The major Swiss mining company Glencore PLC (LON: GLEN) (JSE: GLN) has chosen to acquire its joint venture partner’s stake in a South American copper-gold mining operation and will soon hold a 100 per interest in the project.

Glencore announced Monday that it had inked an agreement with Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) to acquire its 56.25 per cent stake in Argentina’s MARA project for US$475 million and a 0.75 per cent net smelter royalty (NSR) on the mine going forward.

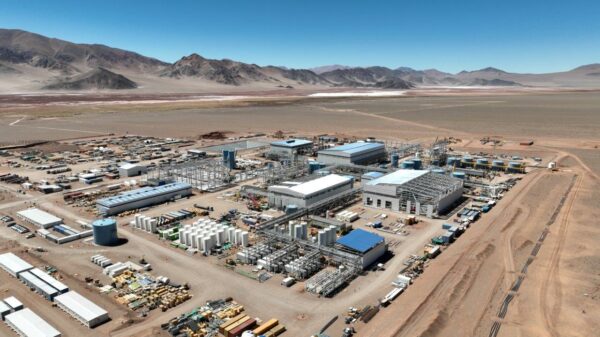

Glencore says MARA is one of the lowest capital-intensive copper projects on the globe. It is expected to become one of the world’s top 25 copper-producing mines in the coming years, generating over 200 kilotons of the metal annually.

The mine, situated in the country’s Catamarca province, was established at the end of 2020 and is expected to have a 27-year mine life. The MARA project’s proven and probable mineral reserves consist of 5.4 million tonnes of copper and 7.4 million ounces of gold within 1.1 billion tonnes of ore.

In October last year, Glencore acquired Newmont Corporation’s (NYSE: NEM) (TSX: NGT) 18.75 per cent stake in the project for approximately US$125 million and a deferred payment of US$30 million once commercial production was declared at MARA. This acquisition gave Glencore a 43.75 per cent stake in the project.

Pan American Silver Corp sells its 56% stake in an Argentine copper project (MARA) to Glencore, gains complete ownership.$GLEN grows its #copper portfolio for energy transition. Big miners acquiring assets w/ longer LOM , ,high-quality grade ore. #stockmarkets $ARG $ARREF pic.twitter.com/MTIuXb7n5W

— Duane Hope (@DuaneHope5) July 31, 2023

Read more: NevGold shareholders approve GoldMining as new ‘control person’ at special meeting

Read more: NevGold discovers new untested areas at Limousine Butte

The MARA mine was a joint venture between Newmont, Glencore and Yamana Gold when it was established. Pan American Silver completed its acquisition of Yamana at the end of March this year.

Glencore also announced last month that it had sold its Cobar copper mine in Australia to Metals Acquisition Corp (MAC) (NYSE: MTAL) for a total consideration of approximately US$950 million and a 1.5 per cent NSR for the mine’s life. Glencore now owns 20.6 per cent of MAC’s shares.

Glencore produces and markets over 60 commodities such as copper, gold, cobalt and nickel. The company has been in existence since 1974.

Pan American Silver was established in 1994 and listed on the Nasdaq exchange in 1995. The Vancouver-based company produced 18.5 million ounces of silver last year.

Mining exports in Argentina hit a decade-high last year with approximately US$370 million being invested throughout the country. Gold, copper and lithium were the primary drivers of the recent growth and mining exports from the nation are expected to increase more than two-fold within the next two years to approximately US$8.6 billion, according to the country’s Mining Secretariat Fernanda Avila.

Glencore shares are currently trading for the equivalent of C$8.02 on the Johannesburg Stock Exchange.

Pan American Silver stock rose by 6.89 per cent to $22.42 on the Toronto Stock Exchange.

rowan@mugglehead.com