HEXO Corp. (TSX: HEXO) (NASDAQ: HEXO) says its last quarter was a period of “strategic realignment” for the company.

On Tuesday the company released its financial results for the fourth quarter that ended July 31 and reported quarterly net revenue of $42.5 million from $45.6 million last quarter which is a decrease of 7 per cent.

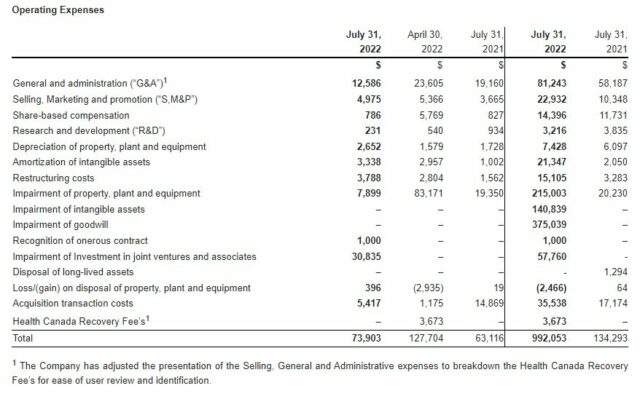

Total net loss and comprehensive loss was $102.4 million from $127.7 million in the last quarter. HEXO reported a gross loss increase of 577.4 per cent to $35.9 million from $5.3 million this quarter. Operating expenses went down this quarter by 42.1 per cent to $73.9 million from $127.7 million in the third quarter.

Graph via HEXO

Read more: Hexo to produce Mike Tyson’s new pot brand in Canada

HEXO also closed the Tilray transaction, amending the terms of the senior secured convertible notes and reducing the associated liquidity and dilution pressures under the previous debt structure. This July, HEXO, Tilray and HT Investments (HTI) amended and restated the terms of the note issued by HEXO to HTI. The note was assigned to Tilray where it acquired 100 per cent of the remaining outstanding principal balance of US$173.7 million of the note.

Read more: Deep in debt, Hexo hemorrhages $146.66 million in Q3

“The fourth quarter was a period of strategic realignment for HEXO,” said Charlie Bowman, President and CEO of HEXO said the company focused on making the changes that will enable the company to maintain and expand its position in the Canadian market.

“By committing to three key priorities – aligning the company for success, resetting the organization for profit and growth, and delivering a preferred cannabis experience for its customers and other stakeholders – we took the necessary steps to position the company for long-term success and have come out stronger as a business,” said Bowman.

Chief financial officer Julius Ivancsits said that re-financing the senior secured convertible note would deleverage the balance sheet and boosted cash reserves, allowing the company to focus on profitable growth.

“We are hyper-focused on cash flow, and to this end, reduced our personnel cost by $65M, divested from businesses that do not offer HEXO a competitive advantage and focused on our quality of earnings, while also optimizing our working capital. We also rationalized to upgrade our product mix,” Ivancsits explained.

Bowman said that the company has moved to the second phase of its transformation where it will focus on producing its core brands, lead innovation and reinforce the company’s market share.

“We evolved our leadership across the organization and are benefiting from strong integration across our most successful brands. By concentrating on these products and ensuring that they do not compete against each other, we have built a loyal customer following and refined what truly sets HEXO apart from our peers,” Bowman said.