The trends suggest that artificial intelligence (AI) has supplanted blockchain as the new tech-du-jour. Gigantic data centers are being erected or co-opted for AI whereas once they were specifically for bitcoin mining.

But the probability is that AI isn’t so much replacing blockchain, as augmenting it and giving it a little extra push in terms of use value.

The truth is that the technologies complement one another and the convergence of blockchain and AI is transforming various industries, with impactful advancements in data management, security, financial transactions, and autonomous decision-making.

Decentralized data marketplaces are emerging, enabling AI models to access large, distributed datasets without centralized control. Blockchain ensures data integrity and secure sharing, which is essential for AI training while allowing data owners to retain control.

Here are five ways artificial intelligence and blockchain technologies are intersecting.

Decentralized Finance (DeFi)

In decentralized finance (DeFi), AI-driven bots are increasingly used to execute trades and manage investments. Through platforms optimized for transparency, AI algorithms can autonomously track market conditions and make real-time decisions.

The cryptocurrency exchange, Coinbase Global Inc (NASDAQ: COIN) is expanding into DeFi, using AI to enhance transaction security, asset management, and customer experience.

For example, Coinbase uses AI-driven analytics to monitor blockchain transactions, identifying suspicious activity and supporting automated compliance. Additionally, the company has invested in DeFi projects and AI-based decentralized applications (dApps). The focus is on developing algorithms that optimize trade execution and lending, making the DeFi ecosystem more accessible and secure.

This approach supports Coinbase’s push into the future of financial autonomy through intelligent, blockchain-integrated solutions.

Coinbase is also exploring the integration of AI-driven customer service and educational tools to improve user experience within its platform. By using machine learning, Coinbase can tailor educational resources and recommend products that align with individual investment goals and risk profiles.

Additionally, Coinbase is developing AI-based lending protocols and automated investment tools to give users more control over their assets.

In addition to publicly traded entities, private companies are also making significant strides in integrating AI-driven bots within the DeFi ecosystem.

One notable example is Autonio, a decentralized AI-powered trading platform that leverages machine learning algorithms to execute trades and manage investment strategies autonomously. Autonio provides users with customizable AI trading bots that analyze market trends, predict price movements, and execute trades based on predefined parameters, all without the need for constant human oversight.

Security and fraud detection

AI and blockchain are integrated to enhance fraud detection in financial services.

In 2023, Americans lost a staggering USD$5.6 billion to cryptocurrency-related fraud, marking a 45 per cent increase from 2022.

Scams primarily involving investment schemes made up about 71 per cent of cases. Additional scams, including call-center frauds and impersonation schemes, contributed further. Vulnerable populations, especially older individuals, were particularly targeted, with those over 60 experiencing about USD$1.6 billion in losses.

IBM (NYSE: IBM) integrates AI and blockchain in areas like financial fraud detection, supply chain transparency, and secure data management. The company uses its IBM Watson and IBM Blockchain platforms to enable applications where AI models analyze and verify blockchain data, improving fraud detection, predictive analytics, and operational efficiencies across industries.

IBM has also collaborated with firms like ConsenSys to enhance blockchain-based security and transparency. This is important in fields that rely on autonomous decision-making and traceability.

But IBM isn’t the only company doing this.

Elliptic is a private company that combines AI and blockchain to enhance fraud detection and compliance in cryptocurrency transactions.

Elliptic’s platform applies AI algorithms to trace and analyze blockchain data. It flags suspicious patterns to help financial institutions identify fraudulent transactions more effectively. Elliptic also leverages both machine learning and blockchain to allow institutions to manage risk and adhere to regulatory requirements, providing tools to detect fraud, prevent money laundering, and improve transparency across crypto-related financial services.

Read more: LinkedIn recruits a new artificial intelligence Hiring Assistant

Read more: Innovative Eyewear surges on release of ‘Lucyd Armor’ smart safety specs

AI Governance and Ethics

AI governance and ethics involve frameworks and principles to ensure that AI systems operate transparently, fairly, and responsibly.

Governance refers to established policies and standards that guide AI development, deployment, and oversight, often to prevent unintended consequences and biases. Meanwhile, ethics in AI emphasizes accountability, ensuring that systems align with societal values and human rights.

Together, AI governance and ethics aim to balance innovation with safeguards, making sure AI technology serves the public good, remains traceable, and maintains trust in its autonomous or data-driven decision-making processes.

Blockchain aids AI governance and ethics by providing a secure, immutable ledger that records AI decision-making processes.

Each action or decision made by an AI system can be logged on the blockchain, creating a clear, tamper-proof trail that auditors or stakeholders can verify. This decentralized approach prevents unauthorized alterations. It also ensures data integrity and enables compliance with ethical standards.

Blockchain’s inherent traceability also helps monitor biases and mitigate risks, supporting governance frameworks that keep AI systems aligned with regulatory and societal values.

Fetch.ai and Palantir Technologies Inc. (NYSE: PLTR) are both advancing AI governance and ethics through the integration of blockchain.

Fetch.ai’s decentralized platform allows autonomous AI agents to perform tasks and make decisions independently, with blockchain recording each action to ensure transparency and enforce accountability.

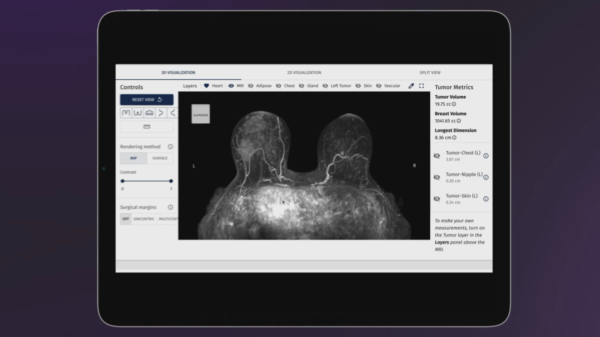

Palantir is known for its focus on secure data analytics. It integrates blockchain and AI to manage ethical concerns around data usage, particularly in sectors like defense and healthcare. By combining blockchain-based verification with AI, Palantir ensures data transparency and enforces governance policies across its applications.

Data Marketplaces

Data marketplaces are innovative platforms where individuals and organizations can securely buy, sell, and exchange data.

Blockchain enhances these marketplaces by offering a decentralized, tamper-proof method of verifying transactions. This ensures that data can be securely shared without a central authority.

These platforms are especially valuable for training AI on large, varied datasets, with blockchain ensuring trust and data integrity. This ultimately creates accessible, monetizable, and private data-sharing environments that support refined AI development.

Ocean Protocol stands out in this space. It enables a decentralized data marketplace where data owners can maintain control and monetize their data.

Through blockchain, Ocean Protocol ensures data privacy and integrity, allowing AI developers to access data for model training without central intermediaries, fostering a more open and collaborative data-sharing ecosystem.

Subsequently, Microsoft Corporation (NASDAQ: MSFT) is also involved in decentralized data marketplaces. The company has integrated blockchain solutions to enhance data security and transparency.

Microsoft leverages blockchain to empower sensitive sectors like healthcare and finance, where data integrity is paramount.

Blockchain provides a secure ledger for recording transactions and validating data integrity in decentralized data marketplaces. This facilitates AI’s access to reliable, unaltered data. Meanwhile, blockchain’s transparency and accountability protect data ownership and compliance, while AI uses the data to train models and make decisions in a democratized, secure environment.

Read more: Big tech is turning to nuclear power to fuel its generative-AI ambitions

Read more: Well Health and Healwell AI work to expand clinical trial access

Tokenized content creation

Generative AI in content creation is transforming how digital assets are produced, tokenized, and authenticated. Through blockchain technology, artists and creators can tokenize their work, assigning it a unique digital signature or token that proves originality and ownership.

This has practical applications across gaming, music, and art. Artists can directly upload their content, allowing fans to buy, sell, or trade it with clear, blockchain-verified ownership. Furthermore, this decentralized, transparent system prevents unauthorized duplication, empowering creators to control distribution, ensure royalties, and retain ownership in an AI-driven production environment.

Adobe Inc. (NASDAQ: ADBE) operates in this space. It has been using both blockchain and generative AI in its content platforms like Adobe Stock and Behance. Through its Content Authenticity Initiative, Adobe uses blockchain to certify the originality of digital assets created and shared within its ecosystem.

This certification establishing transparent ownership rights for creators, which are especially important in AI-assisted art generation.

Custos Media Technologies works at the intersection of AI, blockchain and tokenization. Custos uses blockchain to protect digital content by embedding unique watermarks into media files, enabling content creators to track and manage ownership.

Their AI-powered algorithms detect any unauthorized use, while blockchain provides an immutable ledger to verify original ownership and authenticate digital assets. This approach offers a secure, decentralized solution for digital rights management, giving creators control over their intellectual property in sectors like film, publishing, and digital media.

.

joseph@mugglehead.com