Abbott Laboratories (NYSE: ABT) and Exact Sciences Corporation (NASDAQ: EXAS) announced an all-cash USD$21 billion merger.

The consequences of the merger include a substantial 16 per cent bump in Exact’s share price on Thursday, building on a 24 per cent rally the previous day.

Under the terms, Abbott will pay USD$105 per share. This price represents a premium of about 80 per cent to Exact Sciences’ closing price on November 19. It also provides value to shareholders while expanding Abbott’s portfolio in high-growth areas like noninvasive colorectal cancer screening.

The deal is expected to close in the second quarter of 2026,

Abbott noted the acquisition as a strategic move to accelerate growth in cancer diagnostics. The company said it combines Exact’s innovative tests with Abbott’s global reach and manufacturing capabilities.

Abbott, however, earned billions during the Covid-19 pandemic by selling millions of Covid tests and testing kits.

Meanwhile, the U.S. government no longer pays for most tests, and health insurance coverage has declined. In 2022, Abbott generated more than USD$8 billion in Covid test sales alone. This year, Abbott earned only USD$2.2 billion in total diagnostic sales during the third quarter.

The Trump administration has since dismantled USAID, cancelling thousands of contracts with companies like Abbott. These cancellations reduced Abbott’s ability to provide lifesaving tests and drugs worldwide.

“Covid test roll-offs, USAID defunding, and China VBP pressures have pushed diagnostics into a 3-5 per cent organic growth range – well below the unit’s long-term trajectory,” analysts at TD Cowen said in a report Wednesday.

“Acquiring Exact Sciences could provide an immediate solution to that growth deficit.”

Read more: Breath Diagnostics pioneers novel lung cancer breath test

Read more: Breath Diagnostics takes aim at lung cancer with One Breath

Exact Sciences producers cancer screening

Abbott said Exact Sciences will generate more than USD$3 billion in revenue this year, with high teens organic growth. Once the deal closes, Abbott will make Exact Sciences a subsidiary and push total diagnostics sales past USD$12 billion. The company also described the acquisition as a way to transform cancer care and improve early detection and treatment monitoring.

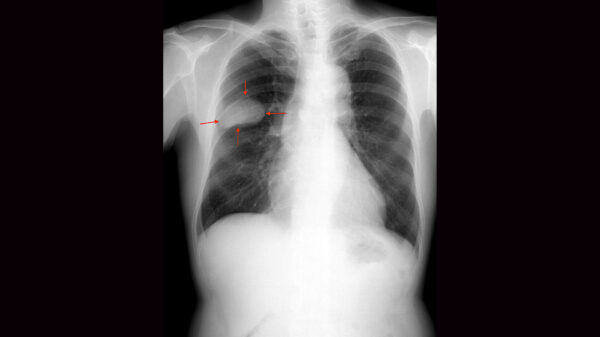

Exact Sciences produces cancer screening and diagnostic products, including Cologuard and Oncotype DX tests. The company also develops liquid biopsy tests for multi-cancer early detection and molecular residual disease testing.

“Exact Sciences’ innovation, its strong brand and customer-focused execution are unrivaled in the cancer diagnostics space, and its presence and strengths are complementary to our own,” said Robert B Ford, Abbott chairman and chief executive officer.

“Abbott has repeatedly taken on the world’s most challenging health issues and made a meaningful impact on the lives of people in areas such as diabetes, cardiovascular disease and infectious diseases.”

The global cancer diagnostics market has grown rapidly in recent years, reflecting increasing demand for early detection and precision medicine. Grand View Research estimates the market at USD$109.6 billion in 2024, with projections reaching USD$155.1 billion by 2030 representing a compound annual growth rate of about 6.1 percent.

Within this broader market, marketers value the advanced cancer diagnostics segment at USD$58.3 billion in 2024 and is expected to rise to USD$127.1 billion by 2033, growing at roughly 9 percent annually.

Read more: Breath Diagnostics onboards new president and closes critical financing

Read more: Breath Diagnostics gives the public the chance to join the fight against cancer

Cancer diagnosis market is growing considerably

Meanwhile, next-generation diagnostics currently account for USD$16.6 billion in 2024, with forecasts projecting USD$41.4 billion by 2033. This reflects an annual growth rate of more than 11 percent.

Several companies are positioning themselves to capture this growing demand. Grail Inc (NASDAQ: GRAL) has focused on early cancer detection with its Galleri multi-cancer early detection blood test.

Grail has completed large-scale clinical trials demonstrating the test’s ability to detect multiple cancers before symptoms appear. Recently, Grail partnered with Quest Diagnostics (NYSE: DGX) to simplify access to Galleri to integrate test ordering into electronic health records. In Canada, Manulife (TSE: MFC) became the first insurer to offer Galleri to eligible life insurance customers, further expanding its reach.

Startups are also innovating in non-invasive detection methods.

Owlstone Medical develops a breath test, which identifies volatile organic compounds in exhaled breath to indicate cancer or other diseases. Its ReCIVA breath sampler standardizes collection. Furthermore, its EVOLUTION Phase 2 trial is evaluating breath-based lung cancer screening in high-risk individuals.

The company collaborates with pharmaceutical companies and academic institutions to validate breath biomarkers across multiple cancer types. Other emerging companies, broadly categorized under breath diagnostics, aim to make non-invasive, low-cost screening widely accessible.

Meanwhile, Breath Diagnostics Inc is a Kentucky–based startup that uses its OneBreath technology to detect lung cancer from a single exhaled breath. Their clinical trials involving 800+ patients have shown 94 per cent sensitivity and 85 per cent specificity.

.

joseph@mugglehead.com