Canopy Growth Corporation (TSX: WEED) (NASDAQ: CGC) dipped its revenue this quarter compared to last year because of higher competition but higher sales for its BioSteel brand helped with the losses.

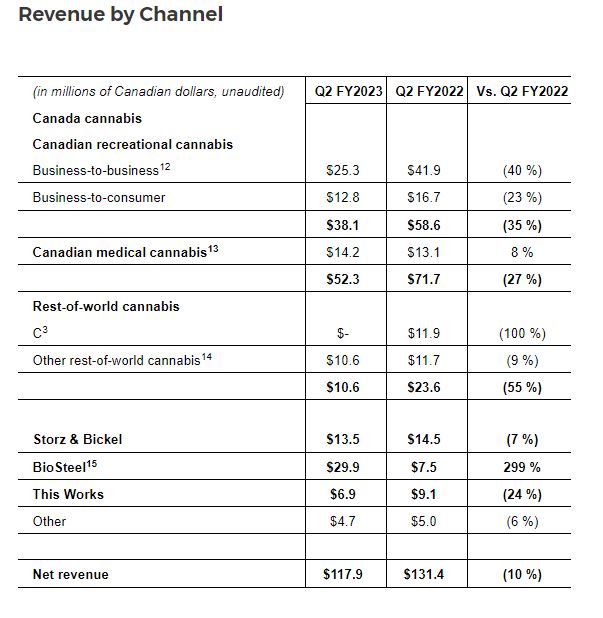

This Wednesday, the leading cannabis producer released its financial results for the second quarter that ended September 30 this year and reported net revenue of $117.9 million which is a 7 per cent increase from the last quarter.

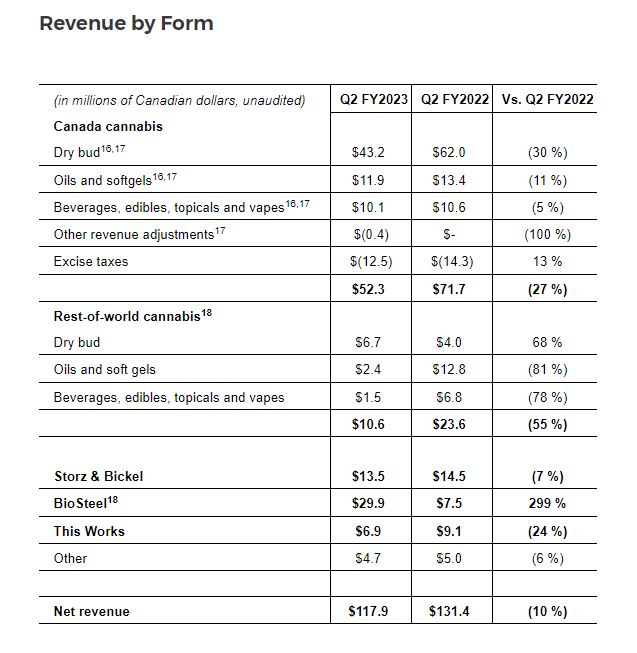

Its year-over-year net revenue saw a decrease of 10 per cent which was attributed to increased competition in Canada and the divestiture of the C³ Cannabinoid Compound Company GmbH and softer performance from This Works, offset by revenue growth at BioSteel.

Canopy’s Canadian medical cannabis net revenue saw a boost of 8 per cent compared to the last quarter primarily driven by patient registrations and more product offerings. Its dried flower brands Doja, Tweed and Vert brands increased market share as well as its Deep Space beverages.

The company’s budtender engagement program High’er Education has had over 10,000 budtender interactions in its first year. The program focuses on education and product knowledge to drive budtender recommendations.

On Tuesday, Canopy acquired a manufacturing facility, which is expected to support ongoing rapid U.S. expansion for the brand and drive gross margin improvement.

Graph via Canopy Growth

Read more: Canopy sells Tweed and Tokyo Smoke pot shops

Read more: Canopy Growth appoints new chief legal officer

Operating expenses stayed flat during the quarter compared to the previous year and were driven by year-over-year reductions in administrative expenses and R&D expenses.

Net loss during the quarter was $232 million which is a year-over-year increase of $216 million which was driven primarily by non-cash fair value changes and an increase in asset impairment and restructuring costs.

BioSteel net revenue increased by 299 per cent compared to the same quarter in the previous year.

The increase in sales and marketing expenses was driven by the BioSteel National Hockey League (NHL) partnership.

Its BioSteel brand signed a multi-year partnership with the NHL and the NHL Players Association as the Official Hydration Partner. The partnership provides BioSteel with league-wide, rink-side marketing and product supply rights, among other rights.

Graph via Canopy

Canopy USA to fast-track entry into the American market

During the quarter the company announced a plan to fast-track its entry into the United States cannabis market by creating the new holding company Canopy USA that holds the company’s investments.

Canopy USA would create a way to acquire Acreage, Jetty and Wana and provide unique opportunities as legalization unfolds in the country.

Canopy Growth has established Canopy USA – a new U.S.-domiciled holding company, which now holds the Company’s U.S. cannabis investments. This structure will enable Canopy USA to acquire each of Acreage, Jetty, and Wana and capitalize on the market opportunity presented by the U.S. cannabis market.

The company still needs approval from shareholders to issue a new class of exchangeable shares.

Read more: Canopy Growth reports $112M in Q4 revenue, down 25% year-over-year

Read more: Canopy Growth to acquire Jetty Extracts for $69M

“Our second quarter marks a key inflection point for Canopy, demonstrating momentum across our key businesses and accelerating our entry into the U.S. cannabis market through the creation of Canopy USA,” CEO David Klein said.

“Canopy is ideally positioned to capitalize on this once-in-a-generation opportunity and accelerate our path to North American cannabis market leadership,” he added.

Canopy CFO Judy Hong said the company delivered solid sequential quarterly net revenue growth and improved margins which were led by BioSteel, the stabilization of our Canadian cannabis business and continued actions to reduce overall costs.”

“We are pressing forward on our path to profitability in Canada and expect Canopy USA will meaningfully enhance our growth and profitability over time once it closes the announced acquisitions of Acreage, Jetty, and Wana,” Hong said.

Canopy stock went up by 2.59 per cent on Wednesday to $4.35 on the Toronto Securities Exchange.