The pot concentrates category has been steadily increasing in Canada but declining in the United States, according to a new report by the analytics firm Headset.

This week, the analytics firm released a report looking into the concentrates category performance across North America and found that since June 2021 the concentrates market share in Canada has increased from 2.9 per cent to 3.8 per cent of total cannabis sales while in the US, market share has decreased from 9.5 per cent to 8.3 per cent in the same time period.

The firm analysts also found that concentrate choices vary among countries. They found that hash is popular among Canadians with 30 per cent of concentrates sales while only being 2 per cent in the U.S. Live Resin, on the other hand, has a higher market share in the U.S. with 34 per cent compared to 22 per cent in Canada.

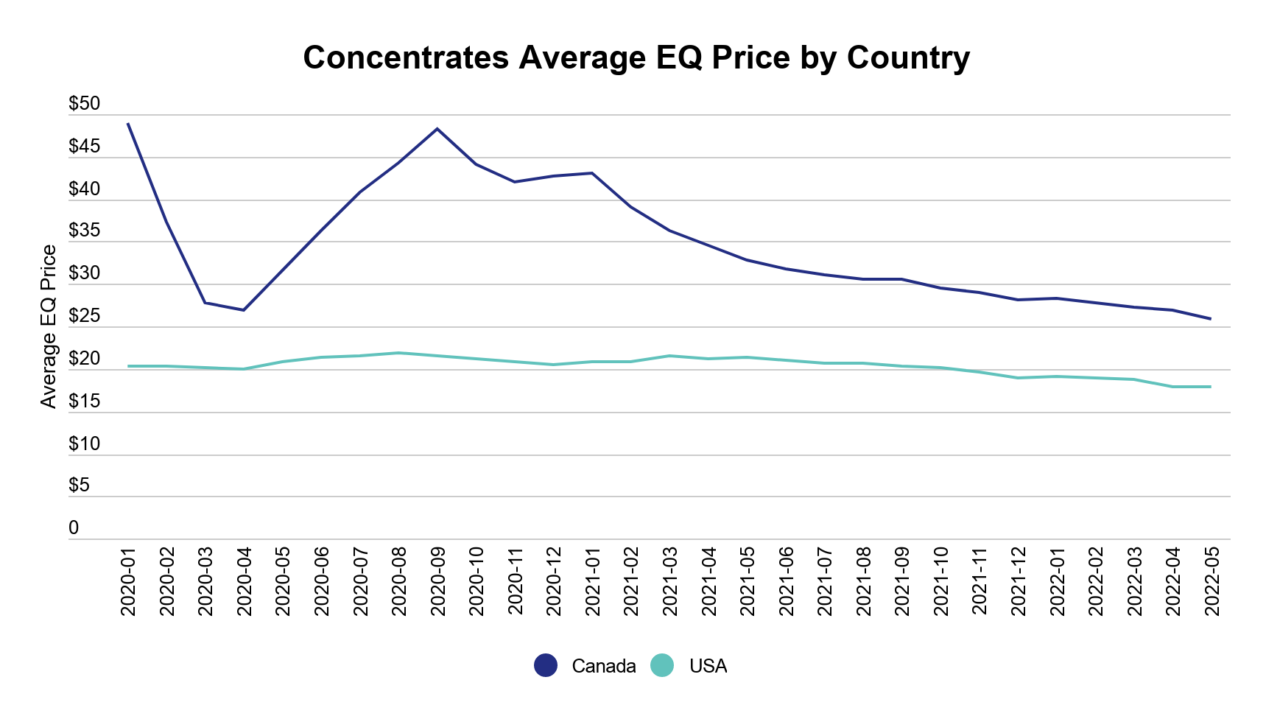

However, prices of concentrates have declined in both countries. In Canada, the equilibrium price of concentrates dropped by 49 per cent from $48.88 in January 2020 to $25.97 in May 2022.

The firm found that, in Canada, Alberta has the highest market share with 4.5 per cent of concentrates sales while Ontario has the lowest at 3.6 per cent.

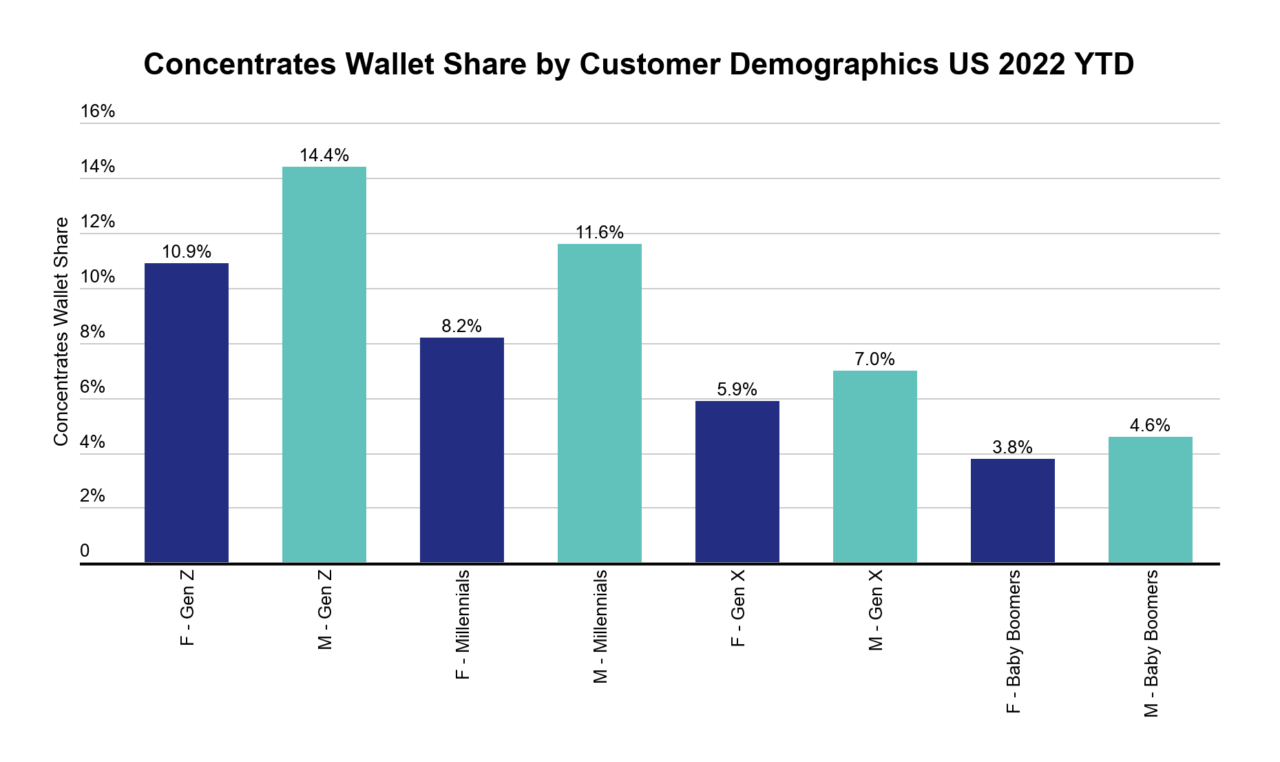

Headset analysts also found that concentrates are more popular among younger customers than older generations with men across generations purchasing more concentrates than women customers.

For the report, Headset analysts used the point-of-sale information from different cities in both countries. In Canada, they looked at retail sales in Alberta, British Columbia, Ontario, and Saskatoon. In the U.S. they used information from California, Colorado, Washington, Nevada and Oregon.

The analyses include data from January 1 to June 1, 2022.

Graph via Headset

Read more: Vapor pens gain popularity, particularly among young people: Headset

Read more: US and Canadian cannabis sales will hit new highs this 4/20: Headset

During the first year of sales in Canada, the average EQ price of concentrates began at nearly C$50 before plummeting below C$30 and then went back up to the high $40s by the end of summer 2020.

Since then, the price has been steadily decreasing and reached $25.97, a decrease of 49 per cent from $48.99 in January 2020. In the US, concentrate prices have been more steady as the market is much more mature than in Canada.

However, there have been some shifts with a fairly steady decline in pricing since August 2020. In August 2020, the average EQ price for Concentrates in the U.S. was $21.86. In May 2022 the average price per gram was $17.85, a decrease of 18 per cent.

Overall, the firm says that the concentrates market share can be expansive and difficult to navigate without proper insights.

“With so many types of concentrates and ways to consume them, Concentrates are an art that appeal to a certain consumer,” reads the report.

“That might be why this category isn’t as dominant as other cannabis form factors as the fifth largest product category in both the US and Canada.”