Renewable energy sources have gained significant traction in the global effort to mitigate climate change and transition towards a more sustainable future.

It’s resulted in entire new industries having sprung up to meet this challenge, each tapping into disparate base sources in search of energy.

Many of these have been failures. Either they don’t generate enough electricity or the operating and opportunity costs are too high to merit pursuit. Some of them, though, have proven lucrative and are being explored as twenty-first century solutions to the largely twentieth century problems society hasn’t yet solved.

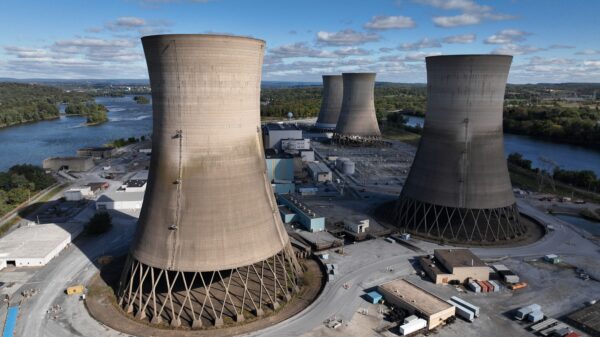

Among these sources, nuclear power stands out as a low-carbon option with immense potential.

Nuclear power plants generate electricity through controlled nuclear reactions, producing minimal greenhouse gas emissions compared to fossil fuel-based plants. Central to nuclear power generation is uranium, a naturally occurring radioactive element. Uranium fuel undergoes fission, releasing a tremendous amount of energy that can be harnessed to generate electricity.

Advancements in reactor technology and stringent safety protocols aim to address challenges with concerns about nuclear accidents.

Additionally, the electrification of transportation, particularly through electric vehicles (EVs), presents another avenue for reducing greenhouse gas emissions. Lithium-ion batteries, the primary energy storage technology in EVs, rely on lithium as an integral component.

Lithium’s high energy density and lightweight properties make it ideal for battery applications, enabling longer driving ranges and faster charging times. As the demand for EVs continues to rise globally, ensuring a sustainable supply chain for lithium becomes paramount. Efforts to improve lithium extraction techniques, recycle lithium-ion batteries, and explore alternative battery chemistries aim to mitigate environmental impacts associated with lithium mining and battery disposal.

In the broader context of renewable energy adoption, balancing the deployment of nuclear power and the expansion of EVs with lithium-based batteries presents a complex yet necessary endeavour. While nuclear power offers a reliable and low-carbon source of electricity, it requires careful consideration of safety, waste management, and proliferation risks.

Then there are the disparate and curious designs on electricity collection and use.

These include green hydrogen and ammonia and even stranger still, the science of drawing latent energy out of waste. These generally provide electrification on a smaller scale, and are therefore typically only used at an industrial scale, but it could be enough to relieve the grid from the demands of the energy-intensive Bitcoin (and cryptocurrency) mining industry.

Read more: World SMR pipeline expands by 65% since 2021; uranium supply challenges persist

Read more: NexGen Energy discovers localized high grade uranium at Patterson Corridor East

Reformed Energy relieves the strain on the Texas grid

Texas-based Reformed Energy Inc. announced this week that it has secured a strategic investment from Riot Platforms, Inc. (NASDAQ: RIOT) to bring its unique plasma gasification technology to full commercialization.

Reformed Energy’s closed plasma gasification system processes solid and liquid waste streams. It prevents over 99 per cent of methane emissions and pollution that occurs with traditional waste disposal methods, while reducing waste volume by about 90 per cent.

This process yields versatile synthesis gas usable for sustainable power generation and synthetic fuel production. The self-contained system does not require grid interconnection and generates carbon-neutral power while actively reducing existing methane emissions.

This investment provides Reformed Energy with the capital to begin developing its pilot site, where municipal solid waste (MSW) will serve as the primary waste stream for generating sustainable power for its initial operations. Reformed Energy plans to incorporate tires, wood waste, industrial sludges, among other waste streams into its waste-to-energy processes.

When the company has finished building the site, it intends to use it as a training and demonstration center for parties seeking to use Reformed Energy’s technology.

The company intends to build more sites once production scales. After which, it will start looking into other sorts of fuel. These include producing synthetic fuels, including sustainable aviation fuel, and providing affordable power to potential power offtake customers, on a mass commercial scale.

The Reformed Energy team’s background spans research and development in plasma gasification, oil & gas, energy, and Bitcoin mining.

Working sketch of the L50 Plasma Gassifier. Image via Reformed Energy.

The nuclear renaissance is under way

The promise of nuclear power is a direct replacement for the existential threat posed by fossil fuels. However, the legacy and lessons of nuclear power are environmental catastrophe, devastation and fear. But those lessons have been learned and new technologies have been built to mitigate those fears and a result, nuclear has enjoyed something of a renaissance.

That renaissance has increased demand for uranium. The global uranium market is a crucial component of the nuclear energy industry, supplying fuel for nuclear power plants worldwide.

Several key players dominate the global uranium market, with major uranium mining companies and producing nations shaping its dynamics.

Among the major players in the uranium market are companies like Canadian-based Cameco Corporation (NYSE: CCJ) (TSX: CCO), Kazatomprom (LSE: KAP) in Kazakhstan, and Orano from France.

These companies operate large-scale uranium mining operations and play roles in uranium exploration, extraction, and processing. Cameco is one of the world’s largest uranium producers, operating mines in Canada and the United States. A few other companies operating in the Athabasca Basin include Denison Mines (TSX: DM), ATHA Energy Corp. (TSXV: SASK) (FRA: X5U) (OTCQB: SASKF) and Skyharbour Resources Ltd. (TSXV: SYH) (OTCQX: SYHBF) (Frankfurt: SC1P).

Kazatomprom is the world’s leading uranium producer, contributing a significant portion of global uranium supply. Orano, based in France, is a major player in both uranium mining and nuclear fuel cycle services, with operations spanning uranium mining, conversion, enrichment, and fuel fabrication.

The traditional barriers to nuclear electrification don’t make sense anymore. The technologies are far more advanced, modular and the lessons of the past have been learned.

Read more: ATHA Energy hires knowledgeable senior vice president of business development

Read more: Stallion Uranium completes extensive geophysical survey on ATHA Energy joint venture property

New nuclear technologies provide new avenues for electrification

Next-generation nuclear technologies offer promising avenues for combating climate change by providing cleaner, more efficient, and safer energy solutions.

These advancements include innovative reactor designs, such as small modular reactors (SMRs) and advanced fuel cycles, which aim to reduce carbon emissions while meeting growing energy demands.

SMRs represent an advancement in nuclear reactor technology over the previous generation. They offer a power capacity of up to 300 MW(e) per unit, approximately one-third of traditional nuclear power reactors.

These innovative reactors have the capability to generate a substantial amount of low-carbon electricity while embodying three key characteristics. They are small in physical size compared to conventional nuclear power reactors, allowing for more flexibility in deployment and location.

Their modular design enables factory assembly of systems and components. It also transported a single unit to a designated installation site, streamlining construction and reducing costs.

SMRs harness nuclear fission to generate heat, making them a promising solution for meeting energy demands while minimizing carbon emissions.

Presently, Cameco Corporation, along with Brookfield Business Partners (NYSE: BBU), now owns the Westinghouse Corporation, which has been a big mover in the development and proliferation of nex generation nuclear tech, including both micro and small modular reactors. Westinghouse signed deals with the Province of Saskatchewan to build a micro-reactor, and the Ukraine for an SMR.

Image via International Atomic Energy Agency.

Electric vehicle production has stalled due to high prices and low demand

Lithium-ion batteries have emerged as the leading energy storage technology powering the electric vehicle (EV) revolution. The lightweight and high energy density properties of lithium make it ideal for battery applications, enabling EVs to achieve longer driving ranges and faster charging times.

In recent months, the demand for EVs has declined with subsequent downstream effects on the price of battery metals.

Electric vehicles offer a promising solution to combating climate change and air pollution by reducing reliance on internal combustion engines. Companies operating in the electric vehicle sector are spearheading innovations in battery technology, vehicle design, and charging infrastructure.

Recently, however, the EV sector has seen something of a setback.

The market was bullish in the early days due to low interest rates and Tesla’s rise. It cooled as those interest rates rose with attendant effects on the cost of raw materials. Subsequently, the cost of an electric vehicle rose substantially, making it considerably more expensive when compared to more traditional internal combustion oriented vehicles.

Read more: Lithium South preliminary economic assessment shows optimism for lithium’s future

Read more: Lithium South near completion of production well and economic assessment at flagship operation

Lithium producers lean into supply glut

This week automakers from Ford Motor Company (NYSE: F) and General Motors Company (NYSE: GM) to Mercedes-Benz, Volkswagen, Jaguar Land Rover, and Aston Martin are scaling back or delaying their electric vehicle plans as the hype dwindles and they embrace consumer choice once again.

Even U.S. EV leader Tesla Inc (NASDAQ: TSLA) is bracing for what CEO Elon Musk described as a “notably lower” rate of growth.

The shift back to a more mixed offering of vehicles still acknowledges an all-electric future eventually. However, it will be at a much slower pace of adoption than previously anticipated.

Curiously enough, lithium producers don’t seem to be particularly worried about the supply chain issues.

Earlier this week, Lithium South Development Corporation (TSXV: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ) installed its first well at its flagship Argentina lithium brine project’s largest claim block. The junior miner announced that it had drilled the well to a depth of 400 meters. Subsequently, Lithium South has piped and gravelled the well before commencing a series of long-term pumping tests.

The world’s second largest lithium producer, Sociedad Química y Minera de Chile (SQM) (NYSE: SQM) also shrugged its collective shoulders at the supply glut, and decided to continue producing lithium.

Despite reporting an 82 per cent drop in quarterly profit recently, SQM said that it expects excess inventory to persist this year, exerting downward pressure on lithium prices. As a result, SQM anticipates only a 5 to 10 per cent increase in its own sales. In contrast, global demand projections are projected to rise by at least 20 percent.

Aerial view of brine ponds and processing areas of a lithium mine in the Atacama Desert. Photo from Martin BERNETTI via AFP

Lithium production is not without environmental challenges

The dominant narrative about EV is that it has a part in the green transition away from our over-reliance on fossil fuels. However, there are other environmental impacts that need to be considered.

One significant concern is the extraction process.

It often involves large-scale open-pit mining or evaporation ponds, which can lead to habitat destruction, soil erosion, and water pollution. Additionally, lithium extraction consumes significant amounts of water, particularly in regions already experiencing water scarcity, exacerbating local environmental stress.

Furthermore, the transportation and processing of lithium ore and chemicals further contribute to carbon emissions and air pollution. Addressing these environmental challenges requires implementing sustainable mining practices. A few of these include water management strategies, and investments in cleaner extraction technologies to minimize the ecological footprint of lithium production.

That’s why a court in the northwestern province of Catamarca, Argentina, has suspended the issuance of new mining permits. It also demanded fresh environmental impact studies for local lithium projects, according to Reuters.

The ruling affects the Los Patos River-Salar del Hombre Muerto area, where global lithium giant Arcadium Lithium Plc (NYSE: ALTM) (ASX: LTM), formerly Livent, has a project. This decision follows tensions over water use with local communities in the region.

Read more: Lithium South Development expands production goals, updates PEA on Hombre Muerto lithium project

Read more:Lithium South Development updates leadership roster, appoints new director

Green hydrogen and ammonia offer energy security

Green ammonia and hydrogen represent promising pathways towards decarbonizing various sectors of the economy, particularly transportation and industry.

The hydrogen is produced through the electrolysis of water using renewable energy sources such as wind or solar power, resulting in zero carbon emissions. This process yields a versatile energy carrier that can be used for a wide range of applications. These include fuel cell vehicles, energy storage, and industrial processes.

Similarly, companies synthesize green ammonia as a feedstock. It offers an alternative to conventional ammonia production methods that rely on fossil fuels. Green ammonia serves as a clean source of nitrogen fertilizer for agriculture and as a potential fuel for marine vessels.

Additionally, green hydrogen and green ammonia offer energy security and resilience by diversifying energy sources and reducing dependency on imported fossil fuels. Furthermore, they can play a role in enabling sectors with hard-to-abate emissions. These include heavy industry and long-distance transportation, to transition to low-carbon energy solutions.

The Government of Canada announced its support for the construction and development of Canada’s first commercial-scale green hydrogen and ammonia facility in Newfoundland and Labrador.

The government agreed to provide World Energy GH2, the organization behind Project Nujio’qonik, with a CAD$128 million credit facility to assist in the project’s development until it secures its own long-term financing. This credit facility will help finance the construction of clean power generation and clean hydrogen production, aligning with Canada’s decarbonization efforts and initiatives.

.

ATHA Energy Corp and Lithium South Development Corporation are sponsors of Mugglehead news coverage