Canada’s uranium prospector ATHA Energy Corp. (TSX-V: SASK) (FRA: X5U) (OTCQB: SASKF) has significantly expanded its asset portfolio in the country and stature in the industry.

ATHA completed its previously announced acquisition of Latitude Uranium (CSE: LUR) (OTCQB: LURAF) on Thursday. Through doing so ATHA now holds a series of promising projects in Nunavut and Labrador. Latitude will delist its shares at market close on Mar. 7.

“This acquisition marks a significant milestone for the company by adding historical resources to our portfolio,” ATHA chief executive Troy Boisjoli said, “enabling us to expand the reach of our robust balance sheet across a diverse range of exploration catalysts.”

ATHA has now expanded its influence outside of Saskatchewan’s Athabasca Basin and into Canada’s northernmost territory and most easterly province. Nunavut’s Angilak project and Labrador’s Central Mineral Belt (CMB) operation are estimated to collectively hold more than 57 million pounds of yellowcake uranium.

“With significant funding and an exceptional team in place, ATHA stands ready to accelerate exploration at Angilak and drive additional discoveries in the Athabasca Basin and the CMB,” Latitude’s Executive Chairman Philip Williams said.

Latitude shareholders are receiving 0.27 common shares of ATHA for each stock they hold through the deal.

Boisjoli recently discussed the current state of the uranium market in an interview with The Deep Dive.

In this interview, Troy Boisjoli, CEO of @athaenergycorp (CSE: SASK) (FRA: X5U), discusses the uranium market's recent pullback and consolidation. Boisjoli shares insights into the current state of the uranium market, emphasizing the robust fundamentals that remain unchanged. The… pic.twitter.com/90q0ARoIu1

— The Dive Feed (@TheDeepDiveFeed) March 4, 2024

Read more: ATHA Energy receives approval for TSX Venture listing; Latitude shareholders authorize acquisition

Read more: ATHA Energy hires knowledgeable senior vice president of business development

ATHA to enhance its Athabasca Basin portfolio through 92 Energy acquisition

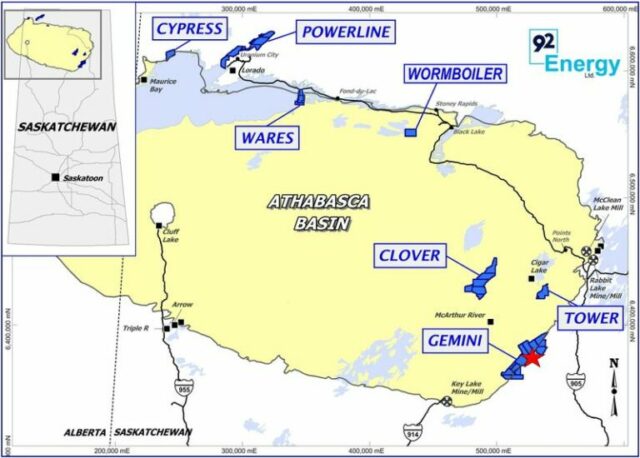

That deal is expected to close by the end of this month. 92 Energy Limited’s (ASX: 92E) (OTCQX: NTELF) Gemini project in the jurisdiction will add tremendous discovery potential in an underexplored corridor, ATHA says.

ATHA is set to acquire six other exploration-stage assets in the region too. A C$14 million financing was completed for the Latitude and pending 92 acquisitions with substantial contributions from IsoEnergy Ltd. (TSX‐V: ISO) and Mega Uranium (TSX: MGA).

ATHA currently benefits from a 10 per cent carried interest on certain portions of IsoEnergy’s land package in the Basin. 92 Energy was founded in 2020 and listed on the Australian Securities Exchange in 2021.

Assets being acquiring from 92 Energy. Map: 92 Energy Limited

In Saskatchewan, ATHA is actively involved in a joint venture with Stallion Uranium Corp. (TSX-V: STUD) (OTCQB: STLNF). The companies hold a significant portion of land together.

Ontario’s Expert Geophysics recently completed the largest-ever airborne geophysical survey in the southwestern Athabasca Basin for the companies. The surveyor covered their entire land package and discovered over 560 kilometres of conductive trends along with “bends and splays” known to be associated with rich uranium mineralization.

Global uranium production is expected to rise by nearly 12 per cent this year as demand for the commodity continues to increase.

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com