tripling of nuclear capacity worldwide to achieve net-zero greenhouse gas emissions by 2050.

Total installed nuclear capacity has grown in the past years

In 2020, the installed nuclear capacity worldwide was around 375 gigawatts; it is expected to rise to 458 gigawatts in 2030, 549 gigawatts in 2040 and 631 gigawatts in 2050.

For context, 375 gigawatts could power approximately 924.8 million photovoltaic panels, 115,000 utility-scale wind turbines and around 37.5 billion LED bulbs.

By mid-2023, 407 reactors were operating in 32 countries, compared to 411 in 2022 and 438 in 2002. The report found that there are 60 commercial reactors under construction in 17 countries, with China building 25.

Despite its popularity, nuclear energy carries high costs and takes a long time before a plant becomes operational.

According to the WNISR, nuclear energy is falling behind other renewable sources of energy in terms of cost and construction time. Nuclear energy requires nearly four times as long as wind power to develop.

Environmental groups have also criticized the declaration with public safety concerns. Other researchers question whether plants could even become functional in time before a climate catastrophe.

“Why would anyone spend a single dollar on a technology that, if planned today, won’t even be available to help until 2035-2045?” Stanford University energy specialist Mark Jacobson said.

Read more: Ontario Power Generation initiates uranium fuel contracts for North America’s first SMR

Read more: Uranium Energy and TerraPower team up to revitalize uranium supply chains

KHNP’s CEO Hwang Joo-ho presenting the i-SMR powered Smart Net-Zero City model Photo via KHNP.

Small modular reactors take a spotlight in COP28

Given their size, time for construction and easy transportation, small modular reactors are great prospects for the nuclear energy transition, experts say.

At the conference, Korea Hydro and Nuclear Power presented its iSMR reactor which is designed to be plugged into existing power grids, run desalination plants and provide urban heating. Once permits are in place, the company will be able to build a plant in two years compared to the 10-20 years it takes for larger reactors, said its Chief Executive Jooho Whang.

Korea Hydro’s iSMR is one of over 80 designs in development but none will be going online before 2030.

In North America, NuScale Power Corp. (NYSE: SMR) had the first SMR design approved by the Nuclear Regulatory Commission, but the program was terminated because of lack of funding.

Read more: NuScale Power opens first Asian SMR training simulation facility at Seoul University

Read more: GSE Solutions and NuScale Power use simulation to determine next step in alternative energy project

Nuclear fuel availability possesses limitations

With the pledge and the emergence of small modular reactors, the demand for nuclear fuel — which requires uranium — has increased significantly, with the commodity seeing its price reach a 15-year high.

Last week, Canada, France, Japan, the United States and the United Kingdom’s leaders announced a total of US$4.2 billion in investments to develop a secure, reliable global nuclear energy supply chain. The investments will enhance uranium enrichment and conversion capacity over the next three years and build a supply away from Russian influence. The announcement came during the Net Zero Nuclear Summit of the COP28.

Currently, Russia is the main producer of high-assay, low-enriched uranium (HALEU), which is crucial for new nuclear technologies such as SMRs. According to the U.S. Energy Information Administration, the U.S. imported around 14 per cent of its uranium from Russia in 2021. Another 35 per cent came from Kazakhstan and 15 per cent from Canada.

American and Canadian companies have been making strides in finding ways to streamline nuclear fuel. Among these, Centrus Energy Corp. (NYSEAMERICAN: LEU) has begun to produce HALEU while the European Union has also initiated production programs.

“This drive for global clean energy, along with uranium supply and demand fundamentals, has tightened the uranium market, transforming it from an inventory-burdened to a production-driven market,” Uranium Energy Corp (NYSE American: UEC) CEO Amir Adnani said.

Uranium Energy has two production platforms anchored by fully operational central processing plants and served by seven U.S. ISR uranium projects.

Read more: ATHA Energy to acquire Latitude Uranium and 92 Energy, creating industry’s largest uranium portfolio

Read more: ATHA Energy defines 18 high-priority prospective mining targets after EM survey

Athabasca Basin estimated uranium reserves. Image via JNR Resouces Inc.

Uranium-rich areas host new exploration projects

The Athabasca Basin in Saskatchewan, Canada, is one of the richest areas in uranium deposits. Companies are now gearing up to start explorations. NexGen Energy Ltd. (TSX: NXE) (NYSE: NXE), operating in the basin, received the first provincial environmental assessment approval for a uranium project in over two decades.

Nexgen’s partner, ATHA Energy Corp. (CSE: SASK) (FRA: X5U) (OTCQB: SASKF) holds rights to 10 per cent of resources discovered in certain regions and recently completed the largest-ever electromagnetic survey in the region.

ATHA recently announced it will acquire Latitude Uranium Inc. (CSE: LUR) (OTCQB: LURAF) and Australia-based 92 Energy Limited (ASX: 92E) (OTCQX: NTELF) and create one of the largest portfolios in the basin. The acquisition will be partly funded with a $14 million financing from IsoEnergy Ltd. (TSX‐V: ISO) and Mega Uranium (TSX: MGA).

Other companies, such as Stallion Uranium Corp. (TSX-V: STUD) (OTCQB: STLNF) acquired exploration permits for its Coffer uranium project and will start drilling in the area soon.

Cameco Corporation (TSX: CCO) (NYSE: CCJ), Orano Canada, IsoEnergy Ltd. (TSX‐V: ISO), Rio Tinto (ASX: RIO) (NYSE: RIO) (LON: RIO), Cosa Resources Corp. (TSX-V: COSA) (OTCQB: COSAF) and Fission Uranium Corp. (TSX: FCU) (OTCQX: FCUUF) also have significant operations in the region.

natalia@mugglehead.com