Freeman Gold Corp. (TSXV: FMAN, OTCQX: FMANF, FSE: 3WU) completed its 2022 drill program in Idaho and extended known mineralization areas previously modelled as unmineralized.

The Vancouver-based company with operations in Nevada announced on Friday the completion of its drill program at its Lemhi Gold Deposit in Idaho. The drill program consisted of 58 diamond drill holes and 13 reverse circulations for 15,349 metres.

It expanded known gold mineralization in all directions and depths and showed a mineralization strike length expanded 80 and 166 metres east and west, respectively. Among the highlights, the company found 2 g/t Au over 24m (FG22-036C) and 2.1 g/t Au over 16m (FG22-016C).

The company said that the drilling expanded known mineralization in areas previously modelled as unmineralized.

Highlighted results from the program include:

- 61 g/t Au over 66m, including 3.1 g/t Au over 5.0m (FG22-011C)

- 0.55 g/t Au over 55m, including 1.1 g/t Au over 18.52m (FG22-001C)

- 0.34 g/t Au over 105.92m including 1.49 g/t over 7.0m (FG22-031C)

- 0.24 g/t Au over 156.69m including 2.1 g/t over 7.44m (FG21-004C)

- 1.2 g/t Au over 24m (FG22-036C), 0.4 g/t Au over 41m (FG22-003C)

- 1.5 g/t Au over 9.0m (FG22-010C)

- 0.61 g/t Au over 90m, including 0.92 g/t Au over 15.97m (FG22-009C)

- 0.94 g/t Au over 41m, including 1.67 g/t Au over 17m (FG22-014C)

- 0.73 g/t Au over 7.5m (FG22-002C; deepest mineralization drilled to date (340m) at Lemhi

- 2.1 g/t Au over 16m (FG22-016C)

Among other highlights, the company reported that after a significant capital raise of US$13 million late last year it was able to complete the multi-phased drill programs.

The Lemhi programs received Permanent Mining Water Rights from the Idaho Department of Water Resources further de-risking project development. It also received initial metallurgical results which indicate excellent gold recoveries averaging 95 per cent.

Read more: Integra Resources finds ‘unexpected’ positive results at Idaho’s DeLamar drill program

Read more: Nevada King intercepts high-grade gold at Atlanta Gold Mine

“We had a very busy year, which included extensive expansion drilling, permitting milestones, positive metallurgical work and a new discovery, as we are completing the building blocks for our PEA. In addition, senior management has supported the stock by continuing to expand our positions,” executive chairman Paul Matysek said in a statement.

Freeman is a mineral exploration company focused on the development of its 100 per cent owned Lemhi Gold property.

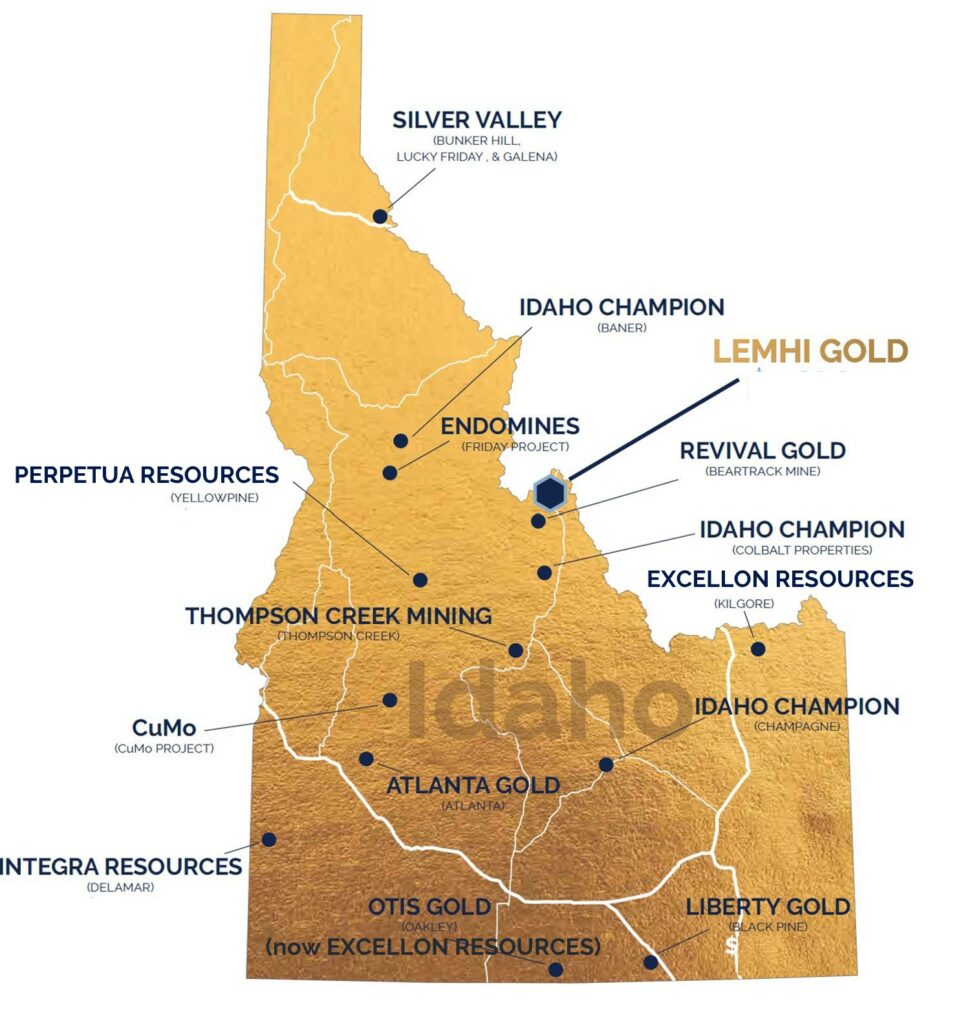

Lehmi Gold Area. Photo via Freeman Gold

Lemhi Gold comprises 30 square kilometres of highly prospective land, hosting a near-surface oxide gold resource. The pit-constrained NI 43-101 compliant mineral resource estimate is comprised of 749,800 oz gold at 1.02 grams per tonne in 22.94 million tonnes (Indicated) and 250,300 oz Au at 1.01 g/t Au in 7.83 million tonnes (Inferred).

Freeman Gold stock went up by 1.75 per cent on Monday to $0.29 on the Canadian Venture Exchange.

Read more: NevGold issues $1.5M in shares to GoldMining Inc. for Nutmeg Mountain project

Read more: NevGold’s oxide gold drill program in Nevada finds positive results

Other companies operating in Idaho such as Integra Resources Corp. (TSX-V: ITR; NYSE American: ITRG) released their drill results from the DeLamar Project and reported finding “unexpected results” including oxide material with some mixed material after stockpile drilling

Neighbouring states such as Nevada have also been shown to carry high-grade gold after some Canadian companies reported positive results from their latest drill programs. NevGold Corp. (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50)’s drill program at Resurrection Ridge in Nevada intercepted more oxide gold on its last assay and expanded its mineralized footprint by over 100 meters.

Last week, NevGold announced it issued 3,658,536 of its common shares for $1.5 million to GoldMining Inc. (TSX:GOLD) (NYSE:GLDG) in line with its Nutmeg Mountain acquisition agreement.

Nutmeg Mountain has a 2020 mineral resource estimate of 910,000 indicated ounces of gold (43.5 Mt at 0.65 g/t Au), and 160,000 Inferred ounces of gold (9.1 Mt at 0.56 g/t Au) with significant resource expansion and exploration upside.

NevGold stock went up 2.56 per cent on Monday to $0.40 on the Canadian Venture Exchange.

NevGold Corp. is a sponsor of Mugglehead news coverage