Hudson Resources, Inc. (TSXV: HUD) (OTC:HUDRF) has transferred a mining exploration license to Neo Performance Materials Inc. (TSX: NEO.TO) which covers the Sargartoq Carbonatite complex in southwest Greenland.

On Monday, the companies announced the agreement where Neo will give US$3.5 million to Hudson for the license as well as receive additional compensation in the form of equity interests or share of future sale proceeds.

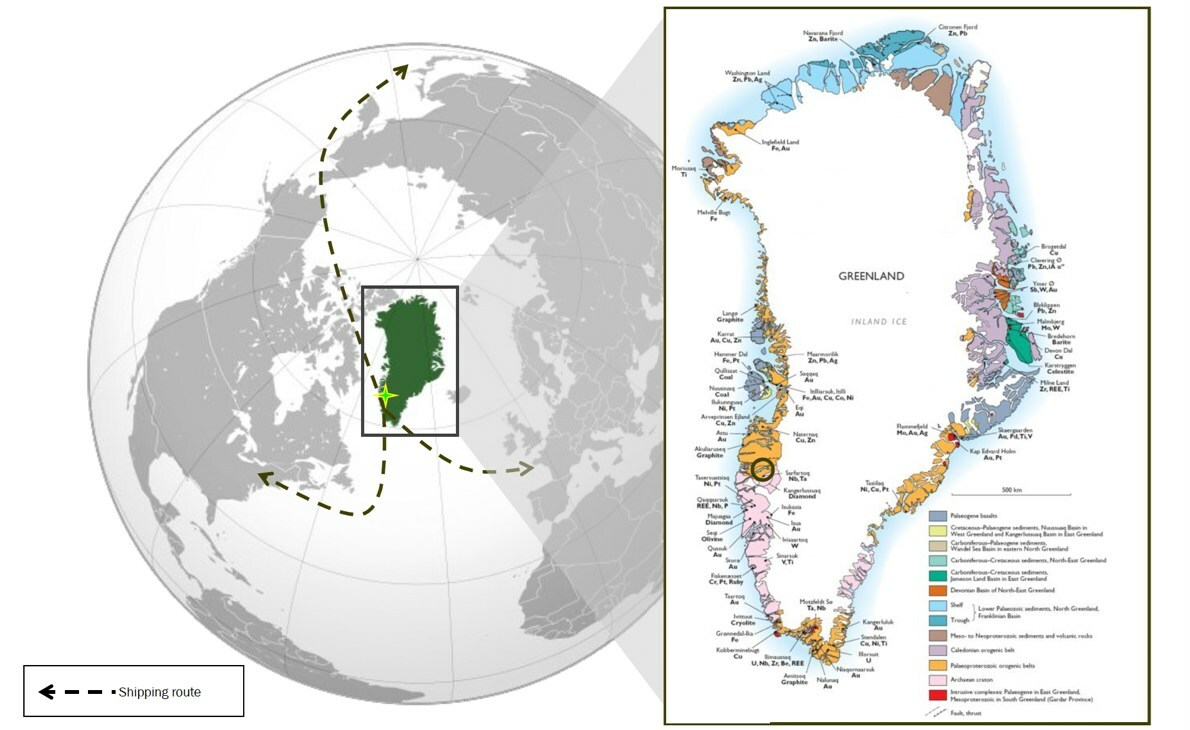

The license covers a portion of the large Sarfartoq carbonatite complex that also hosts Hudson’s ST1 rare earth elements project and the Nukittooq Niobium-Tantalum project.

The mineral deposit found in the project is enriched with neodymium and praseodymium, two vital elements for rare earth permanent magnets. The project’s location makes it suitable for future development, as it’s only 60 kilometers away from the Kangerlussuaq international airport, close to tidewater and a significant port facility, as well as being adjacent to a possible source of hydroelectric power.

Read more: New Tesla motor could disrupt rare earths sector

Read more: U.S. and Canada join forces to secure critical mineral supply chains

The license covers a portion of the large Sarfartoq carbonatite complex that also hosts Hudson’s ST1 rare earth elements project and the Nukittooq Niobium-Tantalum project. Photo via Neo Performance Materials, Inc.

The license will be transferred to a special purpose entity called Neo North Star Resources Inc. (NNSR), which Neo primarily owns, with a substantial investment from Weston Energy III LLC, a company in Yorktown Partners LLC’s portfolio. NNSR has already begun exploring the Project and will seek additional funding to complete the initial exploration program.

NNSR has signed an offtake agreement with Neo’s affiliate, NPM Silmet OÜ (Silmet), which permits Silmet to purchase up to 60 per cent of the ore or mineral concentrate that the project produces after it becomes operational.

The agreement will enable Neo to secure long-term access to rare earth materials and diversify its rare earth supply chain globally. Silmet will utilize the materials obtained through the offtake to supply raw materials for its rare earth separation facility located in Sillamäe, Estonia, which is the only industrial-scale, commercially operating rare earth separation facility in the Western hemisphere.

Silmet aims to produce magnetic rare earth oxides that will serve as feedstock for a new sintered rare earth permanent magnet manufacturing plant that Neo is planning to construct and manage in nearby Narva, Estonia. Thus, the project and the offtake are essential components of Neo’s “Magnets-to-Mine” vertical integration strategy.

Neo’s CEO and Director, Constantine Karayannopoulos, said that the company is committed to exploring various supply chain options to ensure that its customers receive reliable access to rare earth products.

The Sarfartoq project, once operational, will enhance the diversity of global rare earth supply for Neo’s processing facilities across the world. Additionally, the project aligns with Neo’s Magnets-to-Mine vertical integration strategy, which aims to streamline its supply chain. Neo believes that the Sarfartoq project in Greenland is a valuable asset that complements their European rare earth magnet growth strategy. Moreover, this project is anticipated to supplement Neo’s current supply of rare earth concentrate provided by Energy Fuels in the United States.

Read more: Niocorp Developments successfully demonstrates ore separation at critical minerals project

“We are very pleased to complete this transaction with a global leader in the production of advanced materials like Neo,” Hudson’s President Jim Cambon said.

“As the world faces critical shortages of rare earth elements outside of China, we are pleased to help bring the Sarfartoq project a step closer to commercial reality and provide almost two decades of operating experience in Greenland to the Neo team.”

Hudson is a company that specializes in exploring and developing critical metal projects in Greenland, and they’ve been doing so for nearly 20 years. The company owns the Gronne Bjerg anorthosite project, located on tidewater close to Nuuk, which Hudson fully owns.

Moreover, Hudson holds a 31 per cent stake in the White Mountain anorthosite mine, which is currently operational in Greenland. Hudson played a significant role in the permitting, constructing, and commissioning of the White Mountain mine.

Hudson’s stock went up by 40 per cent on Monday to $0.035 on the Canadian Venture Exchange.