Cameco Corporation (TSX: CCO) (NYSE: CCJ) reported CAD$80 million in net earnings and adjusted net earnings of CAD$90 million during a quarter characterized by heightened geopolitical uncertainty, global production shortfalls and transportation challenges.

The company reported its consolidated financial and operating results for the fourth quarter and year ended December 31, 2023, on Thursday, and the largest part of Cameco’s situation is the company’s reaction to the developing geopolitical situation.

The company is bracing for impact following Kazatomprom’s (KAP) prediction of a 20 per cent production shortfall in Kazakhstan due to a sulfuric acid shortage. It’s doing this by engaging with joint venture Inkai to assess the requirements for Inkai’s production in 2024 and in the near future.

Cameco intends to ramp up production at its Port Hope facility, producing between 13.5 million and 14.5 million kilograms of uranium (kgU), including 12 kgU of UF6. Cameco forecasts improved financial performance in 2024 driven by generation of strong cashflow.

However, should Cameco not be able to field the increased demand, the Athabasca Basin sports multiple high grade uranium companies that could take up the slack. A few of these include Skyharbour Resources Ltd. (TSXV: SYH) (OTCQX: SYHBF) (Frankfurt: SC1P), Denison Mines (TSX: DML) and ATHA Energy Corp. (CSE: SASK) (OTCQB: SASKF) (FRA: X5U).

Beyond the demand, however, Cameco picked up a high value acquisition in Westinghouse. In November, Cameco closed its acquisition of Westinghouse in a strategic partnership with Brookfield Asset Management alongside its publicly listed affiliate Brookfield Renewable Partners (Brookfield) (NYSE: BEP) (TSX: BEP.UN) and institutional partners.

Cameco now holds a 49 per cent interest with Brookfield taking up the rest.

Read more: ATHA Energy electromagnetic survey results identify high-tier targets

Read more: ATHA Energy applies for listing on TSX Venture Exchange, gives update on 92 and Latitude merger

Westinghouse becoming a big player in emerging nuclear market

Cameco believes that combining its expertise in the nuclear industry with Brookfield’s proficiency in clean energy positions nuclear power at the heart of the clean energy transition and creates a powerful platform for strategic growth across the nuclear sector.

In 2024, Cameco expects its share of Westinghouse’s adjusted EBITDA to range between CAD$445 million and CAD$510 million. Furthermore, over the next five years, Cameco anticipates that Westinghouse’s adjusted EBITDA will experience a compound annual growth rate of 6 per cent to 10 per cent.

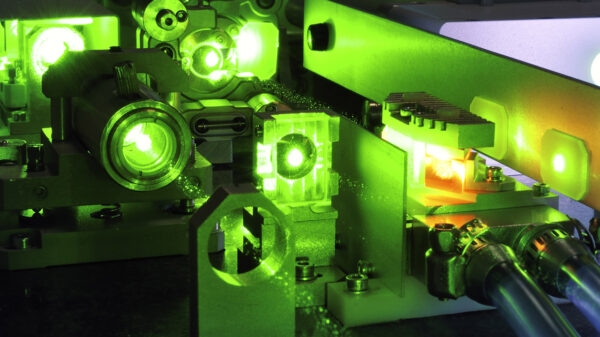

Westinghouse has been making great strides lately regarding the emergence of nuclear power as a viable option to fossil fuels. A few of its latest moves include a partnership with the Saskatchewan Research Council to build a microreactor, as well as other likewise deals with Rolls-Royce Holdings PLC (LON: RR) to build a small modular reactor.

The deal with Westinghouse came with debt and the company presently has CAD$567 million in cash and cash equivalents and $1.8 billion in total debt. Additionally, the company has a $1 billion undrawn credit facility. There is a $500 million senior unsecured debenture maturing on June 24, 2024.

Over the coming months, Cameco will seek an opportunity to refinance this debenture, prior to maturity or as it comes due. Ultimately, the decision will be made with consideration for the company’s cash generation, the interest rate environment, and other capital allocation considerations.

Furthermore, the company has initiated a partial repayment of USD$200 million on the USD$600 million floating-rate term loan that was used to finance the acquisition of Westinghouse.

Read more: Westinghouse and Ukraine nuclear utility sign memorandum of understanding for SMR development

Read more: Westinghouse gets £12.5M in grants to expand nuclear fuel facility

Cameco’s financial results show high sales volumes

In contrast, Cameco’s annual results demonstrate the continued transition back to a tier-one cost structure. The company’s financial results also indicate higher sales volumes and improved average realized prices, driven by increases in uranium and conversion prices due to security of supply concerns.

The company’s production plans include 18 million pounds each at McArthur River/Key Lake and Cigar Lake in 2024. These will benefit from market improvements, new long-term contracts, and ongoing contracting discussions. Additionally, Cameco aims to initiate the necessary work to extend Cigar Lake’s estimated mine life to 2036.

Furthermore, at McArthur River/Key Lake, the company will evaluate the required work and investment to expand production up to its annual licensed capacity of 25 million pounds, enabling them to seize this opportunity when appropriate.

In the uranium segment, Cameco delivered 32 million pounds of uranium at an average realized price of CAD$67.31. Production for 2023 in the uranium segment totaled 17.6 million pounds, slightly lower than anticipated in September. In the fuel services segment, Cameco delivered 12 million kgU under contract at an average realized price of CAD$35.61 and produced 13.3 million kgU. Additionally, the company generated CAD$688 million in cash from operations and achieved adjusted EBITDA of CAD$831 million.

ATHA Energy Corp. is a sponsor of Mugglehead news coverage