Despite gaining significant market share, shares of Aphria Inc. (TSX: APHA) plunged 18 per cent as the Canadian mega-producer reported steep impairment charges on foreign assets amid the Covid-19 pandemic.

The Ontario-based company said Wednesday it earned $152.2 million in net revenue for the fourth quarter ending May 31, and an adjusted earnings before interest, taxes, depreciation, and amortization of $8.6 million.

While sales climbed 5 per cent from the previous quarter, Aphria booked a $98.8 million net loss mainly due to non-cash impairment charges of $64 million on its assets in Jamaica, Lesotho, Colombia and Argentina.

Read more: Aphria remains profitable amid murk of insolvency

The company said the pandemic caused supply issues and delays in new product launches as countries closed their borders to contain the novel coronavirus.

But the health crisis has led to both positive and negative economic shifts in the young weed industry.

On home soil, Aphria reported $65.5 million in recreational cannabis sales in the fourth quarter, which increased 47 per cent from the prior three-month period as customers stockpiled cannabis ahead of lockdowns.

The firm’s recreational revenues in Canada now rival industry leader Canopy Growth Corp. (TSX: WEED), which booked $53.5 million in sales in its last quarter.

Aphria said it has doubled its share of the Canadian recreational market over the last nine months and now holds a 16.1 per cent market share.

“At Aphria, we are setting ourselves apart from the rest of the cannabis industry,” CEO Irwin Simon said in a statement. “We have generated some of the strongest sales growth, we have one of the strongest balance sheets and cash positions, compelling consumer brands and a well-diversified global business.”

Holding a strong $497.2 million cash position at the end of the quarter, the company hinted on its earnings call the cash pile could be used for future merger and acquisition deals.

With over 300 licensed producers in Canada today, CFO Carl Merton told analysts the industry is ripe for consolidation.

Aphria reported production costs for dried flower of $0.88 a gram in the fourth quarter, dropping 5 per cent from the prior quarter.

Company executives shot down questions about a possible merger with Aurora Cannabis (TSX: ACB), after Aphria reportedly held unsuccessful discussion in recent weeks.

“There’s nothing there to comment on because there’s nothing happening,” Merton said.

The company also reported it opened a US$100 million at-the-market equity offering, which will allow it to sell off its common shares “from time to time” through two financial institutions to bolster liquidity.

Despite shares slumping Wednesday, Aphria stock is up 36 per cent since May 1.

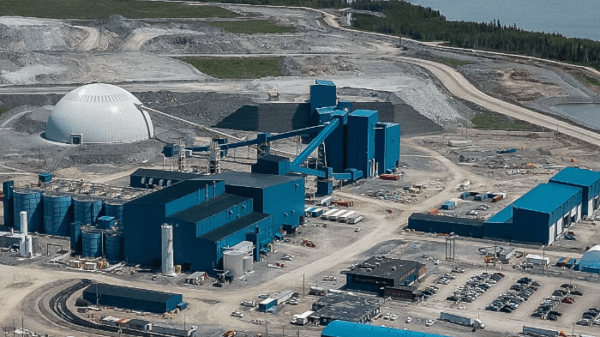

Top image via Aphria Inc.

jared@mugglehead.com

@JaredGnam