Canadian cannabis producer HYTN Innovations Inc. (CNSX: HYTN) is paving a path to profitability after expanding operations during a busy second quarter.

On Tuesday, the British Columbia-based company reported its financial results for the three months ended March 31.

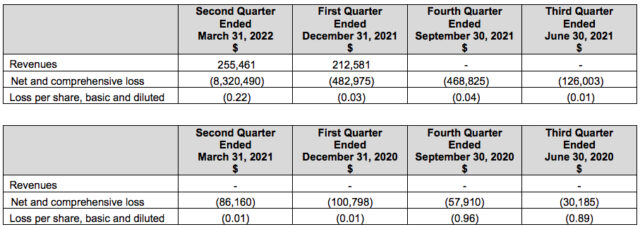

The company posted $255,461 in revenue during the second quarter, a 20 per cent increase compared to $212,581 in the previous quarter.

Revenues and cost of sales increased as a result of the company completing the construction of its Kelowna-based production facility.

Read more: Drinks maker HYTN reports $212K in Q1 revenue

Read more: HYTN exports cannabis flower to Australia

HYTN generated an operating loss of $873,056 for the three months ended March 31, posting a net loss of $8.3 million due to the extraordinary non-cash listing expense of $7.5 million related to the company’s corporate transactions.

As of March 31, the company had $2.2 million in cash and a working capital surplus of $2.3 million.

“We are poised to be a national leader in cannabis edible and extract products and aim to drive strong financial results through data driven decisions based on demand, market size and appropriate brand positioning, with maintenance of SKUs that have a robust margin contribution,” HYTN CEO Elliot McKerr said in a statement.

Chart via HYTN Innovations Inc.

In February, HYTN Beverage completed a share exchange agreement with Mount Dakota Energy Corp., where the latter company acquired all the outstanding securities of HYTN in exchange for 15.5 million common shares and 2.5 million warrants to security holders. Mount Dakota Energy is now known as HYTN Innovations.

The acquisition resulted in a change of business and a reverse takeover of HYTN Innovations. Company shares were delisted from the TSX-V, and began trading on the Canadian Securities Exchange on Feb. 22.

Also in February, HYTN Innovations entered into an agreement to acquire HYTN Cannabis Inc., a private firm headquartered in Kelowna. The deal involved a nominal price, and consolidated legal ownership of HYTN Cannabis’s standard processing licence.

That same month the company also announced an agreement with Promethean Biopharma to develop, export and launch HYTN cannabis nano-emulsions into the Australian medical cannabis market.

Read more: HYTN starts selling cannabis drinks to Australian patients

Read more: Emerald Health partners with HYTN to launch THC drinks in Canada

“Our strong team and world class facility are built to operate without excessive overhead and are scalable to ensure HYTN can meet expected market demands. We encourage stakeholders to review our Q2 Results and monitor our growth,” McKerr said.

Company stock was unchanged Thursday, trading at $0.14 on the Canadian Securities Exchange.

ryan@mugglehead.com