In the dynamic landscape of the global electric vehicle (EV) revolution, Argentina emerges as a pivotal player, poised to secure its position as a major lithium producer.

Researcher Adriana Carvalho from S&P Global Commodity Insights said in a recent industry report that Argentina’s lithium industry is at the forefront of discussions about meeting the escalating demand for electric vehicle batteries. With the United States and Europe intensifying downstream investments in EV-related industries, a global race for African and South American critical minerals has been ignited.

“If Argentina does not achieve its commitment as a major lithium chemical producer in the next few years, the EV revolution will be challenging,” president of Global Lithium Joe Lowry said during the Litio En Sudamérica (Lithium South America) Seminar in Salta, Argentina.

The seminar happened on Aug. 9-10 and hosted over 1,700 attendees and focused on the challenges and opportunities in Argentina related to the industry.

Read more: Stellantis takes 20% stake in Argentina lithium explorer for US$90M

Read more: Glencore acquires Pan American Silver’s 56% stake in Argentina mine for US$475M

Chile’s stake in the lithium industry may be cut in half over the next decade

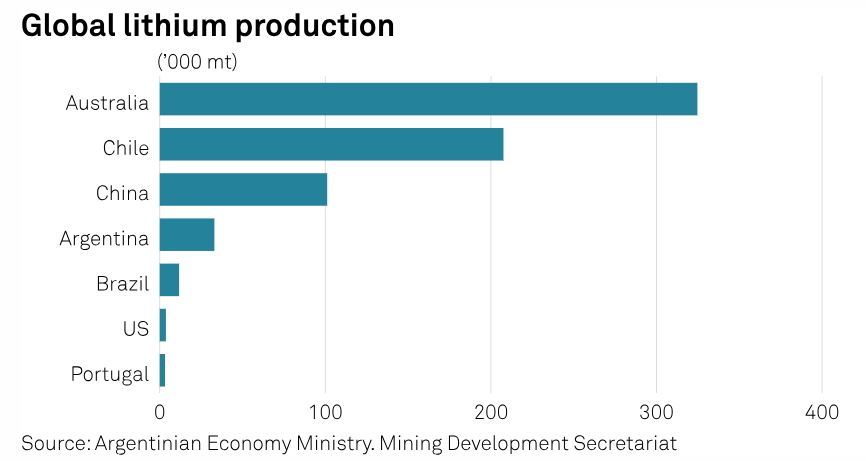

Argentina has a strong pipeline of lithium projects on the verge of production and is eyeing the opportunity to leapfrog Chile in the short term.

According to a study by the Chilean Copper Commission, Chile could go from representing 32 per cent of the market in 2020, to only 15 per cent by 2030. In contrast, Zimbabwe, Argentina, Brazil and the United States could fiercely increase their shares.

“We have to establish an autonomous national policy, which has nothing to do with the models adopted by Bolivia and Chile,” Jujuy province’s governor Gerardo Morales said in a statement.

This shift is crucial, especially as China –a leading player in the EV market– intensifies its search for upstream investments in South America and Africa to secure a stable supply of lithium raw materials.

Last year, China was one of the main recipients of Argentinean lithium exports, totalling 41.5 per cent of sales abroad. Argentina exported 30.7 per cent to Japan, 12.8 per cent to South Korea and 9 per cent to the United States.

“Argentina is in an advantageous position because it´s years ahead of exploration phases, while other countries are just at the beginning,” President of Lithium Americas in Latin America Ignario Celorrio said, adding that Argentina needs to abide by proper quality standards in order to succeed.

Graph via S&P Global.

High-altitude salt flats in the Andean plains host over half of the world’s mineral resources

Argentina, Chile and Bolivia collectively house over half of the world’s mineral resources under the salt flats on the high-altitude Andean plains. While Bolivia invests substantially in untapped lithium resources, Chile’s lithium operations are currently centralized around industry giants Química y Minera de Chile (SQM) (NYSE: SQM) and Albemarle Corporation (NYSE: ALB).

However, recent state-led public-private models in Chile have spooked additional investors, potentially reshaping the distribution of lithium market shares. In contrast, Argentina follows a more pro-market model, fostering over 30 mining projects in different stages.

The northwest provinces of Catamarca, Salta and Jujuy, have committed to investments worth $7 billion in the coming years, projecting strong growth in exports, reaching $1.1 billion by 2023.

Argentina’s current lithium carbonate production of 40,000 metric tons could experience a threefold increase within the next year, driven by the projects in the current pipeline.

According to sources from the Argentine Ministry of Mining, led by Fernanda Ávila, there is a foresight that lithium production will witness a substantial surge by the end of 2023, marking a minimum 50 per cent increase within just one year, reaching an estimated 60,000 metric tons.

In 2022, the total lithium production in Argentina was nearly 38,000 metric tons, derived from operations such as Sales de Jujuy, managed by Allkem Limited (ASX: AKE), and the Fénix project in the Salar del Hombre Muerto, operated by Livent Corporation (NYSE: LTHM)

Both of these projects are anticipated to double their output to 42,500 mt in the coming years, contributing significantly to Argentina’s growing presence in the global lithium market.

Lithium South Development Corporation (TSXV: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ) has operations in the Salar del Hombre Muerto encompassing 3,287 hectares and recently expanded its lithium resource by 175 per cent.

The Hombre Muerto North Lithium Project is surrounded by two leading lithium producers. Korean giant POSCO Holdings (KRX: 005490) is building a US$4 billion lithium project adjacent to Lithium South. While, Allkem and Livent –under their new merger– will develop the west and east portions of the Salar.

Read more: Lithium South Development technical report shows 40% Increase in lithium recovery

Read more: Lithium South Development first production well installed at Hombre Muerto lithium project

Fewer infrastructure bottlenecks and stringent quality standards are critical

The industry’s growth may surpass expectations if there is successful implementation of direct-lithium-extraction (DLE) technologies and the resolution of existing infrastructure bottlenecks, experts say.

Despite these challenges, Argentina’s lithium carbonate production, currently at 40,000 metric tons, is expected to triple in the next year based on the existing project pipeline. Projections indicate a potential surge to 120,000 metric tons in 2024.

In 2024, four new projects are set to start during the first quarter.

Tres Quebradas by Zijin Mining Group Co. (SHA: 601899) in Catamarca; Centenario Ratones by the French miner Eramet S.A.’s (EPA: ERA) subsidiary Eramine in Salta; Sal de Oro by Posco in Salta and Catamarca; and Mariana by China’s Ganfeng Lithium Group Co Ltd (SHE: 002460) in Salta.

Photo via S&P Global.

Read more: Atlantic Lithium’s new mine is African alternative to Chinese lithium dominance

Read more: African nations ban raw mineral exports to lead carbon-free energy shift

Prices will be volatile in the ‘lithium decade’, but this will change over time

“Prices won’t be peaking forever, there will come a time of more stable prices,” said Guillermo Calo, managing director of the Rincon lithium project in Argentina, owned by Rio Tinto Group (ASX: RIO) (NYSE: RIO) (LON: RIO).

Executives and analysts view the upcoming decade as the “lithium decade,” anticipating continuous growth in EV production, which will drive demand for critical minerals. Price volatility is expected, with forecasts ranging between $35,000 metric ton to $50,000 metric ton for the next 24 months.

Long-term considerations include sustainability challenges associated with DLE, energy intensity, water impact and the need for comprehensive studies on water reinjection.

“DLE has been a reality in Argentina since 1995,” Daniel Chávez Díaz, CEO of Eramine South America said.

“Our process achieves a yield of over 90 per cent, with a processing period of about 24 hours, while the traditional process (natural evaporation in pools) offers less than 50 per cent yield in 18 months.”

As Argentina navigates the challenges and opportunities in the lithium market, the global community watches closely. The success of Argentina’s lithium industry is not only essential for the country but also plays a vital role in shaping the future of the electric vehicle revolution on a global scale.

The lithium boom is underway, and Argentina is positioning itself to be a key driver in this transformative era of sustainable energy.

Lithium South Development Corporation is a sponsor of Mugglehead News Coverage

natalia@mugglehead.com