Calibre Mining’s (TSX: CXB) (OTCQX: CXBMF) open-pit operations in Nicaragua will accelerate the junior explorer’s gold production and cash flow for the remainder of 2023, according to recent reports by analysts from Global Equity Research published by the Bank of Nova Scotia (TSX: BNS).

The reports were authored by an analyst team comprised of Ovais Habib, Charles Ehidiamhen and Francesco Costanzo. The first was written on May 8 and the following report was published on May 17.

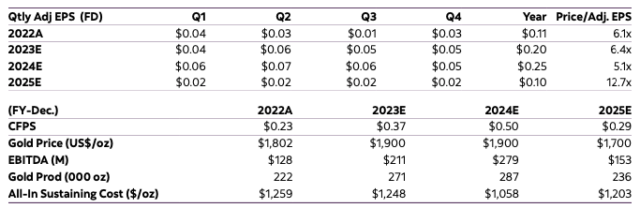

The major Canadian bank’s first analyst report had a mild positive take overall for Calibre’s stock, with estimated earnings per share (EPS) of $0.04 and cash flow per share (CFPS) of $0.08, aligning closely with Calibre’s expectations. Additionally, Bloomberg had a consolidated EPS estimate of $0.05 and CFPS at $0.07.

Calibre’s EPS and CFPS. Table via Scotiabank

Scotiabank’s estimated cash cost per ounce of gold of $1,131 was slightly lower than Calibre’s reported cash cost of $1,164 during Q1 this year but the company’s all-in-sustaining cost (AISC) per ounce of $1,302 was lower than the bank’s estimate of $1,366.

Calibre’s earnings and cash flow per share during Q1 this year can be attributed to higher-than-anticipated production costs that were offset by lower taxes. The company had consolidated gold production of 65.8 kilo-ounces during the first quarter of 2022.

Currently, Calibre’s shares are worth $1.38 on the Toronto Stock Exchange and have dropped by 15.34 per cent over the past month. Despite the recent drop, they have risen by 65.85 per cent over the past six months and were only valued at $0.82 in December last year.

Read more: Calibre Mining’s Q1/23 financials show promising growth in gold mining sector: BMO

Read more: Calibre Mining 2022 sustainability report shows strong support for ESG initiatives

First report was ‘mild positive,’ second was ‘positive’ overall

The bank had an overall positive analysis from the second report, which can be attributed to recent high-grade intercepts from the past-producing Talavera Mine within Nicaragua’s Limon Mine Complex, which included 18.09 g/t gold over 5.7 metres and 4.45 g/t Au over 20.9 metres.

Scotiabank says these results are positive for Calibre’s shares and indicate the potential for mineral resource expansion at the Limon mining operation.

The Talavera area within the complex produced approximately 800,000 ounces of high-grade gold during the 1990s from underground mining. Past drill results in the area include 7.4 g/t Au over 10.42 metres and 18.0 g/t Au over 5.93 metres.

The analyst team said in the report that they looked forward to observing ongoing results from Calibre’s exploration programs this year, including 60 kilometres of exploration drilling in Nicaragua.

The analysts gave Calibre the Sector Perform rating with a share price target of $2.00 when Calibre’s shares were trading for $1.69 on the Toronto Stock Exchange in May.

“At spot gold prices, CXB shares are trading at a P/NAV5% of 0.59x and 2.3x 2024E P/CF vs. peers trading at 0.56x and 5.3x, respectively,” reads the report from May 17.

Another recent analyst report from the Bank of Montreal Financial Group (TSX: BMO) also indicated that the initiation of open-pit mining at Pavon Central and Eastern Borosi in Nicaragua would accelerate gold production and cash flow for Calibre.

Calibre’s share price fluctuations between 2018 – May 16, 2023. Graph via Scotiabank

Read more: Calibre Mining delivers first shipment of Eastern Borosi ore at La Libertad mill

Read more: Calibre reports high-grade results from Talavera deposit in Nicaragua

Ongoing exploration updates from the 60-kilometre program in Nicaragua and 40-kilometre program in Nevada are key points and catalysts for Calibre’s anticipated success this year and Scotiabank’s share price target. This includes delivering the first shipment of ore to the La Libertad mill and the high-grade results reported from the Talavera deposit.

Calibre’s Senior Vice President of Corporate Development and Investor Relations Ryan King spoke about the company’s gold production targets, performance and exploration in the United States and Nicaragua in an interview with Commodity-TV on Friday.

“Production quarter over quarter should increase throughout this year,” said King.

“We’re not only self-funding our exploration and growth, but we’re also adding cash to the balance sheet on a quarterly basis.”

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com