Bear Creek Mining Corp (CVE: BCM) (BCEKF: OTCMKTS) raised USD$14.5 million from a bought deal private placement, selling 64.4 million shares at 22.5 cents per share.

The proceeds will go towards supporting exploration and resource drilling at its Mercedes mine in Mexico. It intends to build a ventilation raise bore and secondary escape way at the Marianas deposit at Mercedes to bolster safety. The deal closed on Tuesday.

Sandstorm Gold Ltd (TSE: SSL) (NYSE: SAND) and Equinox Gold Corp. (TSE: EQX) (NYSE American: EQX) also bought 32.2 million shares each on a gross basis or 12.9 million on a net basis, after each of the companies disposed 19.3 million shares to a third party.

After the sale and offering, Sandstorm and Equinox came away with 58.4 million and 38.3 million shares respectively, representing 19.97 per cent and 13.10 per cent of total outstanding shares.

Bear Creek Mining said its board launched a comprehensive strategic review to assess the strategic and financial options.

The board has formed a special committee of independent directors to oversee the process. Former Equinox Gold CEO, Christian Milau will serve as a strategic advisor. He will guide both the special committee and the board through the review.

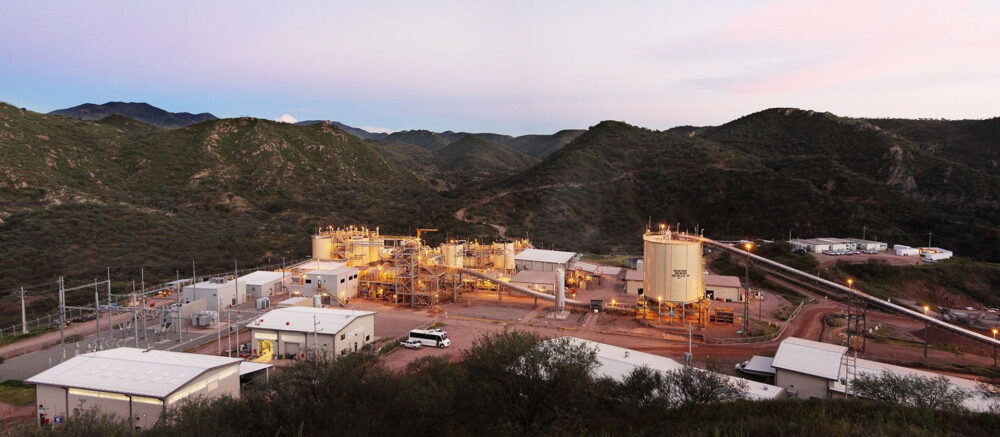

“Production from the Mercedes mine decreased during Q4, 2024 as we continued the transition from mining at San Martin, a bulk-mineable deposit and the biggest contributor to production during 2024, into other areas of the Mercedes operation,’’ said Eric Caba, Bear Creek President and CEO.

In 2024, Mercedes produced 217,675 ounces of silver and 40,220 ounces of gold.

Read more: Equinox Gold acquires Calibre Mining for $2.6B

Read more: Calibre Mining beats gold guidance for 2024 in Nevada and Nicaragua

Equinox has been making big moves lately

Equinox has recently taken major steps to strengthen its position in the gold mining industry. This includes a recent merger with Calibre Mining Corp. (TSE: CXB) (OTCMKTS: CXBMF) and record-breaking production figures.

On February 23, 2025, the company announced a definitive agreement to merge with Calibre in an all-stock transaction valued at approximately CAD$2.6 billion (US$1.8 billion). The combined entity will operate under the Equinox Gold name and become the second-largest gold producer in Canada.

The merger expands Equinox Gold’s portfolio with Calibre’s assets in Nicaragua, Washington, Newfoundland, and Nevada. Collectively, this means diversification across five countries. Additionally, this move is expected to enhance production capabilities and provide a strong pipeline of development and exploration opportunities. Ross Beaty, Chair of Equinox Gold, called the merger a transformational step that will create long-term value.

Alongside this merger, Equinox Gold achieved record-breaking gold production in 2024. The company produced 213,960 ounces of gold in the Q4. It also had a total of 621,870 ounces for the full year, marking its strongest quarterly and annual performance to date. Greg Smith, President and CEO, credited this success to operational efficiency and strategic initiatives that set the stage for future growth.

A key contributor to this record performance was the Greenstone Gold Mine in Ontario officially opened in August.

Furthermore, Calibre has recently closed the private placement of USD$75 million in unsecured convertible notes. These bear interest at 5.5 per cent per year. This follows its joint news release with Equinox Gold Corp. on February 23, 2025.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.