Canadians seem to be whetting their whistles on pot-infused beverages more than their neighbours to the south, according to a new report.

On Wednesday, data firm Headset released an analysis of 2020–2022 cannabis beverage trends in the Canadian and American markets.

With a longer history of beverages in the U.S., the report’s authors say the sector has grown slow but more consistently there.

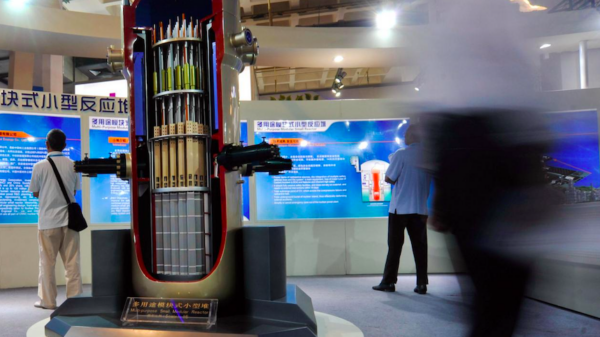

But in Canada, overall growth for the category is stronger. In January 2020, the country’s first infused bevvies hit the market, and reached 1.8-per-cent market share by the end of the year. Drink sales kept rising, reaching a total market share of 2.1 per cent by the end of 2021.

In January 2020 in the U.S., beverages had 0.9 per cent of the market share. Two years later, they reached 1.1 per cent of total sales, which is around half of the relative pot drink performance in Canada.

Screenshot via Headset

Over time, prices in Canada have been stabilizing. When weed drinks first came out, Headset says the products averaged at $16.21 per product, but one year later dropped by 146 per cent to $6.58. Since then, the average price has hovered around $6.

The report also found that Canadians prefer carbonated drinks, making up half of all beverage sales in the country, while Americans preferred drops, mixes, elixirs and syrups.

Read more: PepsiCo launches Rockstar drink with hempseed oil in US

Read more: Hexo and Molson Coors expand CBD drinks to 17 states

Canadians also seemed to like cannabis water products more than Americans, with those making up 20 per cent of pot beverage sales in Canada.

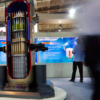

Screenshot via Headset

According to Headset, Canada’s leading brand is XMG with nearly $16 million in sales since beverages launched. The line is owned by Truss Beverage Co., a joint venture between Molson Coors Canada (TPX-B.TO) and licensed producer Hexo Corp. (TSX: HEXO) (Nasdaq: HEXO).

After XMG, the second most popular is CBD-only Everie, owned by Fluent Beverages with over $7 million in sales over the same period.

The most popular drink in the U.S. was Major by Green Med Lab, with sales totalling $25.4 million, followed by Keef Cola from Keef Brands with $23.9 million in sales.

As it is for cannabis overall, California is America’s largest market for infused beverages with around 530 products currently available.

Headset collects its data from point-of-sale systems of its partner retailers in Arizona, Colorado, Illinois, Massachusetts, Michigan, Nevada, Oregon and Washington in the U.S. For Canada, it collects data from stores in Alberta, Ontario, British Columbia and Saskatchewan.

Read more: Cannabis sales continue to climb faster among women: Headset

Read more: Cannabis flower likely to remain dominant consumer choice: Headset

Follow Natalia Buendia Calvillo on Twitter

natalia@mugglehead.com