While American women still make up less than a third of total cannabis sales, that segment is growing over time.

A new market report from Headset shows pot sales growing 55 per cent among female consumers, from first-quarter 2020 to fourth-quarter 2021. Among men, sales were up 49 per cent.

Over that period, the female cannabis consumer segment increased to 32.6 per cent from 31.7 per cent.

Understanding nuances in consumer behaviour is vital to building successful brands and retail operations in today’s industry, Headset says.

“Don’t bring products to market without granular demographic data to inform product positioning and your overall go-to-market strategy,” reads the report.

“Retailers can’t miss opportunities to build more loyalty and grow specific segments of their customer base without knowing where they’re spending their wallet.”

For the report, U.S. data referenced fourth-quarter 2021 figures from stores in California, Colorado, Michigan, Nevada and Washington. In Canada, analysts looked at Alberta and Ontario.

Canadian women spend more money on weed, contributing 36.7 per cent of total sales.

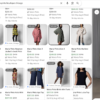

Chart via Headset

Nearly half of topical sales from female consumers

Although over two-thirds of pot buyers are men, purchases by women accounted for nearly half (56.2 per cent) of topical sales. Sales by women also skewed higher for tinctures and sublinguals (43.8 per cent) and edibles (40.1 per cent).

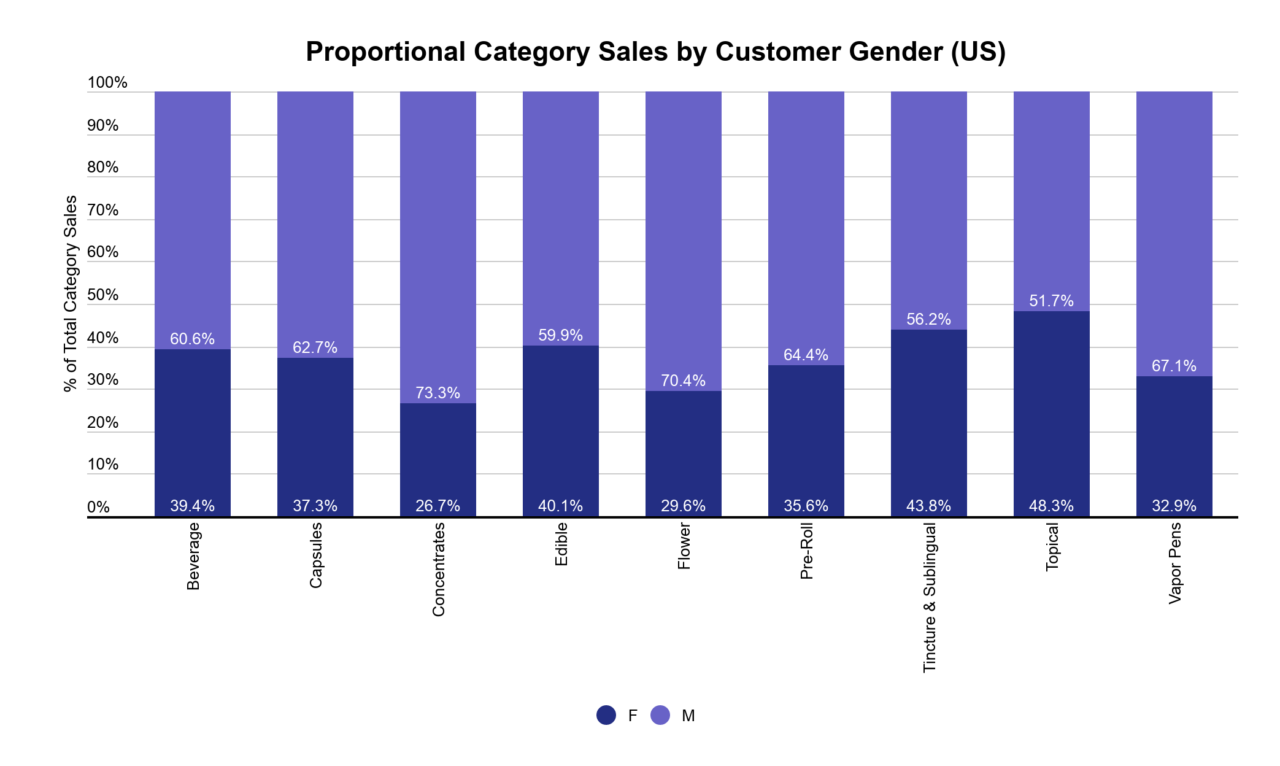

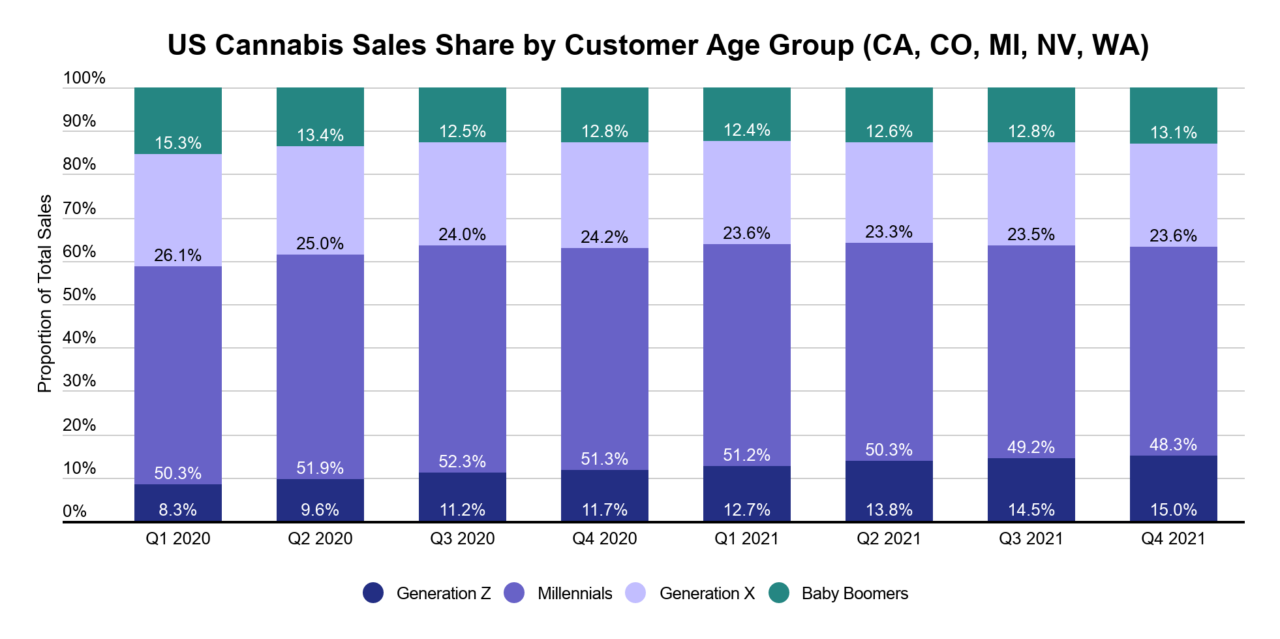

Gen Zers, whose market share in the U.S. has more than doubled over the past two years, show the strongest preference for vapes (31.3 per cent of wallet share).

While they’re the fastest growing demographic, younger consumers spend less overall than their older counterparts. Younger consumers also spend more in Canada than the U.S.

Read more: Cannabis flower remains more popular in Ontario compared to other markets: Headset

Read more: Gen Z women driving most annual cannabis sales growth: Headset

Chart via Headset

But some categories are popular regardless of age.

“Pre-roll wallet share, on the other hand, is remarkably constant across age groups, indicating that the convenience and familiarity of a pre-rolled joint have universal appeal,” reads the report.

American Gen Z customers account for 15 per cent of total U.S. sales in fourth-quarter 2021, a 7 per-cent-increase over first-quarter 2020.

Millennials are the largest customer age group and cover nearly half of all U.S. sales in the last quarter, but the number of total consumers appears to be stabilizing.

Chart via Headset

Follow Natalia Buendia Calvillo on Twitter

natalia@mugglehead.com